Online banking, mobile money transfer applications, cryptocurrency – these new ways to carry out customary banking operations and financial services made all the possible headlines in 2018. However, the question is how to find the right angle to observe what’s going on without bias. For instance, are we witnessing the death of the traditional banking system as we know it or is it the emergence of new innovative approaches?

One thing is certain. Nowadays, there are two major factors accelerating businesses on a global scale – technology and information. Following the trend towards global digitalization, banks should become tech-savvy companies in their own right. Otherwise, due to the shortcomings of modern banking institutions, new FinTech companies may take away a great chunk of their services.

Weaknesses of the current banking system

There are quite a few reasons that influence bank customers to look for alternative options. Below are the ones that lie on the surface:

- difficulties with international transfers and depositing cash into accounts;

- transaction fees;

- the need for a personal presence in the bank to perform certain operations;

- lots of paperwork for opening a bank account;

Almost all banks offer their mobile applications – online banking apps – an attempt to respond to the challenges posed by FinTech startups. However, in most cases, bank applications simply transfer the existing mechanism to an online mode, duplicating problems and difficulties. In other words, it is impossible to use the bank’s application without opening an account there – the circle is closed. In addition, mobile banking as an idea has serious limitations.

Why users switch to applications

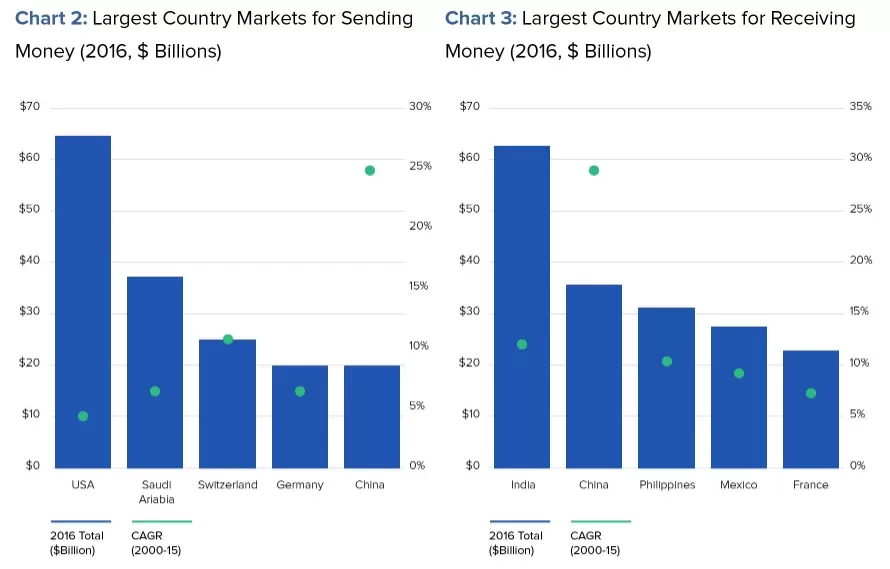

Remittance applications (or money transfer apps) have several advantages over banks. First of all, they make cross-border transfers incomparably faster. Banks do this on an average of 3 to 5 days, but money transfer companies most often do this instantly or within a day.

Secondly, the user does not need to enter bank details. For example, when using PayPal, it is enough to know the user’s email. Often, for a money transfer, you don’t even need to replenish your bank account or open a special account to proceed: funds arrive right there on your mobile phone.

Finally, the commission is lower or nonexistent. Besides, it resolves the problem of transferring small amounts of money as traditional banks have their lower limits which help them to avoid unprofitable actions. Applications and money transfer systems carry out even the smallest transactions without commission.

And what about artificial intelligence in finance? Although its powers are still in its early days, digital bank assistants (or chatbots) effectively solve one of the most important problems of the banking sector – customer service.

But the main advantage of money transfer applications worth a separate paragraph is universal accessibility. As mentioned above, a huge number of people in the world do not have access to banks. But the cost of smartphones dropped significantly, so even residents of developing countries have the opportunity to acquire smartphones and install fintech mobile applications.

P2P money transfer applications

In 2018 over 40% of mobile phone users in the USA made at least one transfer via mobile applications. It is expected that by 2021 the volume of such transfers will exceed $300 billion – in the United States alone. In 2017, PayPal reported that mobile transactions through the app amounted to $155 billion worldwide. Fun fact: by 2020, the volume of mobile payments and transfers in China alone will reach 6.3 trillion dollars.

Money transfer apps vs. banks

The idea that innovative fintech will make the traditional banking sector obsolete is tempting enough. But I don’t think it will happen any time soon. Sure, applications will take a significant share of the service from the banks, but what does it mean for banks in the long term? Only one thing: banks will have to adapt their modus operandi.

All the conditions are already there. Users are looking for alternative ways to solve problems, and banks are quite “slow” to adopt innovations. In this regard, startups seem to implement innovations with a higher pace. In addition, remittance applications meet the needs of those who do not have access to banking services. Finally, mobile phones are an integral part of human existence today. Therefore, money transfers apps represent a logical step towards a totally mobile lifestyle.

Do you remember Apple’s recent announcement about issuing its own credit card in partnership with Goldman Sachs? The card will have no number, no CVV code, no expiration date, no signature. Apple promises to solve problems with transparency to ensure its ease of use. Seems like a mobile phone may become a kind of card issue center, solving many problems with security.

Again, we do not talk about revolution. It’s more about evolution. For instance, Amazon and e-commerce haven’t (still) become a substitute for retailers, and Uber and car sharing providers haven’t eliminated public transport yet. But they have changed the methods of making purchases and trips, which means they have transformed the rules of the game for large companies. So what do banks need to do in order not to lose their share in the market of remittances, the volume of which, by the way, is nearly $1 trillion?

Application of AI and machine learning

The increase in the number of connected devices and data processing tools leads to the creation of personalized insurance products based on a specific person’s data sets. The introduction of AI technologies in the field of customer identification and in systems for combating money laundering is also becoming popular. These solutions, along with decisions that relate to the application of AI for compliance procedures, risk management, transaction monitoring and regulatory reporting, will continue to evolve and will facilitate the return of investment in FinTech.

The other side of using machine learning is to observe the actions of clients with their consent in order to identify the various behavioral traps that people fall into. This will allow them to make financial decisions more rationally: from planning and executing the family budget, ending with actions in trading stocks or operations with other financial instruments.

Checklist for banks

- First, it’s about customer service and its enhancement through the development of machine learning and artificial intelligence technologies. Perhaps, now it is more convenient for many banks to hire an entire staff to form a call center and support online chats, but the future belongs to smart chatbots that will learn in the process of communication with customers.

- Reduce the fees for cross-border transfers and the level of complexity of the client identification procedure. Otherwise, it will make a lot more people looking in the direction of mobile applications for transfers.

- Despite the fact that some giants of the banking sector may not realize that the Age of Offline has passed, it makes perfect sense to develop mobile banking. So instead of investing in the opening of new branches, it is better to invest in mobile development.

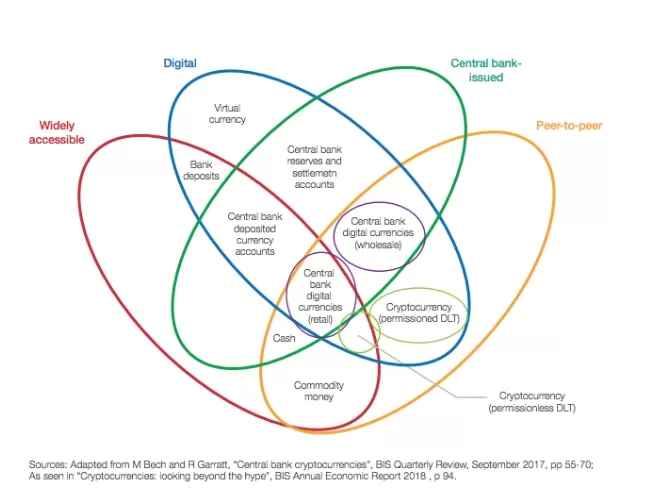

- Enter the blockchain. Sure enough, due to ICOs hype with its stream of fraudulent projects, opinions on the technology have changed. However, do not underestimate its ability to improve banking services. Blockchain has a huge potential for banking, where technology can be used to increase the security of financial transactions, decentralize services and increase the speed of market launch of new products. A blockchain can be used to securely store customer identities or process international payments. Analysts predict that 77% of FinTech companies will adopt the blockchain by 2020. Besides, according to a new study by the World Economic Forum (WEF), about 40 central banks around the world are considering the possibility of issuing their own digital currencies (CBDC). Some banks are already testing this opportunity. Among the most interesting prospects of CBDC is the deprivation of commercial banks of a monopoly on deposits and the transfer of alternatives to private payment solutions.

- The rise of APIs. Open API models allow trusted partners to create new interface layers for customers and implement new fascinating products and services based on the platform for financial service providers. By the way, open banking was made official in the UK.

- The development of p2p-loans by creating special marketplaces. Fair enough: the main business offering of banks is classic lending. However, with the development of the financial services market, it is worth thinking about something new, more customer-oriented.

- Fintech startups. Despite the widespread theory that large companies have more opportunities for in-house development, it is sometimes easier to take a ready-made solution under the wing. The founders of a startup will really burn with their idea, and employees of the IT department of the bank will not be the fact that they share the enthusiasm for the introduction of innovations, especially if the initiative is imposed by top management. Of course, the banking sector is still far from ideal. But perhaps in the near future, we will see a collaboration of advanced application technologies for money transfer and banking system reliability.

Chris Skinner, an independent commentator on the financial markets and fintech, nailed this perfectly in his blog post: “Y’see, business did not understand technology and operations. It was very complex stuff involving mainframes and code that no one could write, except the people in technology and operations. And the technology and operations people didn’t understand the business. The business was all about maximising share of customer wallet and shareholder returns using complex terminologies around CDOs and MBAs, interest rate differentials and cross-sell ratios. How was a person immersed in COBOL supposed to understand that?”

Final Words

Opinions always vary. Five years ago, FinTech was regarded as a sort of obscure underground “thing” by major financial players. Nowadays, it went almost mainstream: just google for the abundance of FinTech seminars, conferences, and hackathons. In 2018, as much as $111.8 billion were invested in the financial technology sector. This figure represents a 120% growth compared to 2017.

As said earlier in the article, most of the financial institutions began to make friends with new technology and startups as they have understood where exactly excellent profits were roaming. So…I suppose that in the near future, we will see banks rather as providers of financial services technologies than purely financial services companies.

P.S. If you’re reading this article, chances are you might be interested in turning your fintech idea into a fintech solution. Check out our fintech solutions portfolio and drop us a line at [email protected]