In the ever-evolving landscape of the mortgage industry, standards play a pivotal role in ensuring quality, consistency, and effective communication. At the forefront of this movement is MISMO, the Mortgage Industry Standards Maintenance Organization. MISMO standards are often referred to as the “Language of Lending”, testifying to MISMO’s importance for the entire industry. In our new interview, we are going to delve into how these standards promote interoperability and enhance the customer experience, while also exploring the role of banking software development services in supporting these advancements.

Brief overview: What is MISMO?

MISMO, a subsidiary of the Mortgage Bankers Association (MBA), is dedicated to crafting standards for information exchange and business conduct within the U.S. mortgage industry.

MISMO includes more than 450 organizations representing various housing, commercial, and mortgage financing sectors. Key stakeholders include:

- banks

- mortgage lenders

- payment service providers

- credit unions

- real estate appraisers

- Federal Housing Administration

- Consumer Financial Protection Bureau, and more

What is the primary purpose of MISMO?

The mortgage industry is very dynamic, to say the least, and industry players are always on the lookout for tools to increase the efficiency of their operations. However, solution vendors often use proprietary interface specifications, resulting in multiple different data formats that need to be supported.

MISMO addresses this complexity by establishing industry-wide standards that create a common language for data across the entire mortgage sector. It’s like giving the mortgage industry a universal translator for seamless communication. The main benefits include:

Interoperability

Mortgage industry participants are trying to steer clear of proprietary lock-ins and are increasingly seeking interoperable, plug-and-play solutions to avoid the need for costly customizations. Software vendors that embrace MISMO adoption find that integrating with other adopters is quicker and more cost-effective compared to vendors who stick to their own proprietary data formats.

Faster loan closings

The standardized and streamlined processes enabled by MISMO standards lead to quicker and more efficient loan closings. This benefits both industry professionals and borrowers by expediting the overall mortgage transaction.

Risk mitigation

With standardized data and processes, there is a reduction in the risk of errors, fraud, and misinterpretation. This not only enhances the overall quality of operations but also contributes to better risk mitigation.

Innovation

MISMO standards are designed to evolve with technological advancements in the industry. This adaptability ensures that mortgage industry players can integrate new technologies seamlessly without major disruptions to their operations.

How exactly does MISMO help the mortgage industry achieve all those benefits?

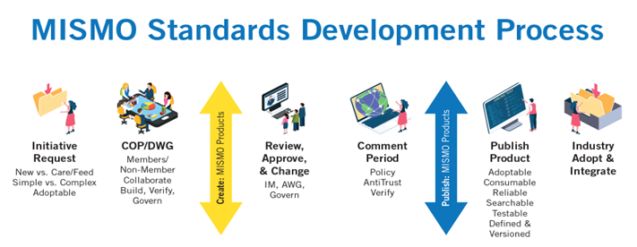

MISMO offers a comprehensive array of standards, specifications, and tools that support various processes, from underwriting and credit reporting to mortgage insurance application and property appraisal to loan origination and loan servicing. The development of these standards follows a systematic multi-step process, from an initiative request to review, approval, publishing, and eventually to industry-wide adoption.

Source: MISMO

The list MISMO standards and resources is quite extensive, here are some key examples:

- Digital Mortgage Resource Center that guides organizations through eDoc/eMortgage interoperability practices, eVault standards, and more.

- Business Glossary — a user-friendly compilation of terms and definitions sourced from both MISMO and non-MISMO references. It encompasses details about business terms, processes, events, documents, forms, and calculations.

- Life of Loan — a business process model that illustrates common activities throughout the life of a mortgage loan.

- API toolkit that facilitates the adoption of microservices-based architecture and streamlines the development of new mortgage and lending products;

- Commercial standards that standardize industry terms and definitions, offering a structured framework for the consistent use of data in commercial loans across various transactions;

- Residential standards that include the Residential Reference Model, the Enhanced Logical Data Dictionary, the Entity Relationship Model, datasets, and more

- eMortgage specifications offer a comprehensive framework for implementing and automating all facets of the digital mortgage process. These specifications include Remote Online Notarization Standards (RON), eMortgage closing guide, eMortgage glossary, and eRecording, among other things.

- MISMO Engineering Guidelines guarantee that MISMO products align with all technology standards and effectively cater to the needs of the mortgage industry.

How can one become a MISMO member?

Membership is available to any organization within the mortgage industry. The first level of membership means that upon joining, the organization receives an end-user and/or distributor license for utilizing MISMO standards. The second level guarantees access to MISMO standards, and the third level provides access to an online collaboration tool.

This means that without membership, specific details about the standards developed by MISMO cannot be accessed. Membership fees range from $3,500 to $50,000 per year.

What about MISMO certification?

In general, MISMO provides individual and product certifications.

For those experts who want to pursue individual certification, MISMO offers a Professional Certification Program with two levels: Associate MISMO Standards Professional (AMSPTM) and Certified MISMO Standards Professional (CMSP).

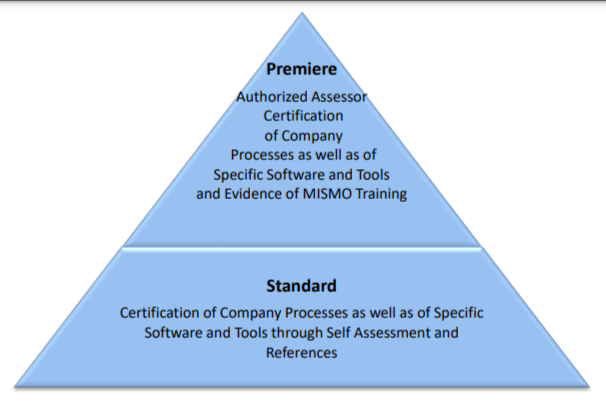

For product certification, MISMO has established a Software Compliance Certification Program, which assesses vendors’ adherence to MISMO standards. This certification aims to ensure a certain level of assurance that the products and services developed meet industry standards. However, in reality, it often boils down to a status symbol that allows product vendors to stand out among competitors and attract more clients. Product certification is available at two levels: Standard and Premier.

Source: MISMO

- Securing Standard Level certification involves conducting a detailed self-examination encompassing policy evaluation, test results analysis, and procedural assessment. After verification, MISMO experts either issue a certificate or offer constructive feedback highlighting areas for enhancement.

- Premiere Level certification builds upon the Standard Level with some distinctions. An impartial MISMO Authorized Assessor undertakes a more exhaustive evaluation of policies, procedures, test results, and associated artifacts. Additionally, achieving Premiere Level certification requires evidence of MISMO-related training or the engagement of project development team members in MISMO-sponsored training.

It’s crucial to note that MISMO certification is not an endorsement that the product complies with federal, state, or local rules and regulations. Having a label indicating that a product is MISMO certified doesn’t negate the need to consider any federal or provincial-level documents that must still be considered during development.

The bottom line

MISMO, the driving force behind mortgage industry transformation, takes center stage by providing a common language for data exchange. With a focus on interoperability and innovation, MISMO standards and specifications aim to shape a seamless and efficient mortgage experience for all industry participants.

Whether you are developing a solution for mortgage management, loan origination, underwriting, credit reporting, and more, Elinext has the expertise to help. Our BAs and engineers know the importance of staying on top of applicable regulations like MISMO to deliver efficient mortgage software solutions for the highly competitive market.