The climate crisis is one of the most concerning issues. Back in 2017, the United Nations created the Task Force on Digital Financing of the 17 Sustainable Development Goals, and climate concerns were featured in two of them. No wonder people and corporations across the globe are committed to taking action to deal with climate change, and, therefore climate-related investments start to grow. One of the most promising areas of climate action is climate fintech.

As climate fintech stands on the intersection of technology, finance, and climate, and is a huge trend among VC investors, Elinext decided to have a deeper look at it. In this blog post, we explore climate fintech to figure out what is it, why it tracks so much attention, and whether are there certain niches to take for us, or our customers and partners.

What is Climate Fintech?

There are debates on what qualifies as “climate fintech”, and its actual definitions. Some say it’s fintech with a sustainable look on the environment, the others say that these are businesses’ new images to make a difference in climate change.

New Energy Nexus sums it up with a simple definition of “Climate Fintech” as a digital financial technology that catalyzes decarbonization. Climate Fintech represents the convergence of climate concerns, financial mechanisms, and technology.

Source: climatefintech.cn

Climate Fintech includes multiple subsectors, including carbon accounting and footprinting, carbon offsetting, climate risk management, impact financing, ESG (Environmental, Social, and Governance) reporting, sustainable banking, and many others.

We’ll dive deeper into their investment attractiveness further in the blog post. In the next sector, we will try to figure out what benefits climate fintech has to bring, and what concerns and considerations have to be made for those who are trying to enter the market.

Investors’ Benefits of Climate Fintech

Climate fintech has the potential to reshape the way we address environmental issues. However, there are certain pitfalls one must be wary of. Let’s explore the benefits first.

Sustainable Investment Opportunities

Climate Fintech opens up new opportunities for individuals and businesses to invest their funds in projects that align with their environmental values. Through platforms like green bonds, impact investing, and carbon offset programs, investors can directly contribute to initiatives combating climate change while earning financial returns.

Let’s take carbon offsetting programs as an example. ComerzVentures estimates funding of startups in the sector to be over half a billion dollars. It is the second-largest space in climate fintech and the fastest growing.

Carbon Offsetting Funding

Source: commerzventures.com

The demand for carbon offsetting and carbon removal technologies is very high, and the leaders of the industry are expecting it to be a larger portion of the market soon as it is in high demand currently.

There are two types of carbon offset buyers. Traditional buyers use carbon offsets to meet their corporate sustainability commitments. The other types of buyers are so-called “corporate contributors”. They look to make big upfront investments in carbon dioxide removal projects. As their projects scale big pretty fast, and last for several years, they want to have it covered throughout the whole journey. Both types of buyers represent wealthy health investors who bring valid cash flow into the industry.

Data-Driven Insights

Climate Fintech relies heavily on data analytics and machine learning to assess climate risks, model environmental scenarios, and identify trends. This data-driven approach not only assists in making more informed financial decisions but also fosters a deeper understanding of the interconnectedness between finance and the environment.

For example, fintech platforms can facilitate the trading of carbon credits and help companies comply with emissions reduction goals. An example of such a platform is CarbonX. It uses blockchain to enable individuals to offset their carbon footprint by converting rewards earned from everyday purchases into carbon credits. So does AirCarbom, Nori, and tons of others.

Enhanced Risk Management

Traditional financial institutions are increasingly recognizing the material risks posed by climate change to their investments. Climate Fintech solutions provide advanced risk assessment tools that consider environmental factors, helping financial institutions better evaluate the potential impacts of climate-related events on their portfolios.

These tools simulate different climate scenarios and assess their potential impacts on a company’s financial performance. Examples of such platforms include Acclimatise and Four Twenty Seven, the affiliate of Moody’s)

Promotion of ESG Standards

Environmental, Social, and Governance (ESG) criteria have become quite popular recently. Climate Fintech enables companies to track, measure, and report their ESG performance accurately, fostering transparency and accountability.

There are several companies that operate in the sector that help with ESG reporting, including Workiva, Ethos Tracking, and others. If you’re looking for a reliable software development partner to enter this or other competitive markets, contact Elinext to receive a free quote on custom software to be built on your ideas.

Concerns and Considerations for Investors

While Climate Fintech presents promising opportunities, it is not without its challenges, concerns, and drawbacks. One of the biggest comes first.

Greenwashing

Greenwashing occurs when companies falsely portray themselves as environmentally conscious to attract capital. Climate fintech platforms must implement stringent verification processes to prevent such deceptive practices and maintain the integrity of sustainable investments.

Some companies may use climate fintech solutions to greenwash their operations, making it appear that they are more environmentally friendly than they actually are. Old accounting tricks can be applied by the biggest polluters: fossil fuel companies and airlines – and that negates the power of climate fintech.

Back in the day, the so-called “Greenwashing Academy” even hosted the Greenwash Academy Awards during the World Summit on Sustainable Development in Johannesburg (2002). They gave “Greenwash” Oscars to the infamous Enron, ExxonMobile, British American Tobacco, and other companies that didn’t care about the environment and pretended they did.

Lack of transparency and regulation

Carbon credit market is still relatively new and unregulated, which can make it difficult to track the impact of climate fintech projects. There is also a risk of double counting, where the same carbon credit is sold multiple times.

The risk of market failure

If the carbon credit market is not properly regulated, there is a risk of market failure, where the price of carbon credits becomes too low to incentivize emissions reductions. However, this is an unlikely scenario.

At the moment, the sector is booming, so let’s explore which sector of climate fintech is the most attractive for investors at the moment and in the future.

Investments in Climate Fintech

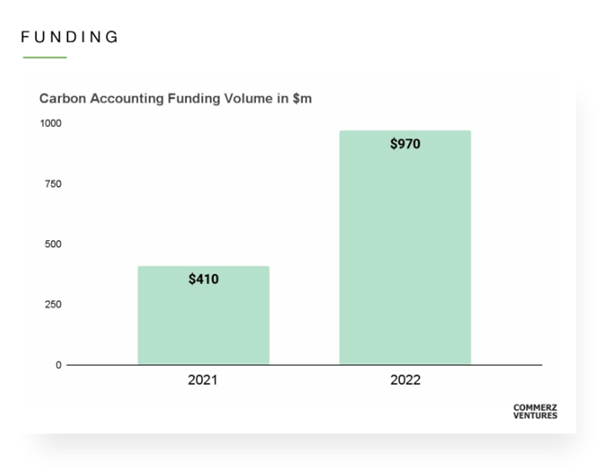

Carbon accounting is the best-funded subsector within climate fintech, according to data by Sifted and CommerzVentures. The latter firm assesses investments to this particular subsector approaching a billion dollars in 2022.

Carbon Accounting Funding

Source: commerzventures.com

Fintech venture capitalists have set their sights on carbon credits as the most attractive and promising avenue for generating substantial returns. As numerous industries increasingly adopt carbon credits, experts interviewed by Sifted reveal that this trend will create an entirely “new financial landscape” within the realm of climate offsetting.

The best-financed company in the sector in Europe is Sweep, a French startup that banked a $73m Series B round.

Notably, the demand from buyers for carbon credits is on the rise, and concurrently, the price of a carbon ton is experiencing a rapid ascent. Trove Research expects a rise in the price of carbon credit of $3 to $5 per metric tonne (current price) to between $20 and $50 per metric tonne (by 2030).

These stats show that this sector which already looks lucrative to become even more profitable in the future.

Certain fintech investors express skepticism concerning the lack of transparency and certain regulations surrounding carbon credits, along with uncertainties about the successful execution of associated projects. Monkey business and fraud are very much possible in the area.

When it comes to carbon accounting and footprinting, systematic tracking and analysis, and emissions, CommerzVentures highlights Watershed and Doconomy as the leaders of the industry.

Mathias Wikstrom, Founder and CEO of Doconomy sees the importance of knowing your carbon footprint for his customers in the following.

They have to understand their impact at first and come to mindful consumption by reducing the impact. When they get the carbon footprint information, they act on it, regardless of whether they were concerned about it without knowing it. Once it is measured, it can be managed, and that’s where we build our business.

From what we see, climate fintech unlocks large amounts of first-time capital despite economic slowdowns. Once the market segments mature and become more regulated, it will show even bigger growth.

Cases and Niches of Climate Fintech Companies

New Energy Nexus highlighted about a hundred startups in their annual report about climate fintech. There are different ways all these companies tackle climate problems. Let’s take a random few for example.

Ecountabl offers a tool that helps consumers see the environmental and ethical standing of the brands they spend money on.

Ant Forest is a green initiative launched by Ant Group that combines mobile transactions and gamification to encourage a low-carbon lifestyle.

Aspiration released a suite of banking products that focus on the reduction of GHG emissions.

There are tons of solutions out there, and they attract capital from climate-aware companies across the world. If you’re ready to jump into the big game of producing climate fintech solutions, Eliтext will be happy to assist you with software development for your project realization, and we already gained significant expertise and experience in the fintech industry.

Conclusion

The emergence of climate fintech stands promises hope in the urgent battle against climate change. By merging technology, finance, and environmental concerns, climate fintech has the power to reshape our approach to environmental issues and create a more sustainable future.

While there are valid concerns, the overall trajectory of the sector seems positive, with carbon accounting and footprinting emerging as particularly well-funded and promising subsectors.

Elinext, as a dedicated software development company, recognizes the potential of climate fintech and is committed to contributing to its growth. With a team of skilled professionals and a focus on innovation, Elinext aims to play a role in developing impactful climate fintech solutions. As the sector continues to evolve and mature, it is clear that climate fintech has the capacity to drive meaningful change and play a vital role in addressing the pressing climate crisis.