As the volume of data sees exponential growth and client needs become increasingly complex, the ability to harness data for valuable insights is no longer a differential but a necessity.

Data analytics — the process of examining extensive data sets to unlock specific, actionable information — is proving to be a game changer, empowering FIs to improve operational efficiencies, gain deep consumer behavior insights and deliver hyper-relevant services.

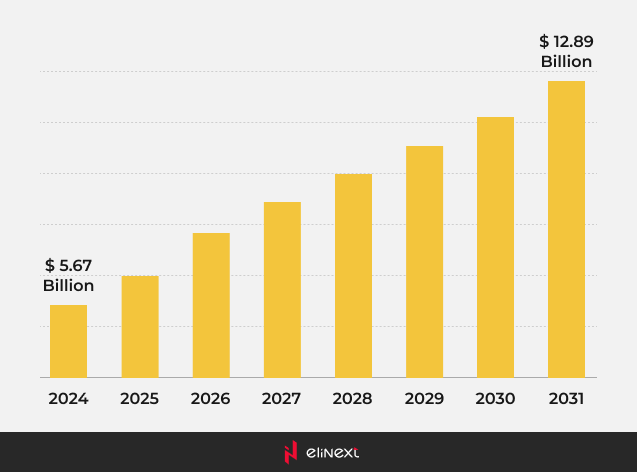

According to Verified Market Research, big data analytics in banking market is estimated to attain a market valuation of USD 12.89 billion over the forecast subjugating around USD 5.67 billion valued in 2024.

Big Data Analytic in Banking Market Valuation, 2024-2031

The Importance Of Data Analytics For Banking

Financial service companies’ CIOs understand that banking data analytics can empower their institutions, paving the way for a successful business future.

There are tons of stories on how advanced data analytics practices help — whether it’s a matter of risk assessment, improving strategic marketing, or fueling the bottom line.

The importance of data analytics for banking goes further, to encompass behavioral insights, which is the key to creating 360-degree customer profiles and delivering context-specific, hyper-personalized services.

Key Integrations Of Data Analytics In Banking Industry

Core Banking Systems

Whether that be recording/managing transactions, overseeing customer accounts, managing risk or handling other critical processes, data analytics integrated into a core banking system ensures all operations are carried out with more speed and fewer errors.

Banking CRM

New data- and analytics-powered CRM solutions for banking industry enhance customer segmentation, track and measure engagement, and provide predictive insights, which is critical for FIs looking to understand their customers better.

Banking Operations Management System

Advanced-analytics-driven operations management systems help collect real-time data, track KPIs, and understand customer demand to create the highest level of efficiency possible within an organization. When testing the performance of these systems, Playwright vs Selenium can help determine the most suitable automation tool for reliable and scalable UI testing.

Security And Compliance Tracking Tools

Advanced data analytics software can analyze vast datasets and identify suspicious patterns, flag potentially fraudulent activities as well as enhance customer due diligence and anti-money laundering (AML) efforts.

Client-Facing Apps

Customer-facing applications powered by data analytics help banking brands capture data about user interactions within an application and deliver a differentiated user experience based on this live, fresh data.

Accounting Or Treasury System

Advanced analytic tools help get insights into a bank’s accounting and treasury operations, including cash and liquidity management, records management, investment portfolios management, etc., identify trends and outliers in these data and do forecasts about future cash flows and market conditions.

Financial Data Marketplaces

With financial analytics tools, banks can access data on market prices, financial news, as well as key consumer trends and leverage these datasets to develop on-demand offerings and improve existing services.

Credit Rating Bureaus

Incorporating ML-based analytics tools helps credit bureaus reduce data asymmetries, level up risk management, increase access to credit at lower interest rates, as well as assess risks and assign scores for unbanked adults using alternative data.

The Use Of Data Analytics In Banking: 8 Real Cases

By treating analytics as a living tool and a true business discipline, financial institutions can grasp the enormous potential. Below are some notable real-world examples of the use of data analytics in banking and finance.

Customer Segmentation

Front Credit Union has launched the Plinqit savings app to motivate younger consumers to adopt saving habits through incentives and progressive friction.

The platform pays people to engage with financial content and has reportedly helped users save over $1 million since its launch in 2019.

Personalized Banking Services

Another compelling example of how advanced analytics help banking brands build stronger connections with customers is the Halifax (the UK) case. The bank keeps a list of clients deemed to have financial problems. Bank agents reach out to these customers to offer advice and tools, such as a payments manager or a subscription manager, to control their finances better.

Chatbots And Virtual Assistant

Royal Bank of Canada uses an AI-enabled assistant called NOMI to provide clients with tailored insights and advice including timely alerts, reminders, and calculated budget recommendations based on their banking habits.

In the first year after its launch, NOMI customers had 50% more digital interactions compared to the entire customer base and spent 93% more time on financial accounts. Additionally, the NOMI project has led to a reduction of customer attrition to less than 2%, compared to the typical 7% to 8% for banks in North America.

Fraud Detection

Revolut, a prominent fintech player, has launched an AI-led scam detection feature to protect its users from card scams.

As per this advanced analytics feature, if there is a high probability that the client is being scammed, the card payment will be declined and additional information will be required to confirm a customer is not being deceived by the intruder.

Risk Management

BlackRock is a strong supporter of leveraging AI solutions to improve risk management and portfolio optimization. Their teams use AI analytics tools to cover areas such as:

- Portfolio risk and scenario analysis

- Portfolio positioning and exposures

- Security risk and interactive analytics

- Asset allocation analysis

- Compliance and oversight and more.

KYC And AML Compliance

JPMorgan Chase utilizes big data analytics and AI-powered compliance and fraud monitoring systems to track and analyze financial transactions. This ensures compliance with KYC standards and helps prevent illicit activities such as money laundering and terrorist financing.

Feedback Analysis

Triodos Bank uses an analytics-driven customer feedback system to process data from listening processes, personalized interviews, ad hoc studies, website transactions, social media movement, and chat messages and identify unique clients’ needs.

Reporting And Audits

PwC successfully integrated ML-based analytics tools into its audit processes to enhance the reliability of audit findings.

One of the Big Four accounting firms uses ML algorithms to conduct comprehensive analyses of entire datasets and recognize deviations from normal behavior (unusual spending patterns, suspicious transactions, or discrepancies in financial records) more efficiently.

“Data is often called a new oil, but it’s even more valuable than that. Our years of experience creating custom data analytics solutions for FIs shows that Big Data with the myriad ways it can be captured and used by means of advanced analytics changes any business. Be it identifying high-potential prospects, tailoring customer experiences, or increasing efficiency, the importance of data analytics in banking is undeniable.”

Anastasia Timoshenko

FinTech Expert at Elinext

Benefits Of Data Analytics For The Banking Industry

When applied right, data analytics models become a source of power for banking and financial brands, leading to increased efficiency, reduced operational risk, more satisfied customers, better regulatory compliance and accelerated growth.

Operational Efficiency

Increased operational efficiency is considered to be among the most clear benefits of data analytics in banking.

Advanced-analytics-driven banks have the upper hand when it comes to identifying bottlenecks in the internal operations such as inefficient workflows, lack of automation, overloading employees, etc.

Better Customer Experience

As per Accenture, 91% of consumers are more likely to engage with a brand that provides them with relevant services.

AI, automation and advanced, predictive banking data analytics transform all of a company’s customer interactions and can be one of the most sure-shot ways of building strong relationships that stand the test of time.

Improved Risk Management

Integrating advanced data analytics in banking enables risk management teams to comb through large amounts of information in a matter of seconds and make better choices about risks be it credit, market, operational, liquidity, or compliance risks.

Regulatory Compliance

Automating processes where possible and equipping authorized officers with the right banking data analytics tools help FIs adhere to applicable government laws or industry regulations like KYC/AML, GDPR, PCI-DSS, Dodd-Frank, Basel III, and FATCA and reduce the risk of punitive fines and civil lawsuits caused by non-compliance.

Strategic Marketing And Sales

Integrating data analytics in banking helps financial marketing professionals gather and harmonize data flooding in from diverse sources and assess each marketing initiative’s impact to find out which efforts yield the best returns and where to allocate marketing spending.

Challenges Of Integrating Data Analytics In Banking

Despite the numerous benefits of data analytics in banking, integrating AA-enabled digital solutions has its challenges. Even the most robust and sophisticated tools are of little effect if banking leaders are not fully prepared to cope with the inevitable analytics implementation hurdles including plenty of technical issues, monitoring and observability, ever-increasing data volume, and more.

The five challenges described here are common ones when adopting data analytics in banking industry.

- Data privacy and security

- Data quality and accuracy

- Integration with legacy systems

- High implementation costs

- Regulatory compliance

Data Analytics In The Banking Industry: The Future?

With ongoing digital disruption and economic uncertainty redrawing the financial services landscape, combined with big changes in consumer behavior and regulatory requirements, the future of data analytics in banking sector will be filled with both challenges and opportunities.

AI And ML Adoption

As we head into the future, we will see increasingly advanced AI/ML solutions assume an even more prominent role in financial institutions’ day-to-day tasks like data entry, transaction processing, and compliance and fraud detection.

Having mastered these initial data analytics use cases in banking, FIs will find themselves turning to more sophisticated implementations like fully autonomous decision-making.

Real-Time Data Analytics

Integration of real-time data analytics in banking is a trend that only continues to evolve and grow over time.

The major real-time data analytics use cases in banking and finance — detection of market manipulation and combating payment fraud and money laundering — are going to achieve widespread adoption within a few years.

Adoption Of Big Data In Banking

The shift towards big data has completely transformed the way traditional financial services companies used to work with data.

Instead of dealing with structured data, neatly ordered into databases, they now have to handle huge volumes of messy external data — those we generate today thanks to the internet and sensor-laden tech.

To remain on top, FIs will have to continue to invest in big data and analytics initiatives that help deliver products and services that accurately match customers’ needs and foster operational changes.

Cloud Computing Solution

Cloud computing offers an effective solution for dealing with huge, complicated datasets. FIs can easily store, manage, and extract maximum value from big data assets by utilizing cloud capabilities.

As the importance of data analytics in banking will grow in years to come, we’ll witness the increasing number of established banking brands and their nontraditional competitors using cloud services to create elastic and scalable ecosystems for their big data analytics needs.

To Sum It Up

With the ongoing Big Data revolution, the demand for data analytics in the banking industry is rising exponentially.

As an experienced banking software development company Elinxet knows that most financial brands are already applying AI-led analytics to enhance risk management, improve regulatory compliance, refine services, create next-best marketing offers and carry out business decisions with greater confidence in the results.

FIs that fail to pursue the opportunities data analytics brings risk falling behind the leaders in their competitive market.

FAQ

What is data analytics in the banking industry?

Data analytics in banking implies the use of tools and technology to analyze data sets, identify trends, and make conclusions from the information they contain.

How can data analytics improve operational efficiency in banks?

Data analytics in banking provides insights into various operational aspects by analyzing data on the time, resources, and costs associated with different company’s processes. This helps banks easily identify areas for improvement.

What role does data analytics play in risk management?

Leveraging data analytics for banking helps FIs analyze data from economic, market, and consumer-related sources and detect the underlying drivers of risks (credit, price, interest rate, liquidity, compliance risks), enabling business decision-makers to respond the right way.

How does data analytics help make banking more secure?

Analytics tools have notable implications for fraud detection. They can monitor financial transactions in real time and detect anomalies and patterns in financial data, thus preventing fraud and related financial and reputation losses.