The gig economy and its participants open up a broad avenue of possibilities for fintech players. Read on to learn more.

Eight hours a day, five days a week — a schedule immortalized by Dolly Parton in our all-time favorite single ‘9 to 5’ — how many Americans stick to it? In fact, the numbers are far from “the vast majority”.

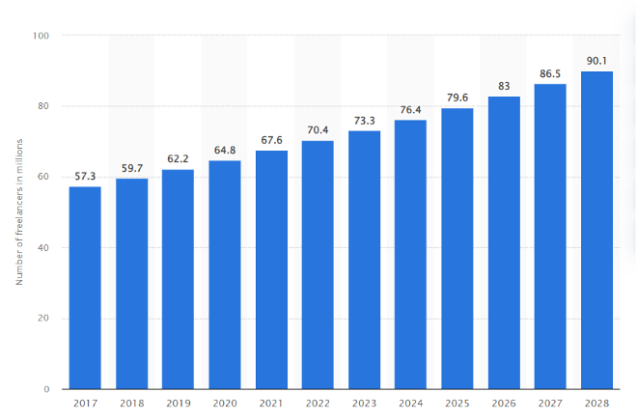

According to Statista, in 2024, nearly 80 million Americans support themselves as freelancers. The source also predicts that in 2027, the number of U.S. people participating in the Gig Economy will reach 86.5 million, or 50.9 percent of the total U.S. workforce.

Number of freelancers in the United States from 2017 to 2028 (in millions)

Source: Statista

What Is The Gig Economy?

A gig economy, also known as the independent economy, or the sharing economy, refers to a market system where job positions are filled by freelancers or independent contractors rather than full-time employees.

Examples of gig economy jobs range from highly paid actors, attorneys, doctors, and accountants to lower-earning babysitters, delivery drivers, or dog walkers.

What Are The Biggest Pain Points For Independent Workers?

While some people with good passive income can afford to leave traditional W-2 employment to choose their own path, on their own terms, the lives of the majority of independent workers are not smooth sailing.

Many see gig work as a lifeline and take on it because it’s what they have to do to survive.

But what are some of the key challenges independent workers face?

The Lack Of Health Coverage

Many independent workers do not have the health insurance benefits provided by employers as they work as temporary or contract workers. As a result, they have to buy health insurance independently or forgo health insurance altogether.

Legal & General U.S. Gig Economy study says 23% of the interviewed freelancers and self-employed workers between 18 and 60 years old have no health insurance.

Importantly, 42% of those surveyed noted that access to affordable healthcare and a pension would be the most influential factors for transitioning from gig work to traditional employment.

Financial Insecurity And Exclusion

A large part of independent workers have to live paycheck to paycheck and experience work-related insecurity and anxiety. Low-skilled physical gig workers often are paid low wages, in some cases earning below minimum wage.

The study by the University of Bristol found, in the UK, 52% of gig economy workers, including those in roles like data entry to food delivery were earning on average £8.97 per hour — 15% below the legal minimum wage.

The Gig Economy Equality Gap report from Rollee found that approximately 70% of gig workers face challenges in obtaining essential financial products such as loans, mortgages, or credit cards.

The same resource states two-thirds of surveyed self-employed individuals experienced loan denials after quitting their full-time jobs for gigs, resulting in one-third being unable to buy a home despite having good credit scores.

It was also revealed that on average, they have had to seek approval from three different providers before being successful. Being denied equal opportunity to financial services is a reason why 39% of gig workers considered giving up freelance work for conventional nine-to-five jobs.

The root cause of this financial exclusion is the limited transparency of income and employment data for independent workers compared to their PAYE counterparts.

Most of today’s financial institutions are reluctant to work with “non-traditional” workers as their risk assessments do not enable them to obtain a comprehensive picture of such worker’s payments, income, and employment records.

Difficulties Calculating Taxes

As an employee, your company estimates and withholds taxes from your gross pay. This ensures that part of your tax obligations is covered. As an independent worker, you’re responsible for all of it.

The problem is that taxes for freelancers are much more complex compared to salary workers. Contractors must pay income and self-employment taxes that often become overwhelming and challenging.

To address tax questions and issues independent workers have to consult with a financial professional or tax advisor, but this is also pretty expensive.

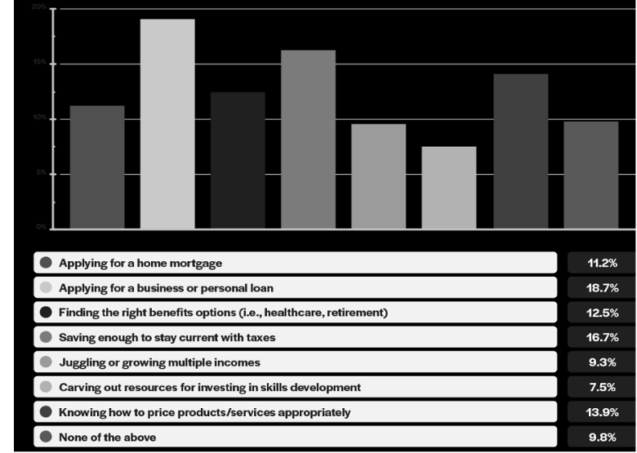

Top financial challenges of being an independent worker

Source: State of Independent Work, Independent Economy Council

How Can Fintechs Help Address Some Of The Common Freelance Challenges?

Because most traditional financial players have not yet responded to the gig economy, fintechs can take up the reins offering progressive solutions to the banking needs of freelance customers.

Considering the current financial challenges independent workers face, they would be willing to pay for (this list is in no way comprehensive):

- business budgeting apps and tools enabling them to capture bills and receipts, and reconciling bank transactions;

- solutions that help send and receive payments globally with competitive exchange rates;

- invoicing tool that automates the calculation and payment of estimated quarterly taxes;

- affordable micro-insurance products.

As we said above, freelancers struggle to get approved for a mortgage or loan. Traditional financial institutions assess loan eligibility based on the regularity of an individual’s income; the dynamics behind their activities are not always taken into account.

Fintechs can promote greater financial inclusion for gig workers by using alternative data (telco data, social media presence, rental payments, utility records, and open banking information) to form a more comprehensive view of the risk associated with lending to them.

Unique Fintech Companies That Create Products and Services For The Good of Gig Workers

KarmaLife

KarmaLifa is a popular India fintech platform that uses the latest technologies to build solutions that help independent workers “efficiently manage liquidity for their enterprises”.

Partnering with the Small Industries Development Bank of India (SIDBI), KarmaLife provides affordable and accessible financial support to blue-collar and gig workers by giving instant lines of credit through a mobile app. Funds are available 24/7 and require no paperwork.

The company is also actively investigating additional services related to micro-insurance products (health insurance and personal accidents), with plans to introduce them in the near future.

Paymenow

A further example of fintechs tailoring solutions for a specific segment of gig workers is South Africa-based Paymenow. The market-leading Earned Wage Access (EWA) platform allows low-income workers in logistics, mining, financial services, etc. to access part of their earned wages before payday.

Additionally, the financial wellness app has features that support users in enhancing their financial literacy and grant them access to more credit as they build financial skills.

Bankly

In Nigeria, Bankly brings thin-file/no-file clients (also known as the underbanked/unbanked) into the financial system.

By combining technology and human touchpoints to digitize cash, they create a digital/financial identity, enabling Nigerian individuals and micro-entrepreneurs to access broader financial services such as credit and insurance.

Since its foundation in 2018, Bankly’s hard work has yielded stunning results, namely:

- the company supported more than 40,000 direct agents and micro-entrepreneurs, fostering employment and growth;

- extended working capital loans of up to $500,000 to small businesses;

- helped 16,000 women micro-entrepreneurs by offering them free payment devices and working capital.

Turaco

Turaco provides microinsurance in Uganda and Kenya with affordable monthly premiums of approximately $2.

The startup collaborates with digital ride-hailing platforms like SafeBoda to offer customized life and health insurance coverage for their drivers, including hospital cash-back payments. Users can submit claims via their smartphones, without the need to wait in lines to get their cash back.

Want To Create A Breakthrough FinTech Product To Support Gig Economy Workers? Partner With Elinext To Go Through This Path Without A Hitch.

Elinext is a global IT consulting and software development company with international offices spanning the USA, Germany, France, Ireland, Singapore, and Hong Kong, and multiple delivery centers around the world, including Poland, Vietnam, Georgia, Kazakhstan, and Uzbekistan.

With 27+ years of industry expertise and a team of more than 700 software developers, Elinext provides world-class engineering services for businesses operating in Financial Services & Banking, Real Estate, Healthcare, Manufacturing, Retail & eCommerce, Telecom, Automotive, Education, Logistics & Transportation, Travel, and Media & Entertainment.

Some examples of our fintech solutions include a Cash And Liquidity Management App For Banks And Financial Institutes, an Update Of A UK-based Crypto Digital Bank, a Donation Management System For Non-Profit Organizations In The USA, and a Data Analytics Platform For Companies Operating On The Nigerian Financial Market.

We are exactly proud of one of our ambitious projects, the Software For Processing And Management Of Securities For A Global FinTech Company.

Elinext has been privileged to work with a UK-based globally recognized product software development company in FinTech solutions.

The challenge before our team was to develop a Corporate Actions Processing solution. The client needed a highly analytical system that would provide simple end-to-end management of the corporate actions lifecycle covering a wide range of various processing phases for an event.

Our efforts resulted in a great outcome — Elinext’s engineers developed the Dashboards features that enable users to get quick data analytics, navigate effortlessly through the necessary parameters, and perform the required actions via metrics, filters, and sorting.

We’ve received positive feedback from the client’s side. That’s just what always makes our team happy and inspires us to take on even extremely complex IT projects.

Get started on your business idea today.