Payroll software is responsible for calculating the wages of your employees based on hours worked, salary, and other relevant data. Payroll solutions help you manage and optimize the whole payroll process. To reduce the burden on the managers, HR specialists, or accounting departments and make the payroll activities more efficient, technologies provided an alternative to manual accounting in the form of specialized software, known as the payroll systems. Additionally, banking software development services can be integrated to streamline payment processing and enhance overall payroll management.

The global payroll software market stood at $21.9 billion in 2020 and is expected to reach $38.4 billion by 2027, with a CAGR of 8.3%, according to ResearchAndMarkets.com. Let’s speak about payroll solutions and their benefits for companies.

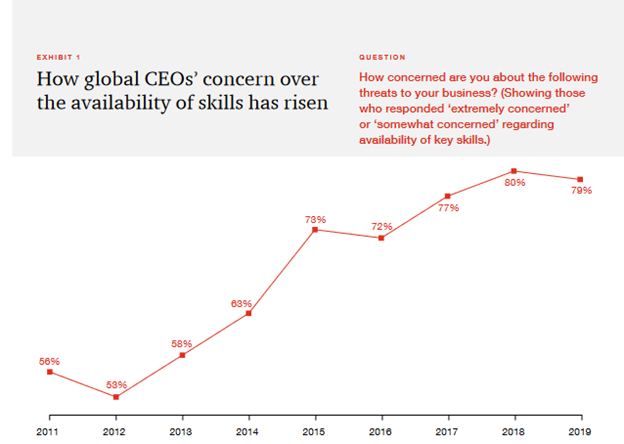

The graphic below clearly shows that the number of businesses using HR and payroll software in the US is growing with every passing year.

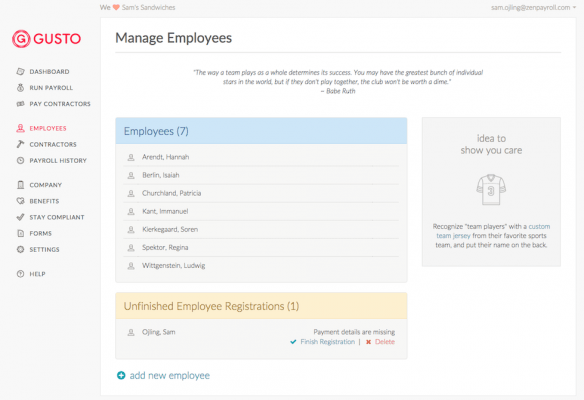

You can use out-of-the-box solutions available in the market or custom payroll software depending on your needs and requirements. There are free options with limited functionality (eSmart Paycheck); if you need more features, you can choose payroll solutions that work on a subscription basis (Gusto) or order a custom payroll platform that will be adapted for your company and meet all your demands. For example, you will be able to add the required functions or ask to develop a cross-platform product that can be installed on both a PC or tablet/smartphone.

It doesn’t matter how large an organization is. Payroll solutions will be useful for both corporations and SMEs. Let’s see how businesses can enjoy payroll solutions:

Payroll Management

These solutions don’t just run payroll calculations; they help your accounting department to manage and control earnings and other payments. Your employees don’t need to make calculations by hand. They can set up a payroll schedule, and the program will calculate everything at the right time.

For example, some platforms are capable of taking into account personnel in the context of contracts concluded with each employee (labor contracts, work contracts, and so on). They can keep various calendars and work schedules, as well as apply individual schedules for each employee. They allow your accountants to keep records of contracts, appointments, and movements of the employee during employment and calculate the salaries by every contract and appointment separately. The above-mentioned Gusto offers customers these features, including hourly and salary-based computations, filterable payroll reports, flexible schedules, and much more.

Tax Calculation

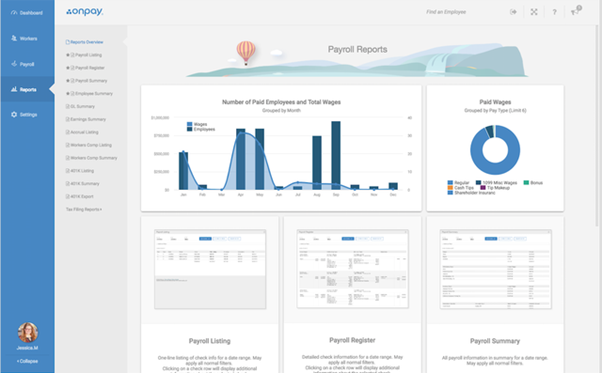

Payroll software will help your employees easily deal with tax legislation. Tax laws are constantly changing, and it’s difficult for employees to keep track of all the novelties, which can lead to various errors in the calculation of salaries or social benefits. For example, OnPay automatically updates payroll laws and tax regulations, allowing customers and their employees to save time on continuous monitoring changes in legislation or re-reading boring legal texts.

Payroll systems can offer you one more advantage. This is the automatic filling of tax reports and forms. Moreover, the platform will remind your employees to file tax returns and other documents, allowing you to avoid paying huge fines. If a UK company with more than 250 employees forgets to report payroll information on time, it will have to pay £400 per month.

Time and Attendance Tracking

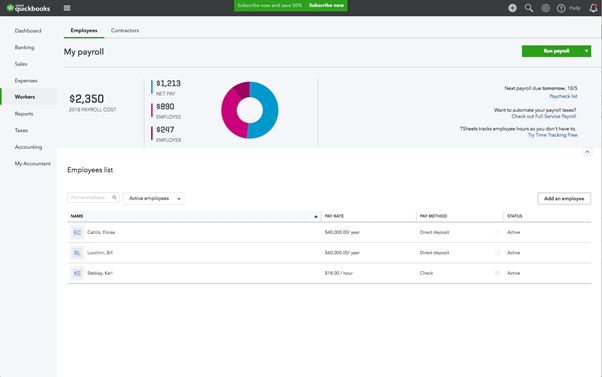

Whether your employees are paid for hours, or days worked, you will appreciate payroll software that can track time and attendance. You will be able to forget about the paper timesheets of your employees. Your platform will keep track of all vacations, sick days, overtime, hours worked, and anything else that is included in the payroll process. With financial software development services, QuickBooks has vacation time tracking and other useful features.

Reporting

Payroll software is designed to help your accountants and HR specialists keep records and create various reports. They will be able to easily and quickly find information about personnel and other important documents thanks to a convenient selection by parameters and generate reporting documents using ready-made templates or customize new ones for the individual tasks of the company.

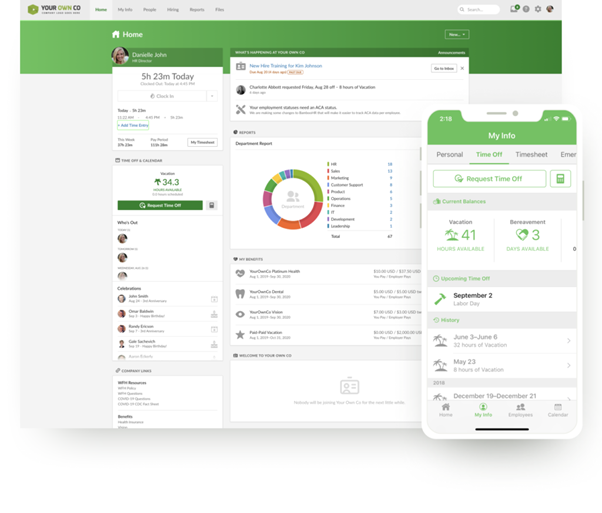

Based on the results of a month, quarter, or year, you can analyze labor productivity using the analytics of the program. In addition, it will be easy for you to draw up the necessary reports, taking into account the order of their submission to the relevant regulatory authorities. The payroll system can provide secure storage of confidential data as only authorized employees will have access to it. For instance, BambooHR offers customers report generation, accurate reporting, data import and export, and so on.

Finance Control

Another great feature of payroll solutions is that they can calculate various bonuses and benefits, as well as keep track of expenses. Are you buying new equipment for an employee? Do you need to reimburse your employees for a ticket or give them a gift for a wedding or birth of a child? The solution will provide you with the required information on time. Payroll platforms allow businesses to always accurately control and track their financial flows.

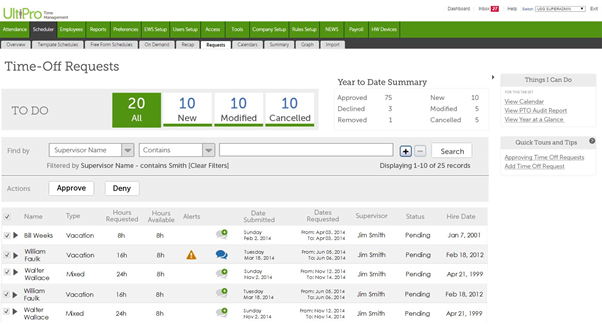

When choosing a job, specialists usually give preference to companies that offer employees an extended social package. At the same time, businesses consider the compensation package as one of the most important tools for stimulating and retaining your personnel. It will be great when payroll solutions help HR specialists and accountants work with health and pension insurance programs, ensuring effective management of all types of compensation packages. UltiPro is one of such platforms that offer customers compensation management, tax management, payroll administration, and other wonderful functions that will be appreciated by your HR and accounting departments.

Advantages of Payroll Software

So, you have learned how your company can use these solutions. Now, let’s see how you can win from using them.

Reduced Number of Human Errors

According to the American Payroll Association, payroll solutions significantly reduce mistakes in paychecks and invoices and allow companies to decrease payroll processing costs by 80%. These platforms provide an accurate and transparent payroll process. They use automatic algorithms that detect inaccuracies even at the stage of data entry, allow avoiding calculation errors, and reduce the risks associated with incorrect execution of taxation operations.

Happy Employees

The payroll process should be quick and smooth because you can’t detain wages. Your employees will be very unhappy when they don’t see money on their accounts on due time. Aptitude Research Partners revealed that 49% of US employees are ready to leave their job after two paycheck mistakes. With a reliable payroll platform, you will never give your staff a chance to impeach your promises regarding their salary.

Increased Productivity

Payroll solutions simplify the execution of routine operations for collecting and processing data in order to calculate salaries accurately. Thus, the accountant’s work will no longer be so difficult and painstaking, and the specialist will have the resources and time for creative analytical activities.

What Features Should Your Payroll Software Have?

Be Easy-to-Use

Your payroll solution should be intuitive no matter how many functions it has. PwC surveyed more than 12,000 employees and found that 65% of them are dissatisfied with their technology experience at work. We recommend you choose a product with an available support service so that your employees will be able to solve any problems.

Be Scalable

If you are a small company now and don’t need a complex payroll solution, it doesn’t mean that you won’t grow your business. In this case, you’ll be able to add more features to your software.

Be secure

When choosing payroll platforms, pay special attention to data security. Your accountants and HR specialists process a vast amount of personal information and other confidential data. Therefore, your platform should have proper protection, such as data encryption, multifactor authentication, access permissions, and so on.

Be Integrable

It will be convenient if your payroll solution can integrate with other software used in your company. For example, it can work in combination with HR and accounting software or workers’ compensation programs, which will make your business processes smoother and faster.

Final Word

So, payroll software will be useful for both large and small companies. An automated payroll process allows you to improve the efficiency of your business processes, increase employee productivity, and reduce costs. Today, there are a huge number of different payroll programs, so it’s important to clearly understand which configuration is ideal for your requirements and goals.

If you haven’t found your ideal solution yet, you can order a program that can be customized to suit your individual needs. If you have any questions regarding payroll products, Elinext experts will help you find the perfect option.