Composable finance solutions are the answer to the lack of architectural flexibility that often challenged financial institutions and a way to easily adapt to changing market trends and customer behaviors.

The terms “modularity” and “composability” are becoming increasingly influential in the world of finance

as today’s consumers expect immediate, best-of-breed, hyper-personalized services.

Leading players across the financial services sector are now shifting to a composable, also known as modular, approach as it enables them to develop and deploy new products and services fast by reusing existing components.

But what composable software design actually is?

What Is Composable Software Development?

In software development, composability refers to building separate, manageable software components or modules in a way that they can be easily composed to roll out new features or entirely new applications. Each module handles a specific part of the system’s functionality and can be developed, deployed, and scaled independently.

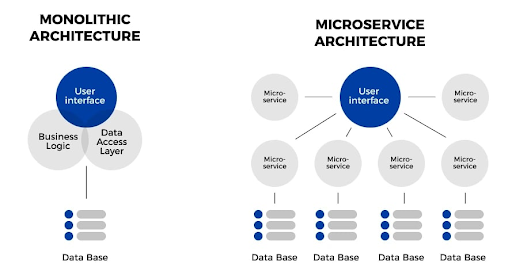

Unlike traditional monolithic architecture, composable, or modular, architecture allows companies to replace parts of their outdated systems more easily, adapt and scale with less friction.

Modularity also enables engineers to reuse existing modules, eliminating redundant tasks and promoting efficient code maintenance.

Monolithic Architecture vs Modular Microservices Architecture

Source: HUAWEI

It’s not what we are used to and quite a tall order, but industry observers, Gartner analysts, for example, declare the future of designing software will be defined by composability.

Modular Software Development: The Benefits For Financial Institutions

Breaking down a software application into a collection of self-contained functional modules can help financial institutions achieve their goals in terms of speed, flexibility, and customer experience. Let’s look at the primary benefits of composable finance solutions closer.

Greater Scalability And Flexibility

Scalability it’s not only about responding to changes in demand or data.

It is an essential attribute of a competitive finance solution as it lets seamlessly integrate new functionalities into systems to build innovative services faster.

Monolithic architecture has limitations in this regard.

A monolith’s internal components are tightly interconnected. Changes to one area can affect the entire application. Thus, integrating new components or replacing existing ones may require extensive development.

In contrast, composable architecture allows making necessary system upgrades and deploying new services with almost no impact on the overall system as each module can be reached and modified independently of the others.

This approach is especially beneficial in the dynamic, fast-changing financial sector where the ability to adapt to evolving customers’ needs and time-to-market is paramount.

Shorter Development Periods

Having a system broken into modules allows for simpler designing, testing, and implementation. Several coding teams can work on different modules independently and simultaneously, which helps manage large projects more efficiently and speeds up development.

The modular approach is also a time savior for engineering teams as it lowers the risks of ending up with programming errors and makes it easier to catch errors, if any. That’s because the errors can be narrowed down to a particular function or a sub-program.

With projects hitting their deadlines and new services available to customers on time, financial brands remain flexible and responsive to consumer demands and gain a competitive advantage.

Software Modules Reusability

Once-developed modules can be reused in different projects. Developers can gather multiple modules for common functionalities into libraries, and later use them in other projects with little additional effort.

Reusing modules in different systems without modification is pretty profitable for financial institutions as it minimizes the development of redundant codes, saves their money, and shortens the time to market.

A modular-based approach helps create more reliable software applications, as companies use well-tested modules rather than fresh, buggy code.

The 5 Key Elements Of Modular Software Design

Modular software design is all about minimizing complexity. To achieve the goal, we need to reduce the complexity of each module and the overall module-dependency network as well.

These five core elements of modular design are critical for achieving successful outcomes.

- Clear purpose: A module’s responsibility should be narrow and well-defined, ensuring that no two modules have overlapping functions.

- Easy to understand interface: A module’s interface tells you what to expect about the behavior of a specific module and what services it will be responsible for. It should be simple and easy to understand but hide a complex implementation.

To hit that objective, ensure a module’s API is well documented and follows a coding standard. A good API is complete, minimal, and hard to misuse. - Encapsulation: All internal details and implementation of a module should be hidden from the outside world. Modules should only expose a public interface that specifies how the given module can be used.

Encapsulation protects the integrity of the module and supports its adaptability and modifiability. Ignoring strong encapsulation principles may result in implicit dependencies which lead to problems with scaling projects. - Сonnection: Minimize each module’s external dependencies to make it easier to reuse modules in different contexts. Assess the overall design quality periodically to uncover complexity-decreasing opportunities.

- Implementation: A module with a crystal-clear purpose, well-designed interface and encapsulation will still fail to yield positive results without correct implementation. The right implementation should be performant, tested and minimal.

What Are The Challenges Of Building Composable Fintech Solutions?

While shifting to composability is a great way for financial services companies to grow and adapt during periods of volatility, modernization and reform, a composable design still has a number of shortcomings.

Below are the key ones to be aware of.

Potentially Increased Complexity

As businesses expand, they often get harder to manage because they become more complicated.

The same might apply to modular software systems. As the number of modules increases, managing numerous interconnections and ensuring uniform standards may take considerable effort.

Thus, to some companies, a monolithic, single-tier architecture may turn out to be easier to deal with.

Lengthy Pre-Development Phase

Developing effective modular software requires a deep understanding of the business requirements, underlying technology, specific design principles, and potential limitations.

Moreover, when it comes to finance applications, where dealing with customer’s money is in question, the stakes are higher and things grow harder.

If you wish to design secure, robust and scalable modular software, be prepared for potential delays at the beginning of the development. More extended studies, brainstorming sessions, and technical review meetings may be needed to structure the project properly.

Higher Development Costs

Although modular software architecture promises long-term advantages in terms of scalability and flexibility, the initial investment and ongoing maintenance and support costs can be higher compared to a monolithic system.

Young, fragile startups as well as smaller financial companies with limited resources need to carefully weigh up the pros and cons before starting to build modular-based software systems.

Looking To Get Future-Ready With A Fintech Product Where A Composable Architecture Is A Foundation? Partner With Elinext.

Elinext is a global IT consulting and software development company with 27+ years of business excellence.

Having multiple international offices spanning the USA, Germany, France, Ireland, Singapore, and Hong Kong, and delivery centers around the world, including Poland, Vietnam, Georgia, Kazakhstan, and Uzbekistan Elinext is an end-to-end technology partner for businesses operating in:

- Financial Services & Banking,

- Real Estate,

- Healthcare,

- Manufacturing,

- Retail & eCommerce,

- Telecom,

- Automotive,

- Education,

- Logistics & Transportation,

- Travel, and Media & Entertainment.

Software For Processing And Management Of Securities For A Global FinTech Company is just one of the many successful fintech projects that allow us to confirm our deep expertise in building top-of-the-line digital finance products.

Our Client, a UK-based globally recognized product software development company in FinTech solutions, wanted to build a Corporate Actions Processing solution.

The Elinext team was expected to develop a highly analytical system that would provide simple end-to-end management of the corporate actions lifecycle covering a wide range of various processing phases for an event.

Right from the start of our partnership, the Elinext experts quickly got a general understanding of the system’s functionality and interconnections and began their work on the project.

Their united efforts resulted in the development of the Dashboard features that enable users to:

- Get quick data analytics,

- Navigate effortlessly through the necessary parameters,

- Perform the required actions via metrics, filters, and sorting.

Enhancing Financial Technology:

Neobank Application Development

Backend App Development for Banking

Update of UK-Based Crypto Digital Bank

Invoice Management System for Digital Banking

App for Integration with Financial Organizations

Data Analytics Platform for Companies Operating on the Nigerian Financial Market