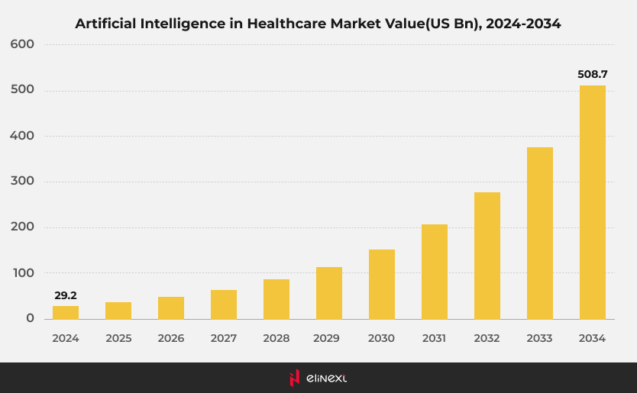

Artificial Intelligence is disrupting practically every domain out there, including the health insurance industry. The global AI market in the health insurance market was projected to grow from USD 29.2 Billion in 2024 and was forecasted to reach USD 508.7 Billion by 2034.

Because AI-powered claims automation can reduce the processing time by 75%, or AI-driven analytics help detect fraudulent claims with up to 90% accuracy (with insurers losing $80 billion annually due to fraud), a good chunk of the market of AI use is going to be in the healthcare insurance sector. We want to explore the most common AI use cases in health insurance in this blog post.

Elinext: expert-level in health insurance software solutions

With 27+ years of experience, Elinext delivers cutting-edge health insurance software solutions. From AI-powered claims processing to fraud prevention, we help insurers optimize operations and enhance customer experience.

The Impact of AI for the Health Insurance Industry

AI health insurance is called to improve efficiency, reduce costs, and enhance customer service.

We’ve already mentioned in the intro automated claims processing that speeds up reimbursements, and AI-driven fraud detection that minimizes financial losses. We can add more to the list of applications. Healthcare analytics solutions help insurers accurately assess risks, leading to fairer premiums and better policy personalization. Chatbots and virtual assistants improve customer support, ensuring 24/7 availability. As AI continues to evolve, it drives smarter decision-making and a more seamless insurance experience for both providers and policyholders.

Ready to Transform Your Health Insurance Business?

Discover how Elinext’s AI-driven software solutions can streamline operations and enhance customer experience.

The Role of Generative AI in Health Insurance

Generative AI is transforming health insurance by automating tailored communications, simulating risk scenarios, and generating personalized policy documents. Generative AI in health insurance drives efficiency and enhances customer engagement.

The adoption of AI technologies within the insurance industry has accelerated markedly. In 2024, 77% of insurers are at some stage of integrating AI into their value chains, a notable increase from 61% in the year before that.

The Role of AI Chatbots in Health Insurance

It’s pretty convenient for both customers and companies to use chatbots for health insurance. AI chatbots streamline customer service by providing round-the-clock support, automating routine inquiries, and assisting with claim processing.

Chatbots handle high volumes of requests. That improves efficiency, reduces wait times, and enhances customer satisfaction by offering personalized assistance without using much human workforce.

WSJ states that AI is more empathetic than Allstate’s insurance reps. They give several examples of how chatbots prevail over human employees (e.g. chatbots are prone to take an accusatory tone or fall back on industry jargon, confusing customers). In a recent survey from the International Customer Management Institute, 35% of respondents said they think AI will reduce hiring requirements, versus 38% who don’t see it being a factor.

Other Real AI Use Cases in Health Insurance

Let us list the most common AI use cases in health insurance.

Automated Claims Processing

AI streamlines claim processing by automating data extraction and analysis, reducing manual errors, and accelerating approval times. This efficiency leads to faster reimbursements and improved customer satisfaction.

70% of claim documents are correctly extracted and interpreted in near real-time.

Fraud Detection

By analyzing patterns in claims data, AI systems can identify anomalies indicative of fraudulent activity. This proactive approach helps insurers minimize losses and maintain the integrity of their services.

Insurance fraud results in approximately $308.6 billion in annual losses. AI-driven solutions are instrumental in targeting and reducing these fraudulent claims.

Personalized Policy Creation

Leveraging AI, insurers can assess individual health data to tailor policies that align with personal risk profiles, ensuring coverage that meets specific needs and promoting customer-centric solutions.

Predictive Analytics for Risk Assessment

AI-driven predictive analytics evaluate vast datasets to forecast potential health risks, enabling insurers to set premiums more accurately and manage risk portfolios effectively.

Machine learning models, such as XGBoost, have demonstrated high accuracy (around 83%) in predicting insurance claims, aiding in better anticipation of claim amounts and risk management.

Discover how AI can transform your health insurance services. Contact us today to learn more about our mHealth app development or custom patient management solutions that we can help you with.

Chronic Disease Management

AI supports chronic disease management by monitoring patient data in real-time, providing alerts for potential health issues, and facilitating personalized care plans to improve patient outcomes.

Underwriting Optimization

In underwriting, AI in the health insurance industry evaluates applicant data swiftly, enhancing decision-making accuracy, reducing processing times, and ensuring fair policy pricing based on comprehensive risk assessments.

A survey indicates that over 90% of health insurers plan to increase their AI investments, with 75% focusing on applications in underwriting and claims management.

Integration with Wearables and IoT

By integrating data from wearables and IoT devices, AI provides insurers with real-time health insights, allowing for dynamic policy adjustments and proactive health interventions.

Population Health Management

AI in the health insurance industry analyzes health trends across populations to identify at-risk groups, inform preventive strategies, and allocate resources efficiently, ultimately improving public health outcomes.

Regulatory Compliance Monitoring

AI assists in monitoring compliance by continuously analyzing operations against regulatory standards, promptly identifying potential violations, and ensuring adherence to evolving healthcare laws.

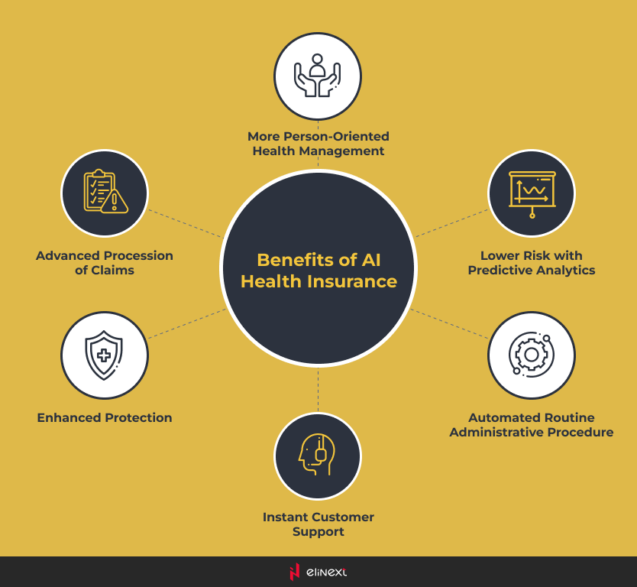

Benefits of AI in the Health Insurance Industry

Advanced Processing of Claims

AI streamlines the evaluation of insurance claims by automating data extraction and analysis, leading to faster settlements and reduced administrative costs. This efficiency enhances customer satisfaction and allows insurers to allocate resources more effectively.

More Person-Oriented Health Management

By analyzing individual health data, AI enables insurers to offer personalized health management plans tailored to each policyholder’s unique needs. AI and health insurance go hand in hand, and this approach promotes proactive care, improves health outcomes, and increases customer engagement.

Lower Risk with Predictive Analytics

AI-driven predictive analytics assess vast datasets to forecast potential health risks, allowing insurers to implement preventive measures and adjust policies accordingly. This proactive strategy reduces overall risk exposure and leads to more accurate pricing models.

Instant Customer Support

Another benefit of the presence of AI in the health insurance industry is AI-powered chatbots and virtual assistants that provide immediate responses to customer inquiries, handling routine questions and tasks efficiently. This instant support enhances the customer experience and frees up human agents to focus on more complex issues.

Automated Routine Administrative Procedures

AI and health insurance equals lower operational costs. By automating repetitive administrative tasks, AI reduces the burden on staff and minimizes human errors. This automation allows employees to concentrate on higher-value activities, improving overall organizational productivity.

Discover how AI can transform your health insurance services. Contact our custom healthcare software development company today to learn more.

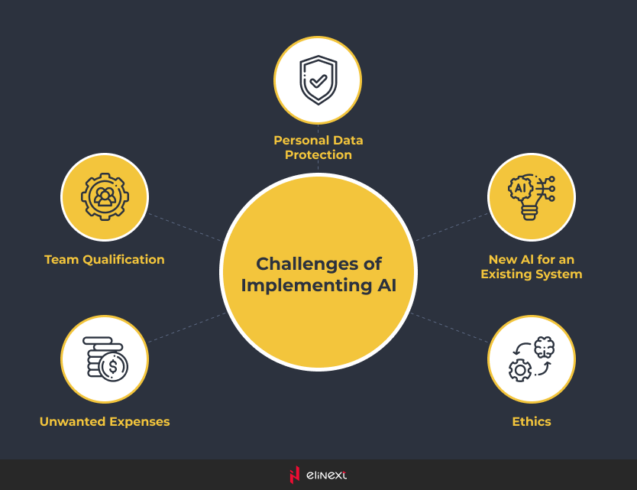

Challenges of Using Artificial Intelligence in Health Insurance

Personal Data Protection

Ensuring the privacy and security of sensitive health information is paramount when implementing AI in health insurance. Robust data protection measures are essential to maintain trust and comply with privacy regulations.

Integrating New AI into Existing Systems

Incorporating Artificial Intelligence into health insurance infrastructures can be complex. Significant adjustments to workflows and systems are required to ensure seamless operation and maximize benefits.

Team Qualification

The successful implementation of AI in health insurance relies on a workforce with the necessary skills and expertise. Investing in training and development is crucial to effectively manage and utilize AI technologies.

Unwanted Expenses

Implementing AI solutions involves substantial initial investments. Without careful planning and clear objectives, these costs can outweigh the benefits, leading to financial strain.

Ethics

AI applications in health insurance must adhere to ethical standards, ensuring fairness, transparency, and accountability. Addressing potential biases and maintaining ethical practices are essential to uphold trust and integrity.

Future of AI in the Health Insurance Industry

Artificial Intelligence is poised to revolutionize the health insurance industry by enhancing operational efficiency, improving customer experiences, and enabling more accurate risk assessments.

As AI technologies advance, insurers are expected to leverage machine learning algorithms to analyze vast amounts of healthcare data, leading to personalized insurance plans and proactive health management strategies. This transformation aims to reduce administrative costs, expedite claims processing, and foster a more patient-centric approach to healthcare delivery.

Conclusion

After exploiting AI use cases in health insurance, we can confidently claim that the integration of AI into the health insurance sector presents both significant opportunities and challenges.

While AI can streamline operations, enhance customer service, and improve risk management, it also raises concerns regarding data privacy, ethical considerations, and the need for substantial investments in technology and workforce training. Addressing these challenges is crucial to fully realize the benefits of AI in health insurance. By carefully navigating these complexities, the industry can harness AI’s potential to create a more efficient, personalized, and equitable healthcare system.

FAQ

Are AI-powered health insurance systems secure?

AI enhances security by accurately collating and analyzing large amounts of information, creating robust privacy models to protect sensitive health data. Patient management solutions using AI are safe if developed according to all the regulations.

How does AI impact policyholders?

AI enables insurers to offer personalized health management plans, improving care and engagement by analyzing individual health data. Policyholders can benefit in multiple ways by using different AI and ML solutions.

How does AI support preventive healthcare?

By analyzing healthcare data, AI identifies potential health risks, allowing for early interventions and personalized care plans to prevent diseases.

How does AI ensure compliance with healthcare regulations?

AI health insurance tools assist insurers in making coverage decisions that comply with regulations, ensuring adherence to standards and preventing discrimination.

How will AI change the health insurance industry in the next decade?

AI is expected to have an impact on the industry by enhancing operational efficiency, improving customer experiences, and enabling more accurate risk assessments.

AI will automate 60-80% of claims by 2035, cutting processing time by 70%, AI-powered fraud detection could save insurers up to $50 billion annually, reducing fraudulent claims by 60%, AI-driven risk assessment will speed up policy approvals by 90%, improving accuracy and reducing underwriting losses. 70% of insurers will use real-time health data from wearables, enabling dynamic policy pricing. Last but not least, AI will enhance disease prediction, cutting hospitalization rates by 15% and reducing chronic disease costs by $300 billion per year.