A human being is a lazy being. Between the two tasks, we are more likely to choose the easy one. It’s not that we aren’t smart enough. It’s just that our brain is the hungriest part of our body (which can be a good excuse for eating many cookies at once ― don’t thank me).

Our brain consumes the most energy, yet takes up on average only 2% of the body weight. So, we choose the easy task because without a clear motive our goal is to save energy. Always.

Take, for example, voice commands and messages. In English, we speak 3 times faster than we type. In the era of communication fatigue, sending short audios is a real time-saver (and you don’t have to google how to write the vehicle). This also applies to other languages. The 2018 study conducted by the Russian telecom company Tele2 showed that voice messages make up 50% of all the calls. At the same time, many users claim that voice messages are great for sending but not so much for receiving. It’s not always comfortable to listen to and to reply to a voice message in an overcrowded restaurant (not a real case for the last 1.5 years but still). Similarly, financial software development services are designed to streamline communication and increase efficiency in financial transactions.

But the main point is that nowadays a smartphone user wants to have a choice: to write or to talk, to be written to or to be talked to. And the services that provide omnichannel and omni-type options are more likely to keep their places in the client’s gadgets.

Why Financial Companies Adopt Voice-Based Technologies

Financial services, despite having an image of a sector that is ossified and buried under paperwork, try to adapt to this new communication reality. They spend billions of dollars on fintech. According to the KPMG research, in the 1st half of 2020, global fintech investment reached a total of $26.5 billion. Voice and speech technologies make a significant part of these payments.

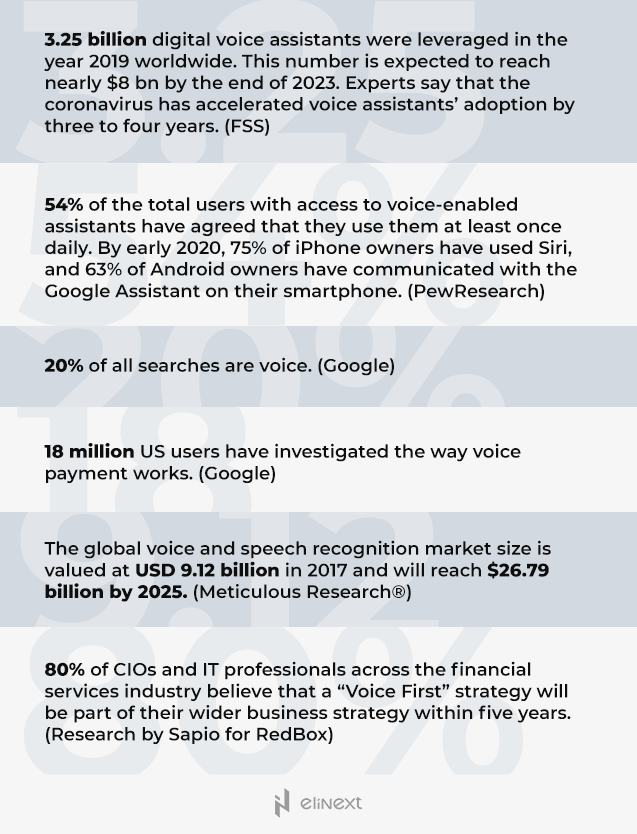

Here are some key statistics that prove this statement:

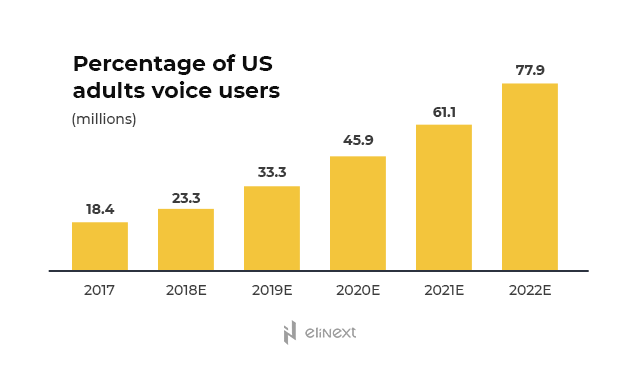

And here are the core figures – according to the Business Insider’s report, adoption of voice payments will grow from 8% to 31% by 2022. There will be 77.9 million users of voice payments by 2022.

You may notice that voice and speech technologies are seen as two different types of tools. What’s the difference?

Voice recognition technologies aim to recognize the voice. Gender, timbre, intonations, and speed, and other individual characteristics are like a vocal fingerprint. It can be used for emotion recognition, but most importantly ― for security and privacy issues.

Speech recognition technologies aim is to understand what the client says. Language, dialect, speed and other factors are analyzed. This helps to create AI voice-based chatbots. That’s how the system understands the question and gives an adequate answer.

Here are some other reasons to introduce voice and speech techs to your financial services:

Customer-Centric Services

Everyone wants to feel special. Personalization is a key to customers’ hearts and pockets. Nothing sounds more beautiful and engaging to us than our name. And now imagine that the customer contacts your AI-driven robotic call consultant and instead of “It’s Bank N, what’s your problem” hears “Guid efternuin Pr. McGonagall, how could I help you?”.

According to the RedPoint Global survey conducted by The Harris Poll in 2019, 63% of clients expect service personalization and believe the offers they get are based on their individual characteristics. Personalization isn’t a buzzword any longer. It’s a must-have.

Conversational AI and Improved Sales

Each contact with your client is a chance to sell. Even if it’s a complaint. And you don’t even have to reach out to your client ― he did it by himself! The problem is that sales and consulting departments are usually separated. And if the forces of sales are ready to consult the overwhelmed employees in the call center try to get rid of the calling client as soon as possible (as their KPIs include call quantity a day as well).

Implementing AI voice technologies can help to mash two potatoes with one fork. First, it unburdens the call center by taking over the most common requests (like, what should I do if I forgot my PIN code or a monthly loan application). Second, your voice bot can offer related services. For example, o a bank app or an e-card that is impossible to lose. It can also provide the client with offers and discounts for special occasions.

Voice is the Data. Data is the King

AI and ML are the motors of robotic process automation. Data is the fuel to this motor. By analyzing numerous conversations with clients and their feedback, voice technologies can be continually updated. For example, if a potential client wants to open an account at your bank for the first time, and the voice bot recognizes the accent quickly, it can offer to speak slower or switch to the customer’s native language. This would be challenging for an employee in a call-center. Unbiased analysis of a client’s emotions during a conversation can help understand what makes him or her angry and what can be improved.

Reduced costs

According to 2018 IBM’s research, businesses spend more than $1,3 trillion on customer service calls, and more than half of these calls remain unresolved. The other problem is enormous employee turnover: the average contact center turnover rate is 30-45%. Employees aged lower than 34 usually stay for just one year. Call centers are a costly part of support, but they can’t be ignored. Voice robotic assistance can be a good solution. Autonomous claims in its research that banks can cut their service call costs by 20% by implementing voice assistance and AI-chat only.

How Voice Technologies Can Be Used in Finances

Every step of your client’s communication behavior can be automated by voice technology. Let’s take a closer look on the most popular voice tech services voiced and go through a couple of case studies:

1.Voice identification

Biometric security and biometric validation are something we know well since countless Mission Impossible movies showed us that that’s how people enter the safest buildings everywhere. Movie characters always used face/voice/fingertips/DNA recognition only. They never heard of keys. But everything you saw in superhero movies in your childhood today becomes a part of ordinary life.

Each voice is unique. We differ in intonations, speed, articulation, etc. It’s not surprising that voice is seen as another tool to provide secure access to personal banking.

Voice identification Case Studies

In 2016, HSBC rolled out its Voice ID. By repeating a standard passphrase, users all across the world could enter their bank account without using the PIN number. HSBC claimed that there are plenty of benefits to this new system: increased safety and speed, better user experience There is no need to recall the passwords and it improves accessibility for people with physical issues.

After saying the code phrase “My voice is my password,” over 100 vocal metrics are analyzed. The bank promises that even a cold or cough won’t hinder the tool from recognizing you. (hopefully, this also applies to three face masks).

Recently, HSBC UK reported that voice recognition systems allowed to prevent over 50% of banking frauds during 2020 which accounts for £249 million of customers’ bank savings.

Currently, HSBC Voice ID is used by over 2.8 million active customers in the UK. According to the bank representatives ‘Since the technology was introduced in the UK in 2016, over 43,000 fraudulent phone calls have been identified, with over £981 million worth of customers’ money protected.’

Australian Westpac Banking Corporation has chosen another way and integrated the three most popular voice assistants in their services. Now, using Alexa, Siri or Google Assistant Westpac’s, customers can access their accounts using only their voice commands. They don’t have to remember any specific phrase.

Moreover, using the standard commands like” What’s my balance?” or “How much money did I spend last week?” the user can get all the necessary information in seconds.

Drawbacks of Voice Identification

Voice recognition sounds great but the technology is young, and safety standards still have to be improved.

Firstly, all the voices are unique but some of them are very alike. To differentiate one from another one should use professional recording equipment. (the latest iPhone can cost just as much as a recording device but it doesn’t mean it can work as one)

Well-known is the case from 2017 when a BBC journalist cracked the safety system of HSBC Voice ID in a beautiful and simple way. His twin could open his bank account. The global rate of twin births is now higher than ever, so this security weakness has to be addressed.

Secondly, it is not yet clear how some background noises can influence the initial record and following recognition quality.

Thirdly, there is no well-developed mechanism that could prevent voice phishing. If you send a voice message, how could you be sure it won’t be reshared or leaked? All you need is your voice. But frauds also need just that. And in a world where roughly 200 billion voice messages are sent daily, a voice sample isn’t hard to get.

Considering these weaknesses, we and the FBI recommend using voice recognition as an additional step of the verification process. Combined with PIN code, finger or face recognition, voice verification can secure access up to nearly 100%.

2. Voice payments

The voice payment has the same logic behind it as biometrics voice validation. The customer logs in the banking app or uses the voice assistant integrated with online banking to carry out some basic financial operations. Voice payments should go through if there’s a 100% match of the user’s voice and the voice sample. Now, only 6% of voice assistants are used to check bank info and only 11% to conduct bank transactions.

According to an OC&C Strategy Consultants study, the value of voice-based payments will increase from $2 billion in 2018 to $40 billion by 2022. According to Business Insider, the adoption of voice payments will grow from 8% to 31% of US adults by 2022. This growth is naturally connected to the growth of voice assistance usage. The use of voice assistants is set to triple over the next few years, according to Juniper Research. (8 billion voice assistants by 2023 compared to 2.5 billion assistants in use in 2018).

Voice Payments Case Studies

Royal Bank of Canada, known as the most innovative in the region, introduced voice-based payments in 2017 by connecting Siri. Last year, the bank introduced a multiplatform digital assistant NAOMI that uses text and voice chatbots, but voice payments remain the privilege of the Siri owners.

Barclays and Santander companies adopted Siri for handless payments as well. And mobile platforms such as PayPal or Zeare are known for allowing their users to manage the e-valets by voice only.

The Turkish mobile bank Garanti introduced a mobile app that enables the user to buy or sell currency or to find out the exchange rates using voice commands.

Drawbacks of Voice Payments

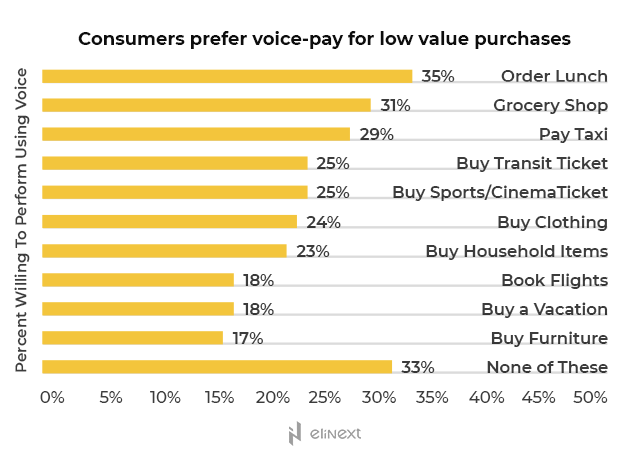

Voice payments also face the challenges we discussed above: safety and trust. According to the 2018 Paysafe study, almost 40% of the responders find voice-controlled payments risky. Those who are brave enough to pay using voice typically start with smaller payments (not to regret if something goes wrong).

The second problem is non-standard speech recognition. The more dialects, accents, and other speech features should be considered, the more speech samples should be analyzed, learned, and adopted by voice software. It takes time, and it takes money. Machine learning will, most likely, deal with this issue in the future. But it takes time. And so far, the issue significantly affects the quality of service, especially when it comes to multinational countries such as the USA and Canada. And it’s easy to make your customer angry if you emphasize that his or her English is not good enough for your bank. (It’s an old video but it can give you an idea of how frustrated your customers will be)

3. Conversational Voice Assistance

In-office consultations, FAQs on the bank’s website, and even call centers for client support are almost dead. The majority of customers (75% according to the FIS) prefer onsite-chatting or contacting the support via the app. The key challenge here is that customers expect to get the answer immediately. No one likes being in a call queue and listening to rambunctious on-hold music that will remain your earworm for several days. At the same time, according to the CGS survey, 86% of users prefer to interact with a human being when it comes to finance support questions. But as mentioned above, sustaining a support call center can be very costly and not very effective.

So how about conversational voice chatbots? Automated support with a human touch.

Conversational assistants use the scope of technologies – machine learning, speech recognition, natural language processing, and AI. Clients can sometimes not even tell the difference if there is a friendly person on the other side or just a sophisticated algorithm.

In a real-time conversation, the voice assistant can predict the end of your question before you say it out loud. It’s not the Interactive Voice Response (IVR) as you know it. You don’t have to spend an hour answering countless yes or no questions to get the information you are looking for (my experience with old IVRs ended up in nervous phone dropping and messaging real employees on LinkedIn).

Today, users can talk to the voice bot in the same way they’d talk to a human and get the answer quickly. Machine learning guarantees the constant growth of the knowledge base, so if your client asks the voice-bot “What transactions can I make with my credit card?” in 500 different ways, it will not only recognize them all but predict the new options as well. According to Nexus research, the potential cost savings for banks from AI applications is estimated at $447 billion by 2023.

Conversational Bank Assistant Case Studies

In 2018, Bank of America launched its voice-driven virtual assistant Erica. The timing could not have been better: the COVID-19 pandemic and prohibition to visit banks physically would overload the call center otherwise. But Erica managed it easily. 19.5 million users are now in the base of AI-assistant, and that’s 12 million more than in the same quarter last year. Since its birth, Erica has answered more than 250 million financial questions. Its’ database counts now a million unique questions and answers, many of which are connected to pandemics’ impact on the bank. Bank of America acts as a digital booster in the banking sector. Last year, it broke its record on registering new patents. Patents included predictive AI for financial advice, AI-powered error check, deep-fake monitoring, and biometric encoding (it’s interesting that this patent record came while 85% of the company’s employees worked from the home office ― a counterargument to the fairy tales about unproductive remote work). These advancements highlight the importance of banking software development services in driving innovation and improving the overall banking experience.

Russia’s financial giant Tinkoff Bank also puts efforts into upgrading its voice assistant Oleg. The bank claims it is not just a robotics voice bot but a real assistant that monitors your financial lifestyle. Together with Oleg (it’s a Russian male name and also the name of the bank owner, which is a pretty cool marketing ploy) you can set individual saving programs, work out financial habits, become more financially educated, buy tickets to the cinema, plan your vacation budget, etc. So, it looks more like Alexa with a financial emphasis.

HSBC UK launched a voice response system that takes 450k calls per week. The service allows clients to switch between mobile and website banking platforms and pick up the conversation at any point.

Voice assistants are widely spread in other financial branches, too. TD Ameritrade created an AI assistant for its clients to consult on trading issues, while Fukoku Mutual Life launched a voice tool to advise on insurance.

Drawbacks of Conversational Voice Assistants

Technology answers questions quickly but not necessarily accurately. Machine learning is a great thing but without any human control, it can be awkward at best. For example, the Russian Oleg assistant learned how to be rude and violent in the first week of its life. When a client would ask why fingertips recognition doesn’t work, it would advise her to cut off the fingers. Too ultimate of a solution, isn’t it?

Secondly, speech recognition alone is not enough. Without voice analysis, the bot cannot estimate how frustrated the client is and whether it’s better to forward the call to a human operator.

4. Lending and Loan Collection Using Voice Bots

Today, you can send your loan application remotely via the app or online banking in a few clicks. The trickiest issue for software developers is to provide a strong connection between several financial organizations while the bank has to check the credit history of an applicant first. The voice tool can be used here as a consultant as well. The next step, collection, is even more interesting. Lending money is easy, but getting it back can be tricky. Noone likes being Ebenezer Scrooge. Arguing with a client for hours and convincing them to bring the borrowed money back isn’t a dream job. Collector has to have empathy and iron nerves, while sounding soft and persuasive. It’s a rare combination.

The robotic collector is a perfect executer. It can send messages or call the debtor 24/7. It will not get mad or rude, and even the saddest fake story won’t interfere with the task. Using the debtor story, the bot can choose between different dialogue scenarios, tone of voice, etc.

What’s more, when it comes to debts people prefer to communicate with a bot. The reason for it is that no one wants to communicate our problems to a stranger. our. The robotic tool eliminates the shame and embarrassment of this task. The success of bots that deal with debt can be also explained with the fact that people that possess the highest debt in the USA are between 35 and 45. They trust technology, sometimes even more than they trust other people. In the long run, all financial institutions have to implement chatbots as they are new normal for GenZs ― their future clients.

To sum up

Voice technology changes our financial habits and banking environment. The interoperability and optionality that voice technologies bring with them should not be underestimated. But before implementing it in your business, consider – what exactly should this technology bring to your business.

Estimate how necessary it is to replace the call center with a voice bot. How secure is voice recognition in your country? How exactly should voice and speech tech broaden your consumers’ experience? Without a clear target, a voice tool can be just another fancy marketing feature and not the cheapest one.

After all, voice and speech technologies shouldn’t replace humans. They can be a useful extension to solve repetitive issues. The hardest tasks remain for creative human brains. At least for now.