The fintech sector continues to evolve at a neck-breaking speed. Just last year, the fintech industry saw record-breaking investments as the total global funding reached US$210 billion across 5,684 deals. If anything, this suggests that the fintech market is becoming more mature, with more consolidation activity and big M&A transactions taking place.

Fintech shapes every aspect of financial services, with electronic payments, insurance underwriting, peer-to-peer lending already an integral part of everyday life for millions of users. And as these fintech subsectors continue to grow, we see a surge of interest in embedded finance, cryptocurrencies, and other fintech software development trends. Without further ado, let’s see what they are.

Fintech trends to keep an eye on in 2022

1. Embedded finance

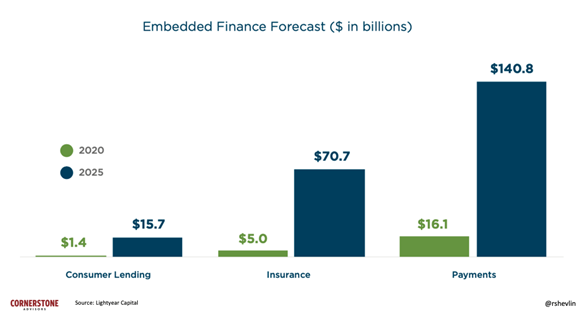

Embedded finance is a new trend but it is already gaining traction. Simply put, embedded finance refers to the blending of financial tools into non-financial platforms and solutions to enhance the user experience. This integration enables customers to access services like loans, insurance, payment processes without disrupting their flow. By 2030, embedded finance is forecasted to become a $7.2 trillion opportunity.

Source: Forbes

Some examples of embedded finance include car insurance provided together with car-sharing or taxi services. British Airways, for instance, provides travel insurance on its website when a customer purchases a flight ticket.

Another well-known example of embedded finance is the Buy-Now-Pay-Later model, or BNPL for short. BNPL is a form of installment payment service that allows customers to split a purchase into several parts. Amazon has teamed up with Barclays to offer a BNPL plan — customers can split their Amazon purchases into 3 to 48 monthly installments.

2. Focus on cybersecurity and data protection

In 2020, financial institutions were the most common targets of cyberattacks. Since then, investments in fintech cybersecurity have more than doubled, and ensuring reliable protection of customers’ data remains the top priority for fintech experts.

A particular interest lies in the use of AI, machine learning, and automation to improve security posture. Namely, fintechs are increasingly deploying AI-driven endpoint detection and response (EDR) solutions that perform dynamic behavior analysis across complex systems and automatically identify suspicious patterns and uncover threats that would be impossible to detect with static behavior rules.

3. Cryptocurrency and CBCD on the rise

Despite shifting regulatory environments, the interest in the cryptocurrency space is strong as ever. In 2021, global investment in blockchain and cryptocurrencies skyrocketed to $30.2 million, which is five times higher than in 2020.

As cryptocurrencies are becoming mainstream, merchants and major payment service providers expand their support for crypto settlements. PayPal, for example, allows users to buy, sell, and hold Bitcoin, Ethereum, and Litecoin. So does Revolut, a UK-based fintech startup, that now supports over 30 cryptocurrencies.

Source: The Papers

Governments and central banks are also warming to the idea of cryptocurrencies. El Salvador was the first country to make Bitcoin a legal currency. Other countries look into developing a central bank digital currency (CDDC) of their own. In February 2022, India announced its plans to introduce a digital rupee within the next couple of years. China has been testing its digital yuan, dubbed e-CNY, since 2020. In fact, 80% of central banks are considering launching CBDC, according to PwC.

4. The rise of super apps

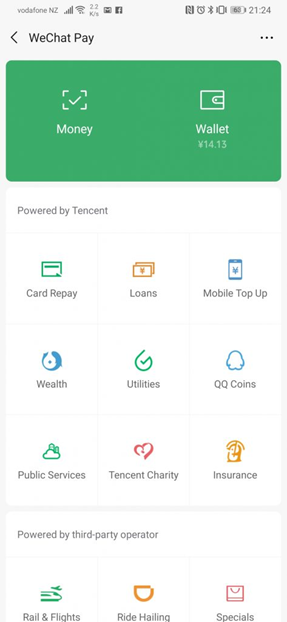

This year, industry experts also expect to see the race of super apps getting more intense. A super app basically refers to a “one-stop-shop” app that offers a wide range of products and services under one roof. The most vivid example of a super app is WeChat, which is used by more than two-thirds of the Chinese population. This popularity is not surprising given the impressive functionality of WeChat — paying bills and getting loans, booking a taxi or buying a movie ticket, messaging and calling, and much more.

Source: Agile Tech

Asia may have pioneered the concept of super apps, but now the Western world is catching up with the trend. Last year, PayPal acquired Paidy, a Japan-based buy-now-pay-later (BNPL) startup. Walmart also aims to make a big splash in the super app arena. The commerce giant is on track to acquire two fintech startups — Even Responsible Finance Inc. and ONE Finance Inc. — and then relaunch under the name ONE with a “financial services super app” status.

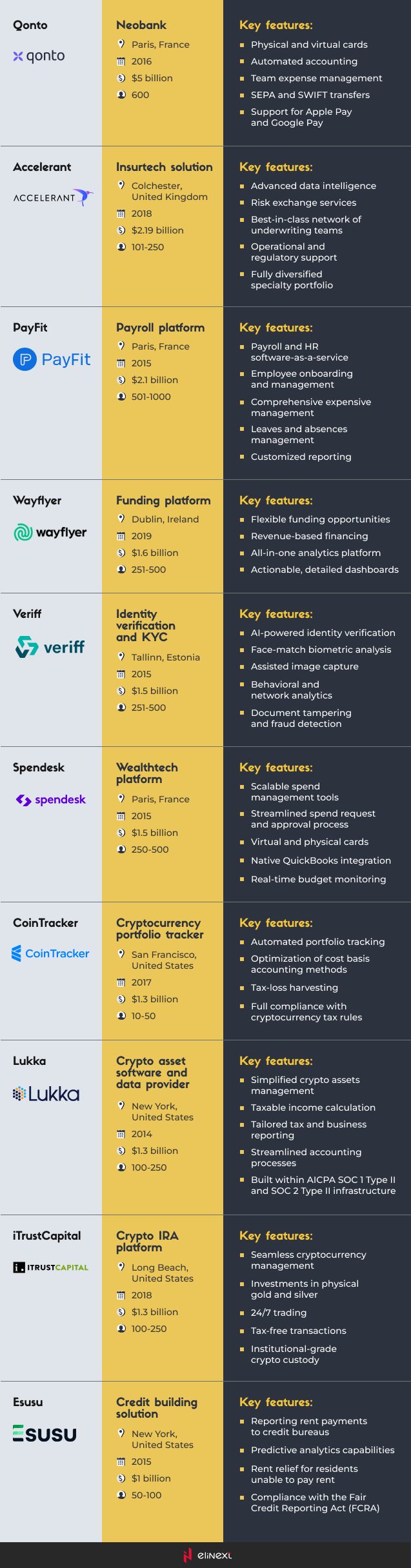

Top 10 highest valued fintech unicorns in 2022

According to a Dealroom report, there are now 473 fintech unicorns globally, with 40 added in the first quarter of 2022. We have compiled the list of top ten fintech unicorns with the highest valuation.

New and promising fintech niches

With seamless payments, alternative funding, personalized insurance offers, the fintech sector has come a long way. But still there are niche areas that fintech is yet to exploit.

Non-fungible tokens (NFT)

NFTs are all the rage right now — in 2021 the NFT market surpassed $40 billion. Simply put, NFTs are tokens that exist on a blockchain and are used to prove the ownership of digital items. And financial players are starting to see the lucrative opportunities and new revenue streams in NFT development.

Cryptocurrency regulation

As crypto is becoming mainstream, robust cryptocurrency regulation is needed to support innovation while protecting against fraudulent activity. Japan, for example, has become the first country to regulate crypto exchanges that must be registered and comply with traditional AML/CFT requirements.

ECG-focused fintechs

Since the UN Climate Change Conference, the prioritization of environmental, social and corporate governance (ESG) initiatives has been happening on a much broader scale. Now there is a growing focus on ESG capabilities among fintechs, and VC investments into ESG-related fintechs have surged within the last 24 months.

To sum it up

We are almost halfway through the year, and we have already seen 40 new fintech unicorns added to the big family. There is no doubt that fintech is a forward-thinking industry that leverages cutting-edge technologies to improve customer experiences and deliver innovative products and services, from embedded financing solutions to super apps to cryptocurrencies and NFTs. In parallel, fintech is expected to play a crucial role in encouraging green initiatives and supporting ESG capabilities.