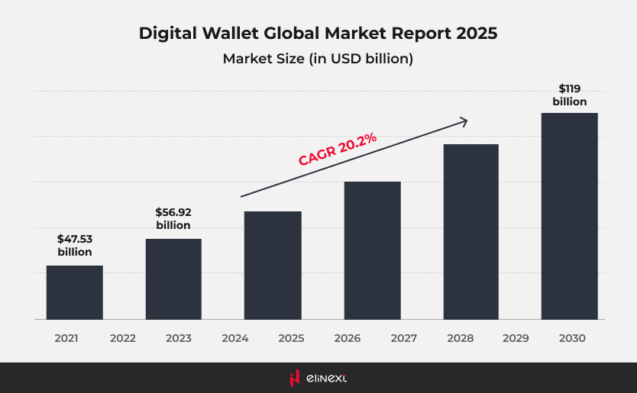

According to a report by Juniper Research, digital wallets are expected to account for more than 50% of e-commerce transaction value globally.

The global mobile wallet market was valued at US$ 11.51 billion in 2024 and is projected to grow from US$ 14.71 billion in 2025 to US$ 104.56 billion by 2033. This growth represents a significant CAGR of 27.78% during the forecast period from 2025 to 2033, indicating the growing adoption of mobile payment solutions across the globe.

For deeper digital wallet market insights, including digital wallet market trends and future forecasts, read our article to learn what a digital wallet is, how it works, its advantages and disadvantages, how to create a successful e-wallet, and what key features it should include. Understanding these aspects will provide valuable insights for navigating the evolving digital payment landscape.

Benefits of Digital Wallet Market

Digital wallets offer numerous benefits, including increased convenience, improved financial inclusion, and secure transactions. Using financial software development services, companies can create innovative digital wallet trends that streamline payments and enhance customer experience in the changing financial landscape.

E-wallets provide a number of advantages over traditional ways of storing and transferring money. Some of the most notable benefits include:

Convenience

The future of digital wallets looks promising, as they continue to simplify transactions, allowing users to make payments quickly and effortlessly. Digital wallets provide a convenient way to store, send, and receive money. They can be used to make fast transactions that are processed in real-time, making them convenient for online payments as well as transferring money between countries.

Security

E-wallets are protected by a password, pin, or other security measures, making them more secure than traditional methods of storing money. Digital wallets enhance security by leveraging blockchain development services, which provide a decentralized and immutable ledger for transactions. This technology ensures that data is securely stored and resistant to tampering, significantly reducing the risk of fraud and cybercrime. As digital wallets evolve, their integration with blockchain will further bolster user trust and protect sensitive financial information.

Low fees

Digital wallets usually have low money transfer fees, making them more profitable than traditional money transfer methods, such as bank transfers and credit cards.

The digital wallet market is thriving, in part, due to the low fees associated with transactions. For example, platforms like KuCoin and eToro offer fee-free transactions, making it easier for users to manage their finances without incurring high costs. This accessibility encourages more people to use digital wallets, increasing their popularity and availability in everyday transactions.

Availability

These solutions can be accessed anytime and anywhere in the world. You can send and receive money at any time of the day, even when banks and other financial institutions are closed.

Wide range of choice

The future of digital wallets promises a wide range of choices for users. They can be used for online shopping, paying bills, transferring money to other countries, and more.

For example, platforms like PayPal and Apple Pay offer a variety of payment options, from online shopping to in-store purchases. This versatility allows consumers to choose the most convenient method for their transactions, improving the user experience and further promoting the adoption of digital wallets in everyday life.

Disadvantages of Digital Wallet Market

In the digital wallet market, users may face issues such as dependency on technology, which can become a vulnerability if devices are compromised. While digital wallets offer convenience and speed, they may not be accepted by all merchants, limiting their use. Additionally, concerns about security breaches and potential fraud may deter some users from fully adopting digital wallets.

Security risks

Despite all security measures, digital wallets, like any other online services, become the targets of hacker attacks, which can lead to the leakage of personal and financial data. Also, if you forget your password or pin, you may lose access to your money.

An Internet connection is required

You need Internet access if you want to use digital wallets. There are a lot of countries and regions with poor Internet connectivity, where e-wallets can be unavailable.

Not all merchants accept digital wallets

Even though the number of merchants accepting digital wallets is growing, there are still places where they are not accepted. This may limit their usability.

Limits on maximum amounts

Digital wallets can have limits on the maximum amounts that can be sent or received in one transaction. This may limit the use of digital wallets for large transactions. For instance, the daily maximum total transaction amount in Google Pay is $2,500.

Fees and currency exchanges

The future of digital wallets includes evolving fee structures and currency exchanges. Some digital wallets can charge transaction and currency exchange fees, which can increase the cost of using these wallets.

Difficulty of use

Digital wallet trends show that ease of use remains a challenge, as complex interfaces can deter new users. Some mobile wallets have a high entry threshold for new users, which can make wallets difficult for some people to use.

What Are Digital Wallet Trends in 2023?

E-wallets are becoming more and more popular as they allow people to make fast and secure online transactions. Let’s look at the trends that govern the development of the payment industry:

Mobile wallets

There are 6.92 billion smartphone users worldwide, which is 86.22% of the world’s population. The rise in smartphone and mobile app usage is driving the growth in the popularity of mobile wallets. Most major banks and financial companies (e.g., Bank of America, Wells Fargo, JPMorgan, and others) have already offered their mobile wallets.

Cryptocurrency wallets

With the development of cryptocurrencies, there is a need for wallets that can store and manage cryptocurrencies. Crypto wallets can be either cold, which means they are stored offline, or hot, which means they are always online. According to Grand View Research, there were 84.02 million crypto wallet owners worldwide as of August 2022.

Multi-currency wallets

Wallets that support several currencies are becoming more and more popular. They allow users to store and manage a lot of currencies in one place, making their lives easier.

Use of blockchain technology

Blockchain is a technology that allows you to create distributed databases that can be used to store information about online transactions. Some digital wallets are already using blockchain technology to improve the security and transparency of transactions. There are Electrum, Jaxx, Samurai, and other solutions.

Biometric authentication

Some digital wallets have already used biometric authentication, such as the face or fingerprint recognition to keep users safe. It also makes using wallets more convenient as users don’t want to remember complex passwords. For example, “123456” is the most commonly used password.

What Concerns Are Associated with Digital Wallets?

While digital wallets provide many benefits, there are some risks associated with using them. Some of the most common concerns include the following:

Security

One of the main concerns associated with the use of digital wallets is security. If attackers gain access to your wallet or data, they can transact on your behalf or steal your savings. Thrive asked users why they are slow to adopt digital wallets. 46% of respondents were concerned about security.

Low fraud protection

Unfortunately, online fraud is a common problem and digital wallets are no exception. While many wallets have fraud protections, such as two-factor authentication, there are still cases where scammers can gain access to your wallet.

Misuse

Another concern is the misuse of e-wallets. If you’re not familiar with the technology of digital wallets and don’t understand how they work, you can make mistakes and lose your money.

Regulation

Since digital wallets are a relatively new type of financial instrument, legal regulation in this area is still at an early stage of development. Some governments and regulators may restrict the use of digital wallets, which may affect their popularity and stability. For example, financial companies in China can’t make crypto transactions.

Possibility of loss of access

If you forget your password or lose access to the device where your e-wallet is installed, you may lose access to your money. Therefore, it’s important to take precautions and keep your wallet in a safe place.

What Features Should a Successful Digital Wallet Have?

According to Checkout.com, 43% of US customers used digital wallets in 2022. What should a digital wallet be like for consumers to choose from? Features of a successful e-wallet may include:

Ease of use

A mobile wallet should be easy to use and have an intuitive interface. This will provide usability for users.

Safety

A digital wallet must have a strong security system to protect the personal and financial data of users. This includes the use of encryption, two-factor authentication, and other modern security methods.

Opportunities for multiple payment systems

An e-wallet should support multiple payment systems and currencies for user convenience, including cryptocurrencies, payment cards, etc.

Wide coverage of merchants

A successful digital wallet should have a wide reach of merchants that accept it to allow users to make payments.

Reasonable fees

A mobile wallet should have reasonable fees for customers to make it more attractive to use.

Reliability and support

A digital wallet must have a high level of reliability and quality support so that users can be confident in its operation and be able to quickly resolve any possible problems.

How to Develop a Digital Wallet?

Juniper Research predicts 60% of the world’s population to use e-wallets by 2026. Therefore, now is the best time to create a digital wallet. The Elinext team has launched many financial and banking solutions to the market. Our experts are ready to share their knowledge and experience with you. They prepared a brief guide on the development of digital wallets. The development process includes the following steps:

Step 1: Research

At this stage, market research, competitor analysis, user needs, and features are determined. This allows you to set the requirements for a future digital wallet and develop a concept.

Step 2: Design

Then you will create the design, user interface, and functionality of your e-wallet. Your task is to develop algorithms and identify the technologies and software components required to implement the functionality.

Step 3: Development

Then developers write code, create software, do tests, and remove bugs. They define the technological infrastructure and ensure the security of the wallet as well.

Step 4: Testing

Then testers will check your digital wallet on different devices, operating systems, and platforms, while the development team identifies and fixes bugs, as well as improves the app performance.

Step 5: Release

When the mobile wallet is successfully tested, it’s ready for release. You can publish it on your website or any app platform like Google Play or the App Store.

Step 6: Support and update

When the digital wallet is released, you will continue to support its operation and improve its features in accordance with user needs and market changes. You can add new features and integrate them with other platforms and services.

If you need more details about the development process, programming languages, development tools, market trends, and so on, our specialists will be happy to answer all your questions.

The Future of Digital Wallet Market Trends

E-wallets are becoming more and more popular as they allow people to make fast and secure online transactions. The future of digital wallet market trends points to increased adoption, enhanced security, and integration with AI for better user experiences. Let’s look at the digital wallet trends that govern the development of the payment industry:

-

Decentralized Wallets and Web3 Integration

A ML software development company plays a crucial role in the development of decentralized wallets and Web3 integration. Using machine learning algorithms, these companies can improve security, enhance user experience, and facilitate smooth transactions in decentralized environments. This integration gives users more control over their digital assets, promoting trust and innovation in the blockchain ecosystem. As decentralized wallets gain momentum, the expertise of ML software development companies will play a vital role in shaping a secure and user-friendly future.

-

Voice and Gesture-based Payments

The future of digital wallets aims to embrace voice and gesture-based payments, revolutionizing user interaction. As technology advances, users will be able to complete transactions simply by speaking commands or using hand gestures, increasing convenience and accessibility. This innovation will cater to a wider audience, including people with disabilities, making digital wallets more inclusive. By integrating voice recognition and gesture control, digital wallets will not only simplify the payment process, but also create a more engaging user experience, paving the way for a cashless society.

-

Digital Identity and Embedded KYC

Digital wallet market trends are increasingly focused on digital identity and built-in KYC (Know Your Customer) processes. This innovation allows wallets to securely verify users’ identities in real-time, enhancing security and compliance. By integrating KYC directly into the wallet experience, companies streamline the onboarding process, reduce the risk of fraud, and build user trust. As regulations tighten, the demand for seamless digital identity solutions will grow, positioning wallets as essential tools for secure transactions in the evolving fintech landscape.

-

Regulation-driven Innovation

Regulation-driven innovation plays a key role in shaping industries, encouraging companies to adapt and evolve. As governments impose new regulations, companies must innovate to ensure compliance while improving their offerings. By viewing regulations as opportunities rather than obstacles, companies can drive technological advancements that meet legal standards, paving the way for sustainable growth and improved user experiences.

-

Wallets as Financial Hubs

Digital wallet market insights indicate a significant shift towards wallets becoming financial hubs for users. They now integrate various services, allowing seamless management of payments, savings, investments, and even loans on a single platform. This convergence improves user convenience, promotes financial literacy, and encourages more people to engage in digital finance. As wallets expand their functionality, they not only streamline transactions but also provide personalized financial tools, making it easier for users to achieve their financial goals.

Conclusion

In conclusion, the future of digital wallets looks promising, driven by advancements in banking software development services and emerging trends. By 2025, we can expect wallets to evolve into comprehensive financial hubs that integrate services such as payments, investments, and personalized financial management.

However, challenges such as security, compliance, and user adoption need to be addressed. Collaboration between fintech and traditional banking will be critical to overcoming these barriers, ultimately creating a more inclusive and efficient digital payments landscape. Innovating while prioritizing user experience will ensure the growth and sustainability of digital wallets in the coming years.

FAQ

What is driving the growth of the digital wallet market in 2025?

The future of digital wallets is driven by mobile payment convenience, AI security features, and integration with services like crypto and loyalty programs, e.g., Apple Pay and Google Wallet.

How secure are digital wallets today?

Digital wallet market insights show strong security measures today, including encryption and biometric authentication. Examples like PayPal and Venmo use these features to protect user data and transactions effectively.

What are the key digital wallet market trends this year?

Key insights for the digital wallet market in 2025 include the rise of super wallets that integrate various services, fueled by AI innovations from an AI software development company. These wallets will improve the user experience with personalized financial assistants and improved security features, making transactions seamless and efficient.

Which regions are leading the adoption of mobile wallets?

By 2025, the Asia-Pacific region will lead mobile wallet adoption, particularly in Southeast Asia, where penetration rates are significantly higher than in other regions.

What features should a next-gen wallet include?

Based on digital wallet market insights, next-generation wallets should include AI-powered financial analytics, personalized recommendations, multi-factor authentication, seamless payment integration, and predictive spending tracking to improve user experience and financial management.