Even in the digital age financial technology inclusion is not guaranteed. Low-income families, economically vulnerable groups, the unemployed, and other financially underprivileged segments often face numerous barriers when trying to gain access to banking services. These barriers can range from a lack of necessary documentation or credit history to meet banking requirements, to physical distance from banks in rural or remote areas. In some cases, the minimum balances or the fees for keeping an account can be prohibitive. Furthermore, a lack of financial literacy can also become an obstacle.

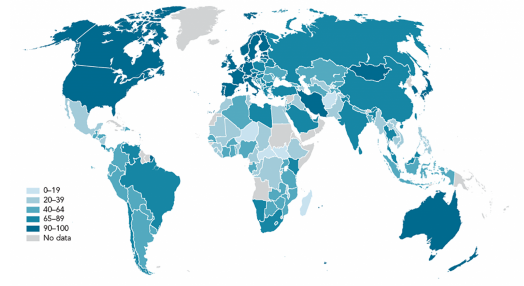

It goes without saying that financial inclusion varies greatly across nations. In developed countries, a large majority of adults have an account at a financial institution. At the same time, there are about 1.4 billion unbanked adults, as reported by the World Bank, coming mostly from developing countries.

Account ownership across the world

Account ownership varies widely around the world

Source: Atlantic Council

As for the European Union, the population without banking access has reduced significantly, by over half, in the last four years. the number of unbanked citizens more than. Yet, more than 13 million individuals within the EU still lack adequate access to financial and banking services.

In this article, we are going to concentrate on the German financial landscape and how German microfinance startups are leveraging fintech software development to promote financial inclusion.

A quick overview of the German financial ecosystem

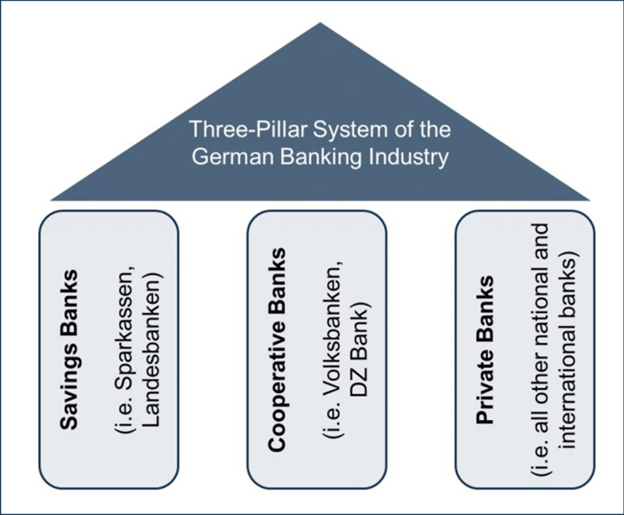

Germany showcases a strong financial inclusion scenario due to the country’s well-evolved and sophisticated financial infrastructure. According to data from the World Bank’s Global Findex Database, a mere 0.02% of the population remains without banking services. Germany’s financial system is built upon a “three-pillar” foundation that includes private commercial banks, public-service banks, and cooperative banks. These entities work in unison, offering a plethora of financial services throughout the country.

Three-pillar structure of the German banking

Three-Pillar System of the German Banking Industry

Source: Researchgate

Furthermore, Germany has seen an upsurge in digital financial services recently in no small part due to increased smartphone penetration and internet access. But despite these advances, there are still challenges to achieving total financial inclusion in Germany:

- A strong preference for cash transactions from a large share of the population, especially among the elderly, immigrants, and low-income groups, which makes it difficult for them to integrate fully into the digital financial system;

- Gaps in access to credit for small and medium businesses and people with lower creditworthiness;

- The digital divide between those with reliable internet access and financial literacy and without;

- Stringent regulations on fintech can stifle innovation and hinder the potential of these platforms to boost financial inclusion.

Microfinance to the rescue

Microfinance is a format of financial inclusion that offers financial services to individuals or small businesses that are excluded or have limited access to conventional banking and financial systems. The ultimate goal of microfinance institutions (MFIs) is to empower people by promoting financial independence and generating economic activity.

The promotion of financial inclusion through microfinance can happen in a number of ways:

Extending microcredit

Perhaps, the most commonly associated form of microfinance, microcredit involves providing small loans to businesses or individuals with low income without the need for the typical collateral required by traditional banks. This opens up a host of opportunities for people — from expanding a small business to improving living conditions or paying for education.

Fintech in the spotlight: Headquartered in Frankfurt am Main, CashCape offers instant and transparent microloans to consumers. To that end, CashCape uses its proprietary rating system based on current user information that is often more reliable than outdated historic data used for scoring by traditional rating agencies.

Encouraging micro savings

Microsavings is another fast-growing branch of microfinance. By offering micro-savings accounts with lower minimum balance requirements and fees, MFIs encourage better saving habits among economically disadvantaged groups. Having a micro-savings account can help people manage financial emergencies and better plan for the future.

Fintech in the spotlight: Pigtie, a Munich-based fintech startup, has secured a pre-seed investment in the six-figure range, bolstering its ambition to become the go-to financial app for Generation Z. Pigtie uses small amounts of money, or micro-savings, to help young professionals prepare to worry-free retirement.

Providing affordable microinsurance

Microinsurance is a mechanism designed to protect low-income communities against certain risks, provided they make regular insurance premium payments. It is essentially insurance with lower, more affordable premiums and coverage limits, aimed at individuals who are typically underserved by the insurance market. Microinsurance can cover various risks, including health, disability, property damage or loss, and even crop failure for farmers.

Fintech in the spotlight: Some fintech startups are even offering peer-to-peer insurance models to make microinsurance products more affordable. One such example is Friendsurance, a German fintech startup that allows individuals to collaborate with people from their social network to buy collective insurance. Such an approach leads to savings of up to 40% on premiums compared to conventional insurance offerings.

Promoting accessible micro-investing

Another subset of microfinance, micro-investing is all about allowing individuals to invest small sums of money, often by rounding up change from daily purchases or investing small regular amounts. The aim of micro-investing platforms is to lower the barriers to entry and offer investment opportunities to individuals who may not have large sums of money to invest.

Fintech in the spotlight: Peak is a micro-investing app that allows users to set aside small amounts of money and invest those finances in a globally diversified portfolio. After two successful years in the Netherlands, Peaks successfully launched in Germany with the mission to make investment widely acceptable. Circling back to Germany-based fintech startups that want to drive financial inclusion, one notable example is FinMarie. This is the first online investment solution created specifically for the needs of women. The solution takes into account data about women’s financial situations, including gaps in salary and pension, and offers coaching sessions and personal financial advice to help women stay in control over their wealth.

Improving financial literacy

Last but not least, some microfinance institutions are also looking to educate their clients about financial management, savings, debt, and other financial concepts. This education helps individuals make informed decisions about their finances and avoid over-indebtedness.

Fintech in the spotlight: Touted as the first family fintech, Bling is a Berlin-based fintech platform that strives to improve financial literacy among children, teenagers, and families in general. In addition to educational modules, Bling helps parents do financial planning and allows children to set up saving goals and earn money via chores and errands.

The bottom line

Even today, financial inclusion continues to be a challenge to underprivileged communities, economically disadvantaged households, the unemployed, and other financially vulnerable groups. And even though Germany can boast a robust financial ecosystem, challenges still persist, including a strong preference for cash transactions among certain demographic groups, gaps in credit access, the digital divide, and strict regulations that can inhibit fintech innovation.

Microfinance has emerged as a key solution to these challenges. By extending small loans (microcredit), encouraging small savings (micro savings), providing affordable insurance (microinsurance), promoting accessible investment (micro-investing), and improving financial literacy, microfinance institutions are bringing financial products and services to the underserved segments of the population.

And while a lot has been achieved in promoting financial inclusion in Germany, there’s still work to be done. It will require ongoing commitment and innovation from all stakeholders — including banks, fintech startups, regulators, and consumers themselves — to ensure that everyone, regardless of their income or background, can access and benefit from the financial services they need.