The embedded finance model enables nonfinancial businesses to offer their customers a broad range of financial services, including payments, lending, and insurance—all without needing to go through banks. Financial software development services play a crucial role in building and integrating these solutions. Keep on scrolling to find out about the core technologies behind it.

Whether you apply for car insurance straight from an auto retailer’s website, invest in stocks directly through your favorite news app, or simply place a mobile food order, you are engaging with embedded finance technologies.

Embedded finance is the new imperative for modern businesses that stands to touch nearly any sector, including retail, real estate, hospitality and leisure, media and entertainment, and more.

Having experienced a tipping point in demand during the COVID-19 pandemic, when the adoption of fintech and digital banking services soared dramatically, embedded finance technologies continue contributing to financial evolution.

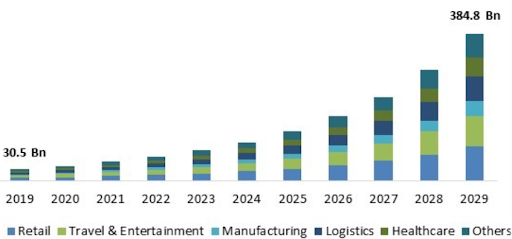

In fact, the embedded finance market is forecast to reach $384.8 billion by 2029, growing at a 30.0% CAGR throughout the forecast period.

Embedded Finance Market Size, By End-use, 2019-2029

Source: kbvresearch.com

What Is Embedded Finance?

Embedded finance refers to the integration of financial services directly into nonfinancial companies’ platforms or applications.

Tik Tok Shop, Tesla Financing Options, and Uber with its own digital wallet, Uber Cash, and credit card system are all showcases of embedded finance in action.

What New Opportunities Embedded Finance Can Open Up For Nonfinancial Firms?

Embedded finance early adoption can mean the difference between keeping pace within your industry and falling behind. Let’s delve into the advantages businesses can take from offering financial services within their non-banking ecosystems.

Bettering Financial Inclusion While Acquiring More Customers

The latest edition of the Global Findex shows that 1.4 billion adults worldwide remain unbanked.

Importantly, many of those underbanked individuals have mobile phones that can expand access to convenient financial services. However, they continue to buy goods on e-commerce platforms and pay them through cash.

For nonfinancial organizations, e-commerce companies in particular, this means that opportunities abound to acquire customers, whose first interaction with banking services may be through an experience that’s embedded in smartphone applications.

Whatsapp, for example, embedded payments within its platform to offer immense convenience to its customers, including those who are new to digital payments. As a result, in a short span of time, over two million users have availed banking services on the platform.

More Convenient Customer Experience

Embedding financial services directly into your business ecosystem allows users to access what they need effortlessly, without having to run an obstacle course or navigate multiple platforms.

Be it an e-commerce platform offering instant loans at checkout, or a ride-hailing app with in-app payments, providing financial services as an added value within the current customer journey will ensure a user-friendly experience that encourages loyalty and adoption.

Expansion Of Revenue Streams

Nonbanking businesses can also look at embedded finance as a key to new monetization opportunities.

Receiving a portion of transaction fees, cross-selling complementary products, and charging for premium financial services are some valuable examples of revenue opportunities embedded finance can open up when integrated into the non-FS business’s ecosystem.

Competitive Advantage Over Others In Your Market

Blending non-financial and financial services like payments, lending, and insurance without the need to shoulder the burden of dealing with regulatory approvals (as your bank partner is responsible for this matter) empowers companies across industries to stay ahead of the curve in the highly competitive business landscape.

Data-driven insights and personalized financial experiences generated by using customers’ behavior patterns and demands provide a foundation for informed business decision-making, reducing guesswork and intuition.

Embedded Finance Examples

Embedded Payments

Embedded payments involve integrating payment processing directly into non-financial apps and platforms.

Embedded payments make digital purchases easier as they allow customers to save payment information within the website or app. This eliminates disjointed payment methods that require users to switch between applications or enter payment details every time they make a payment.

Embedded Lending

Embedded lending enables non-financial digital platforms to offer diverse lending solutions such as loans or credit without sending their customers elsewhere to access them.

Basically, it works like this: Once a customer chooses a loan product, the system starts pulling data from multiple sources including credit scores, current consumer debt levels, and customer behavior within the platform to evaluate their creditworthiness and make a quick lending decision.

In case of approval, money is either sent directly to the customer’s account or allocated for specific use within the platform, such as buying services or goods.

Embedded Investing

When embedded investing — API-based integrations into investment and/or brokerage platforms — come on the scene, buying, selling, and exchanging stocks happen within the context of users’ existing digital experience with a particular non-financial app, without the need to leave it.

Embedded Insurance

In fact, embedded insurance, read integration of insurance coverage into the purchase of products or services from non-insurance companies, has been with us for a long time.

Examples of embedded insurance solutions could be travel insurance on travel aggregator platforms, renter’s insurance on commercial property management platforms, or subscription-based insurance on fitness apps.

Technical Considerations: Software Development Kits Engineers Can Use For Embedded Finance Development

As a rule, to shortcut development processes and enhance the overall development experience of embedded finance applications organizations add to their tech stacks sets of specialized software kits, written in one or more programming languages, called SDKs (software development kits).

Most SDKs include:

Code libraries

Pre-written code sequences that provide specific functionalities, for instance, data processing or user authentication, that developers can reuse to save time when programming.

Tools

Code editors, compilers, debuggers, testing frameworks, emulators/simulators, and other tools that assist developers in building, testing, and deploying software applications.

APIs

An application programming interface (API) is a software interface that facilitates interactions with the targeted platform.

Documentation

Guides, tutorials, and reference materials that explain how to use the SDK effectively.

There are numerous dev kits available for various purposes and technologies. The SDK you choose depends on your project’s specific requirements and the target platform.

Following are SDKs companies may consider to use to facilitate the development of their embedded finance projects.

1. Stripe SDK

Stripe SDKs wrap their APIs for a vast array of technologies and programming languages and are a good choice if you are creating a platform where you need to charge someone.

Be it managing the user interface for entering payment details, support during the communication with the payment provider, or dealing with responses from that provider, this SDK simplifies the complexities of payment processing.

2. Box SDK

Box, a cloud-based content management platform, provides a developer-friendly SDK that enables them to integrate secure file-sharing and collaboration features into applications.

The toolkit unlocks a multitude of possibilities for optimizing workflows, managing files, and boosting team collaboration.

Box offers libraries and prewritten code in Node.js, Java, and Python to interact with its APIs.

Among companies that use Box SDKs in their tech stacks are UNIQLO, Pandora, SendGrid and many others.

3. Visual Studio SDK

Written by Microsoft, this free full-featured development platform allows dev teams to build scripts and applications across multiple languages from one interface.

Visual Studio SDK also features a comprehensive ecosystem of extensions, with the Visual Studio Marketplace offering a rich set of plugins for various programming languages, frameworks, and integrations.

There is a robust community base and any issues your team may experience with the product can be resolved very quickly, either by the community itself or through Microsoft support.

4. Eclipse SDK

Eclipse is an open-source integrated development environment (IDE) that supports a wide array of applications, from Java-based websites and programs to those built on JavaScript, C, C++, PHP, Perl, Python, Ruby, COBOL, and Ada.

Often utilized for embedded systems development, Eclipse comes equipped with a plethora of source and graphic editors, along with tools (2-plan Desktop, Acceleo, Adobe Flash Builder, CityEngine, IBM Lotus Notes, Zen Coding, Zend Studio, etc) and APIs that cover all your needs for deploying, running, and testing applications.

This all-in-one IDE is compatible with Windows, macOS, and Linux, making it a versatile option for engineers using different platforms.

5. Postman SDK

Postman is a must-have kit for developers working with APIs (APIs let nonfinancial entities access financial services directly on their platforms). It offers a customizable environment to generate and test API calls easily. Postman provides support for Rest API, GraphQL API, and gRPC.

The best things users like about it are its intuitive, developer-friendly interface and a good number of tutorials available.

Characteristics Of A Good SDK

Whilst in theory an SDK is supposed to enhance development experience, that’s not always how it pans out in practice. Besides the above-mentioned, proven dev kits, there are many SDKs out there. Some of them are good enough, while others can make the development process even more complicated.

Here are the hallmarks of an effective SDK:

Easy to install

Things can go wrong from the very beginning if a kit is hard to install.

Good documentation

It should cover reference materials in all supported languages, a guide to implementing common features, and tutorials to help you get started easily. Without good documentation in place, an SDK can turn out to be even useless.

Clear code samples

Having clear code snippets developers can copy, paste, and edit allows you to speed up the development process at times.

Few dependencies

A well-designed SDK should have a minimal number of external dependencies. If not, problems may arise when adding dependencies to your own project.

Looking To Benefit From The Embedded Finance Boom? Let Elinext Help

Elinext is a premier full-service custom software development company that offers world-class development services both locally and internationally to businesses operating in Banking, Healthcare, Data Analytics, ERP and Asset Management, CRM and Loyalty, Artificial Intelligence, Machine Learning, Blockchain, Cybersecurity, IoT, and IT Infrastructure Management domains.

Having been in the industry for almost 30 years, we already have the necessary modules available for businesses of all stripes to craft and launch their embedded finance solutions.

A B2B Online Payment Platform for an Automotive Business is just one of the many successful projects that allow us to confirm our rich experience in creating tailored embedded finance products.

Our Client, a major European car manufacturer, hired Elinext to build a B2B online payment system.

The Elinext team was expected to improve the first version of the Client’s application that allowed them to sell to customers online. The original app lagged a lot and was tough to use.

The app our team worked with required lots of improvements, so our team had to rewrite it.

As a result, the architecture our engineers built proved itself much cleaner, more stable and more load-resilient than the original.

Moreover, the Elinext team was entrusted to build the second version of the app and enrich it with new features. Importantly, during the work on the application, we removed third-party tools, which, eventually, made a positive impact on the Client’s budget.

Check out other successful fintech cases Elinext has under its belt:

- Bider, Internet Bank,

- Smart Banking App,

- Phoenix Banking App and contact us today to discuss your next project.