AI-powered chatbots go beyond simple communication, evolving into customer-facing tools for financial institutions. They aren’t limited to answering questions but are now integral to enhancing customer interactions and experiences.

Chatbots in banking are AI-powered virtual assistants that use natural language processing (NLP) and machine learning (ML) to engage in human-like conversations with customers. The American Express (Amex) bot demonstrates how banking chatbots can offer more than just basic assistance. As part of comprehensive banking software development, it connects U.S. Cards to Facebook Messenger, providing purchase alerts, benefits info, and customer support. If unable to assist, the Amex bot requests details or suggests logging into an account for further help.

How chatbots are changing the banking industry

Chatbots in banking industry streamline banking tasks that once required extensive paperwork, saving time for both customers and banks. They assist with opening accounts, retrieving balances, and accessing account details, enhancing efficiency for bank employees. Generally, banking chatbots are capable of handling 80-90% of client requests in banking without needing human assistance. This leads to significant benefits, improving overall productivity and user experience in the banking sector.

Use Cases for Chatbots in Banking

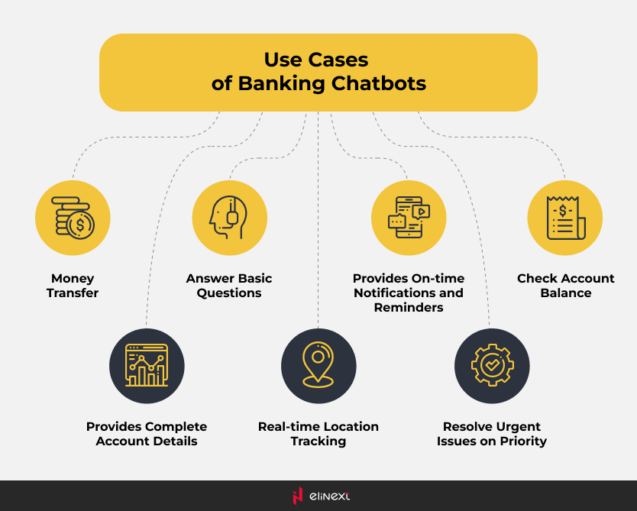

In the past, chatbots in banking were limited to rigid, pre-programmed responses and struggled to adapt to dynamic scenarios, such as updating customers on new policies if the database wasn’t promptly updated. However, advancements in AI solutions have transformed banking chatbots, making them more adaptive, conversational, and capable of handling complex banking tasks. Below is an overview of the most disruptive use cases for chatbots in banking.

Account Opening

Banking chatbots simplify account opening by guiding customers through the process, collecting necessary information, verifying data, and submitting applications, all while providing 24/7 assistance.

Aadhar KYC

Aadhaar, India’s biometric ID, enables e-KYC for quick KYC verification using an Aadhaar number with instant verification via one-time password. Aadhar KYC performs the same functions as chatbots in banking providing transparent and improved customer experience and helping in ease of doing business.

Delivery of Information

Chatbots in banking analyse user questions using natural language processing to interpret queries. They access internal databases for information and provide relevant responses, ensuring efficient and accurate service that enhances the banking experience for users.

Chatbot Applications in the Banking Industry

As you may see, AI chatbots in banking are well-established to enhance customer service and operational efficiency. As a part of financial software development services, chatbots for banking modernize the customer experience, handle routine inquiries, educate users about financial products, and assist with applications, making banking smoother and more intuitive.

Personal Banking Assistants

AI chatbots for banking play a key role in offering personalized customer service, interviewing clients to open accounts, explaining available services, and assisting with transactions like loan payments and deposits.

Task Assistance for Banking Personnel

Chatbots in banking industry handle simple customer requests and common problems, allowing employees to avoid repetitive tasks. This leads to lower turnover, as agents can concentrate on more important responsibilities.

On-time Notifications and Reminders

AI chatbots in banking enhance customer engagement by sending alerts for pending bill payments, transfer requests, and transactions. For example, Bank of America’s Erica bot offers financial insights and reminders for better money management.

Customer Advisors

AI chatbots for banking help financial organizations personalize offers based on client preferences and history, tailoring recommendations for diverse needs like student loans or first-time homebuyers efficiently.

Real-time Location Tracking

Real-time GPS tracking as an application of chatbots in banking allows users to receive location-specific services and alerts, providing directions to nearby bank branches and personalized information based on their current location.

Real Examples of Chatbots in Banking

According to EY, by 2030, chatbots will be so integrated into banking that customers may find it difficult to tell whether they’re interacting with a bot or a human. This highlights the advancing capabilities of AI and Machine Learning solutions in enhancing customer finance experiences. Below is a short overview of real examples of chatbots for banking.

Bank of America – Erica

Bank of America’s Erica is a digital assistant that offers real-time financial updates via preferred communication channels. It uses predictive analytics to help with payments, debt reduction, balance checks, and provides access to FICO scores and educational content.

Swedbank – Nina

Swedbank’s Nina tool resolves 40,000 conversations monthly, addressing 81% of issues. By expanding to handle 350 customer questions, it enhances personalization and reduces the time needed for customers to find information or complete transactions.

Societe Generale

What began as a basic bot for France’s Societe Generale answering a few questions about equity fund investments has evolved into a sophisticated application. It now assists customers in selecting and subscribing to investment funds, transferring money between funds, paying bills, and withdrawing money from their accounts.

Royal Bank of Canada

Royal Bank of Canada’s chatbot AIs operate 24/7, support multiple languages, and handle unlimited chats, ensuring global customer assistance anytime. They personalize experiences by analysing queries, retrieving relevant data, and refining responses over time for better engagement.

Benefits of Chatbots in Banking Industry

According to industry research, chatbots can potentially save banks up to 70% in customer service costs. At the same time, while chatbots are often seen as external resources, benefits of chatbots in banking also involve internal operations, enhancing efficiency and streamlining processes within organizations.

Enhanced Customer Service

Banking chatbots reduce wait times with 24/7 support, offering accurate answers and resolving issues quickly. They also handle sensitive matters discreetly, like late payments, without human agents.

Personalized Customer Experience

Chatbots for banking access client data like history and purchases for personalized help, targeted offers, and smooth onboarding. AI chatbots provide natural, seamless support, even resuming paused chats.

Improved Cost Effectiveness

AI and machine learning chatbots self-update by collecting data, improving service quality over time. This reduces programmer oversight, relying on AI trainers for guidance, making them cost-effective.

More Overall Efficiency

Chatbots continuously collect and update customer data, enabling personalized interactions, product recommendations, and financial advice. Employees also use chatbots for instant info and task support.

Higher Productivity of Banking Agents

Chatbots in banking industry benefit employees by assisting with high-value tasks. Integrated into call centre solutions via APIs, they act as lead generators, saving customer details and notifying sales agents of opportunities.

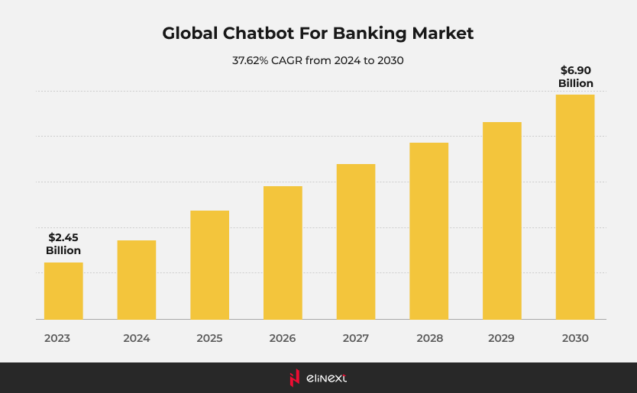

The Future of Chatbots in Banking Industry

The future of chatbots in banking will be driven by technologies like AI or blockchain development services. Due to these, banking chatbots will act as valuable resources and co-workers. Investing in AI chatbots will continue to position banks for the future, especially to attract Gen Z clients. By 2027, 64% of Gen Z is expected to use voice assistants monthly, making advanced chatbot solutions essential for engaging this tech-savvy generation.

Large Language Models (LLMs)

By utilizing advanced natural language processing, LLM-powered chatbots can analyze a client’s account, understand their intent, and provide tailored solutions in real-time, which significantly boosts customer satisfaction and loyalty.

Natural Language Understanding

In banking, NLU-driven chatbots will provide precise transaction support and account management. They assist users in navigating financial services, enabling tasks such as fund transfers, balance inquiries, and bill payments with ease and security.

Voice Bots

Voice bots tend to handle a growing number of customer interactions, such as providing account balance updates or managing PIN resets. Additionally, they will be increasingly used for internal applications, including transcribing conversations for future reference and automatically logging data into CRM systems.

Automation

Banking chatbots leverage OCR technology to instantly read uploaded documents, automating data extraction and storage, which streamlines processes and saves time. Using entity extraction, they identify key data, check for errors, and ensure accuracy, enhancing efficiency and reliability in financial operations.

Conclusion

Chatbots offer transformative benefits in banking by automating daily operations, generating new revenue streams, and enhancing client trust. Early adopters of this technology gain a competitive edge, enabling them to thrive in the evolving financial landscape and stay ahead of rivals. Their potential to streamline processes and improve customer experience makes them essential in modern banking. If you’re interested in developing your own chatbot, let us know at contact@elinext.com.

Q&As

What are banking chatbots?

AI chatbots in banking are programs that interpret customer queries and offer solutions using conversational AI. They enhance personalized service and boost operational efficiency for banks.

Are chatbots secure for financial transactions?

Modern AI chatbots for banking use encryption, authentication, and fraud detection to secure customer data and transactions. However, establishing secure links with banks’ legacy systems remains a challenge.

Who primarily uses banking chatbots?

Advanced AI chatbots benefit not only bank customers but also financial institution employees by managing routine tasks and common inquiries. This enables staff to concentrate on more complex customer issues, enhancing service quality.

What are the limitations of current banking chatbots?

In the past, banking chatbots were limited to pre-programmed responses and rigid scenarios, unable to adapt quickly to updates like new policies. AI has revolutionized these tools, making them more dynamic and efficient and extending the range of potential use cases.