The digitalization of assets is transforming the economy by streamlining business processes, improving company productivity, and increasing customer engagement. That’s why many companies are tokenizing their assets today. SWIFT expects crypto assets to rise to $24 trillion by 2027.

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) plans to explore asset tokenization in 2022. Its goal is to find out if it is possible to provide a seamless market for tokenized digital assets.

Looking at Tokenization in Detail

Asset tokenization is the process of transferring rights to a financial asset into a digital token. Simply put, a digital asset is recorded on a blockchain where all the transactions will be registered. Since blocks containing information can’t be changed, removed, or faked, this system is considered more secure and confidential than traditional mechanisms used to process data. At the present time, you can tokenize almost all assets, including securities, precious metals, real estate, land, works of art, and so on.

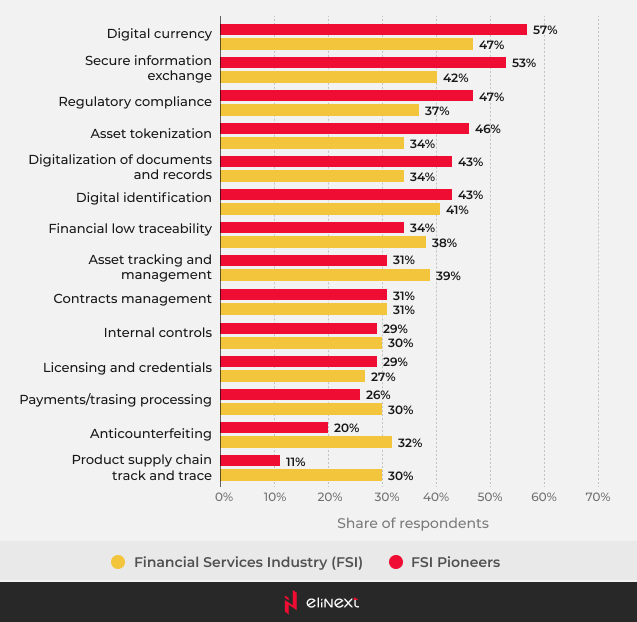

Tokenization helps startups and SMEs raise funding without any barriers. Most of them find it difficult to place traditional financial instruments due to a large number of intermediaries, market regulation, high costs for placing instruments, lack of funding sources, and much more. By issuing tokens, the company transfers them directly to investors. Tokens are stored in the wallet, and ownership is protected by a smart contract. The Statista data shows that 46% of companies have already applied asset tokenization in 2021.

Source: Statista

Investors are also interested in working with tokenized instruments. Dealing with traditional assets requires tons of paperwork, registering the transfer of ownership, interacting with intermediaries, and so on. Lack of transparency, low liquidity of instruments, low transaction speed, and much more motivate borrowers and investors to handle tokens. Blockchain provides cryptographic protection, high liquidity of digital assets, full transparency of financial transactions, and high speed of settlements. The global tokenization market value stood at $2.3 billion in 2021and is projected to grow to $5.6 billion by 2026.

Exploring Asset Tokenization Process

To tokenize your assets, such as a building, car, company, work of art, and so on, you need to create a digital certificate that looks like a unique digital code. A digital asset can be divided into an unlimited number of parts, known as tokens. A token is a certain part of a real asset. After that, the ownership to a part of the tokenized asset can be bought, sold, transferred, and other things.

If you want to tokenize your assets, you can use special platforms, such as Polymath, Securitize, OpenFinance Network, Smartlands, Atomic Capital, BankEx, Swarm.Fund, Trusttoken, Harbor, and others. Crypto exchanges like LAToken and Openfinance provide the same services as well. For example, in January 2021, DX.Exchange started to offer traders to buy tokenized shares of a range of companies, such as Apple, Netflix, Tesla, Facebook, and others on NASDAQ.

Examples of Asset Tokenization in Various Industries

Deloitte believes that tokenization can solve the problem of multihoming and disintermediation; therefore, companies should pay attention to this business model. Now, it’s time to see how tokenization of assets is being applied across various industries.

Mining Industry

Tokenization can increase the liquidity and commercial feasibility of mines for mining companies that are having difficulty raising capital. The use of blockchain, digital assets, and smart contracts will lead to the emergence of new sources of funding, attracting new players and investors to the mining industry.

Deloitte also thinks that tokenization of assets and blockchain offer great opportunities for the mining industry. In the report, the auditor gives the example of Goldcorp, a Canadian gold production company, that started selling gold to dealers and banks directly using the blockchain.

Real Estate

Real estate tokenization is another promising area that opens up access to a multi-million dollar market. According to ResearchAndMarkets.com, the global real estate market is projected to grow from $2,774.45 billion in 2021 to $3,717.03 billion in 2025. The tokenized real estate can be divided into smaller ownership units, which allows investors to buy them for less money. Thus, more buyers will be able to invest in the building, thereby providing the capital required to finance projects. Instead of trying to get traditional sources of funding, you will be able to raise capital through borrowed funds and equity.

For example, in October 2018, Propellr and Fluidity tokenized a $30 million building in the East Village, Manhattan, to raise investment. Also, the American company Coldwell Banker, which sells real estate, has teamed up with Coinweb, the developer of blockchain platforms, in the first project to tokenize housing. The project is expected to increase liquidity, simplify the investment process, and provide a higher level of security.

Art Objects

Blockchain and tokenization easily solve these problems as these technologies allow buyers to purchase artworks from anywhere in the world. Given the fact that blockchain transaction records cannot be altered or faked, the owner of the painting will always be able to prove ownership. It is also possible to arrange joint ownership of a work of art. Tokenization allows simple folks to buy famous and expensive paintings. For example, Leonardo da Vinci’s The Savior of the World was sold for $450 million. If it were divided by 1 million tokens, you could purchase a share for $450.

By the way, people have another option to justify the ownership of any art object. There are so-called non-fungible tokens, or NFT that appeared in 2017 on the Ethereum blockchain. But there is a difference. You don’t sell the object. NFT is a digital certificate confirming your ownership of any image, piece of music, animation, or any other object. In simple words, you buy a certificate to a painting or something like that, but you don’t receive it physically. For example, the founder of Twitter, Jack Dorsey, sold an NFT for his first tweet for $2.5 million.

As already mentioned, absolutely everything in any industry can be tokenized. Let’s explore the benefits of asset tokenization for businesses and the economy.

Benefits of Tokenization of Assets

Increased Liquidity

Tokenization will unlock the liquidity of unrealizable assets that are difficult to physically separate. Examples of such assets are real estate, which is usually expensive and inaccessible to ordinary people. This inaccessible asset can be tokenized and split into any number of low-cost tokens available to any investor, which will increase its liquidity.

Security and Transparency

Tokens created on the blockchain are registry entries in the form of a unique code, so they cannot be hacked or stolen. Thanks to blockchain technology, you will be able to track any transactions and, using smart contracts, identify the identity of the buyer, determine the scheme for distributing income or paying dividends, and much more.

Fewer Intermediaries

As a rule, a huge number of intermediaries are involved in transactions. They may charge a fee for their services, which increases the cost of the operation. Tokenization allows the token holder to sell it directly to buyers without the involvement of banks, dealers, and other middlemen.

High Speed

Since blockchain and smart contracts automate document flow and bureaucratic procedures, transactions are carried out several times faster.

Market Access

Thanks to the tokenization of assets, investors who previously didn’t have the opportunity to buy an expensive asset or enter into a trust management agreement with a bank can enter the market. Now, it’s enough to register on the cryptocurrency platform and go through the identification and verification of the identity. You don’t have to buy an expensive whole asset, it’s enough to buy out its share. You can enter the industry with any capital and make deals with any person from any country (there can be some issues that are discussed below).

Pitfalls of Tokenization of Assets

In spite of a number of advantages, this business model has some disadvantages, including:

Legal Regulation

In spite of the fact that blockchain is already widely used in many countries and has a lot of benefits for business and the economy, governments have not developed uniform standards for regulating this technology and cryptocurrencies yet. Smart contracts are still not considered legal contracts in most jurisdictions, either. However, it’s no longer possible to ignore disruptive technologies and digitalization, so sooner or later regulators will have to develop laws to work with tokenized assets and digital money. Some countries, such as Luxemburg, Austria, Liechtenstein, and Germany are making first steps in this direction.

Technical Issues

Blockchain is experiencing scalability issues, which adversely affect asset tokenization as it requires significant throughput. It is the number of transactions processed by the system per second. Visa’s electronic payment network, VisaNet, processes nearly 20,000 TPS, while the Bitcoin blockchain can only handle 3 to 7 TPS. By the way, this problem is expected to be solved soon.

Security Challenges

In spite of the fact that blockchain is considered secure and safe, hackers never gave up their attempts to attack financial instruments and services based on this technology. From 2012 to 2020, attackers stole more than $13.6 billion. It’s turned out that blockchain has vulnerabilities as well. Nevertheless, new projects and developers try to solve these issues. For example, Ethereum 2.0 boasts of increased transaction processing speed, high efficiency of consensus protocols, and so on. All these features can help to cope with security issues because they allow to easily check smart contracts for vulnerabilities.

Final Words

Tokenization of assets opens up huge opportunities for businesses and allows companies to access global markets. You can tokenize a great number of assets and trade them on the exchange. These are real estate, securities, precious metals, works of art, land, and much more. The transfer to the blockchain will save money on intermediaries, transactions, and network maintenance, increase the transparency and security of transactions, reduce time spending by automating processes, and so on.

Of course, there are problems and risks, such as the lack of regulatory mechanisms, security problems, and technical issues. All these barriers will be solved over time. Many countries support cryptocurrencies and tokens as well as welcome the use of blockchain and smart contracts. According to Roland Berger & Keyrock, tokenization is expected to bring €4.6 billion by 2030. It’s unlikely that anyone wants to stay away and not bite off a piece of this delicious pie.