A wide range of functions covered by so-called “Digital Banking Platforms” attracts more and more attention. We’ve decided to cover the basic ideas that make digital platforms that popular, track the ways to the success of the leaders at the market.

In this article, we are going to cover the definition of “digital platform”, and its application in relations to the banking industry. We will also try to predict how the banks would look like in 2025, and what role in it will digital platforms play.

What is the Digital Platform exactly?

If you are going to ask the person who operates in banking or financial business what they think of when they hear “digital platform”, they’d tell you that think of their online banking platform, or mobile application that allows.

We’d like to take a strict course on what we are about to talk by giving a strict definition.

“The plug-and-play business model that allows multiple providers and consumers to connect, interact, and create and exchange value,” – Platform Strategy helps us with the fitting wording.

Therefore, plenty of big names on the Internet fall into this category. Facebook, Google, Amazon, even Uber – you name it.

Martin Kenney and John Zysman tell the following in their material “The Rise of the Platform Economy” for “Issues in Science and Technology”.

“Google and Facebook are digital platforms that offer search and social media, but they also provide an infrastructure on which other platforms are built.

Amazon is a marketplace, as are Etsy and eBay. Amazon Web Services provides infrastructure and tools with which others can build yet more platforms.”

Banking and Their Digitalization

Amazon seems to be everywhere. South Park creators even dedicated the last two episodes of their 22nd season to joke around Jeff Bezos and his company’s presence in every sphere of modern people’s life.

The banking is about to change drastically as the leading banks are embracing this or that form of a platform for their digitalization.

“We are in the midst of a reorganization of our economy in which the platform owners are seemingly developing power that may be even more formidable than was that of the factory owners in the early industrial revolution.”, – continue Kenney and Zysman.

While Amazon doesn’t seem like an easy target to compete with at any sphere, there are ways of building your own platform using AWS that would attract customers from the banking sector.

Nikolay Storonsky, creator of neo-bank Revolut is ready to crush traditional banks that are not able to compete with their unwillingness to get digital.

There are also smaller companies that help those banks to get digital. One of these companies is Fidor Solutions.

“Getting an emergency loan, paying friends on social media, sending money to the other side of the world” – they build solutions for banks with the trivial functions every traditional bank on the planet is ready to offer.

There is an opportunity to build your custom software – that will be utilized by the banks – and Elinext one of the companies that have high-profile expertise. If you already have an idea of a digital platform that would be interesting to the banks – contact us to get a free quote.

We’ll speak of what kinds of platforms have already found their way in the banking industry in the following chapter.

Business Banking Platforms and Banking API Toolkits

Forbes contributor Rob Shelvin figured that there are five types of platforms that have immense popularity in the banking industry right now. They are:

- Megabank API Toolkits

- Business Banking Platforms

- Marketplace Platforms

- Analytics Platforms

- Core Integration Platforms

While all of them to some extent are connected with certain aspects of modern banks (or banks that are trying to be modern), the major impact comes from the first two: API kits and business banking platforms.

The toolkit looks like an organic component of platform strategy, according to the aforementioned definition – “ helps providers and consumers to connect, interact, and create and exchange value”.

However, bankers are mostly interested in additional profits that come from the sales that happen due to the platforms existing, ignoring most of the other aspects.

The list of top banks that have portals that enable third-party apps to have access and integration of data to the customer’s base includes some big names of the industry: BBVA, Capital One, Citibank, Deutsche Bank, and HSBC to name few.

As for activities that are available – those include identity verification, money transfers, branded accounts and cards in those APIs.

At the same time, JP Morgan partnered with Canadian fintech FI.SPAN, a cloud-based bank API services platform. That way, the bank is able to use fintech features as a service.

As for banks that want to be digital to meet the new decade, we’d like to highlight the steps for them in the next chapter.

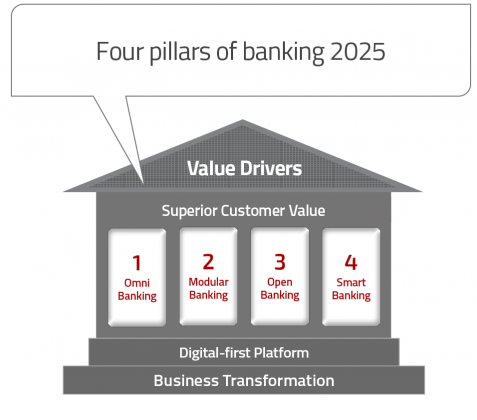

Four Pillars for Digital-First Banking – How Digital Banking Platform Should Look

It comes as no surprise that there are significant gaps in the ability to receive real-time, personalized banking experience should we compare it with the one consumers get while using Amazon, or let’s say Facebook and many other providers.

Backbase, the company that produces digital platforms for banks, prepared a whitepaper on how they see Banking 2025.

Omnichannel Banking

Traditional approach with all the channels of communication are different and create a separate path of user experience is outdated and creates a lot of mess.

The great example when the solution looks the same in different instalments and creates an overall similar experience for the customer is Google. There is no parallel to it in banking for the moment. The financial organizations should be able to provide an easy customer journey, regardless of the channels the consumers use to reach out for them.

Modular Banking

Banking organizations should focus more on the customers’ expectations and rapidly react to any signs of dissatisfaction from them.

The goal of the financial organizations should be in fast introduction of new features, or products at a low or zero cost. The perfect examples of how to do it right are such platforms as Facebook or Uber.

Their modules are agile enough to exceed customer expectations while not causing unneeded damage.

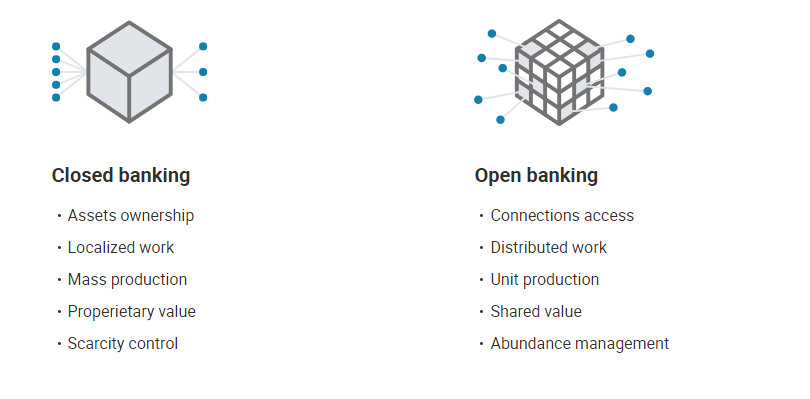

Open Banking

The concept of open banking is relatively new and gets active spread across the world. The main differences between closed and open banking are seen in the picture below.

The general idea is that the banks must open up their APIs and leverage finance software solutions. That way they can benefit by becoming consumers of them, tapping into third-party capabilities to add real value to their offering.

That is connected with some threats to security, but if done correctly, nothing would go wrong.

Their entire financial lives of customers should be visible on a single dashboard – ideally. That is what banks should be aiming for, and “platformification” is here to help them greatly.

Smart Banking

A new era of personalization is coming for banks. Each product or service needs to be tailored to the individual needs of the customers and delivered to them via the most suitable channel. Only such an approach would give the customer the needed level of satisfaction.

Takeaways

The banking world is taking a new digital shape, and platforms are participating in it big time.

We have explored the way leading banks are approaching digital platforms and how they implement them in their digitalization strategies.

We are waiting for the future full of banking products and services delivered to us with the help of different channels, on agile modules, and get those products personalized for our needs.

At the same time, the bank can’t pursue a platform strategy and not be “open”. Platforms are changing the way banks acquire and deploy the technology. At the same time, the new “Amazon of banking” is still to be found.

However, the banks that are willing to turn digital right now have a better starting position in this race for the future of banking.