Paying a bus fare with a QR code, tapping a sales terminal with a mobile phone, sending a text to pay for a coffee — even before COVID-19, the payments industry has been undergoing a tremendous shift to more efficient payment methods. As the pandemic has accelerated the shift to digital behaviors, it is expected that the global digital payment market will amass $361.3 billion by 2030, growing at a CAGR of 20.5%.

Innovative paytech startups recognize that seamless and embedded payments provide a competitive advantage so they are catering to evolving consumer needs through new, more convenient products and services. According to IDC’s research, 74% of consumer payments will be handled by non-traditional financial service providers by 2030.

The race is on as customers are picking their primary provider of payment services And to succeed in it, financial institutions need to embrace the brave new world of PayTech.

PayTech market overview

As the name suggests, PayTech refers to any payments that involve technology. This is a fast-growing sector of FinTech that focuses on transactions and payments rather than finance in general. In fact, PayTech companies make up 25% of FinTechs, valued at over $2.17 trillion.

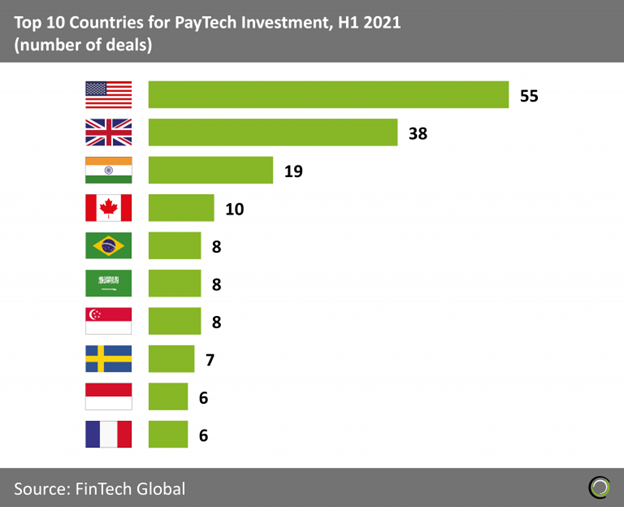

The pandemic has accelerated the global use of innovative payment products and high-profile investors are confident investing large amounts into the PayTech landscape. Last year, 52% of deals in the payment industry were larger than $10 million, with the United States running at the forefront.

The PayTech ecosystem thrives on a diversity of players and is continuously growing in complexity to embrace participants providing digital support, infrastructure or niche services. The PayTech landscape consists of:

- Payment Service Providers

- Card networks

- Electronic Money Institutions

- Issuing and acquiring banks

- Payment gateways

Key types of PayTech solutions

Payment processing technologies are rapidly advancing to enable innovation and make way for modern payment solutions that meet the need of the hour. These technologies include:

Digital wallets and super apps

A digital wallet, a.k.a. e-wallet, is an online payment solution that enables customers to carry out transactions via a phone, a computer, or a smart device. This is basically an electronic version of a physical wallet as it keeps all the important financial details in one place. Financial software development services play a crucial role in building these secure platforms. Digital wallets will account for more than a half of all eCommerce and point-of-sale transactions by 2024.

Many digital wallets are going a step further and expanding their array of services to become superapps — solutions that can fulfill almost any financial or leisure need a user might have. The biggest adoption of super apps is seen in the APAC region where population embraces digitization as a way to gain access to earlier unavailable services and products.

Case in point — Alipay

Alipay was founded in 2004 as a digital wallet and in 2022 it became the world’s most popular e-wallet with 1.3 billion users. In addition to sending and receiving money, the super app offers a tightly knit ecosystem of services from hailing a taxi to buying insurance to paying utilities.

Buy now, pay later

Buy now, pay later, or BNPL for short, is just what it sounds like — a payment method that provides credit options for customers to pay in installments. Last year, the BNPL market was valued at $125 billion and by 2030 it is expected to reach a whopping $3.98 trillion, according to Allied Research.

And this growing popularity of the BNPL model is easy to understand. Consumers choose this payment method for its convenience and ease of use since it does not require credit history. And merchants use BNPL to decrease abandoned carts, boost conversions, and drive sales.

Case in point — Klarna

Klarna is one of the most popular providers of BNPL products trusted by H&M, Sephora, Adidas, and more. When making a purchase through Klarna, customers can pay for the purchase within 30 days without fees, pay in four installments, or finance it over a period of up to 24 months.

Account-to-account payments

Open banking initiatives have removed the barriers of a fragmented banking ecosystem and facilitated the adoption of account-to-account payments. A2A payments refer to the direct money transfer from one bank account into another one. These payments do not typically involve credit or debit cards, which reduces the transaction costs and enables more robust security.

Case in point — SEPAexpress

Germany-based paytech SEPAexpress provides white-label A2A payment services to merchants and businesses across Europe. Launched in 2017, the paytech now processes millions of transactions on a monthly basis and has payment flows of more than €200 billion. Recently, SEPAexpress was acquired by fintech platform Banking Circle Group.

Crypto and digital currencies

Crypto and digital currencies, including central bank digital currency (CBDC), are also gaining momentum, marking the beginning of a new era of payments. Moving from centralized, FIAT-backed credit to decentralized digital currencies brings the benefit of cheaper and instantaneous domestic and international payments. The added bonus is potential reduction in energy consumption and decreased carbon emission.

Despite the recent cryptocurrency plunge, the future of payments is undoubtedly digital, and forward-thinking companies are starting to tap into this market. For one, PayPal recently allowed users to transfer cryptocurrency from their PayPal accounts to other wallets, in addition to the ability to buy and sell digital currencies.

Case in point — China

China boasts one of the most prominent pilot CBDC projects as transactions in digital yuan or e-CNY surpassed 100 billion yuan as of August 31. The People’s Bank of China (PBOC) reported that over 5.6 million merchants could accept digital currency for payments. The successful trial has now been extended to four more major provinces, including Guangdong, Jiangsu, Hebei and Sichuan.

Real-time payments rails

Touted as the next payment gamechanger, real-time payments rails are platforms and networks that enable users to initiate and receive payments nearly instantaneously. These networks are accessible round the clock, 365 days, meaning that they are always ready to process transfers. In addition to speed, real-time payments enable end-to-end transparency and smooth bilateral communication between the parties.

Case in point — The Clearing House

In 2017, The Clearing House (TCH) launched an RTP platform, the first of its kind in the United States. Today, TCH’s platform powers such giants as Fiserv, Sherpa Technologies, Volante and others in their quest to provide a range of various real-time payment services, including peer-to-peer (P2P) payments, payouts for gig economy work or insurance claims, and interbank account transfers.

Summing up

Customer expectations and behaviors are changing across all industries, and the payments industry is no exception. Now, consumers are demanding seamless, safe, and fast payment experiences. And the PayTech revolution has enabled merchants and businesses to successfully address the challenge of payment speed, convenience, transaction costs, and risk protection. From digital wallets and super apps to A2A payments to digital currencies, PayTech solutions are emerging on top of legacy infrastructure to help businesses keep up with the pace of the change.