Innovations irrevocably change the face of every industry, requiring businesses to adapt to new environments. Expressly in banking & finance, the modification resulted from the implementation of innovative techs has picked up dramatic speed. In recent years, it resulted in the emergence of a brand-new breed of banks focused on providing digital services — challenger banks and neobanks.

This blog post aims at pointing preconditions for the development of new dimensions in banking, highlights the main differences between traditional and digital banking models, and attempts to answer the question on which model is better.

Challenger and Neobanks: Background

Millennials’ (Gen Y) coming of age period, the one having a greater influence on how humanity develops, happened to coincide with the information revolution that, in turn, has led to the development of various devices carrying huge amounts of digital information. With the world going smartphone crazy in the late 2000s and increasing hunger for digital transformation among millennials, the banking industry players faced the necessity of making their services more accessible. Banking mobile applications have performed brightly with that task, thereby opening opportunities for the emergence of financial institutions focused on providing exclusively digital services.

The United Kingdom was among the first countries to undergo digital transformation in banking. Financial institutions operating within the country have started implementing digital technologies back to the dotcom era — in the late 90s. So there is no wonder why the first challenger bank was introduced exactly in the UK, in 2015, followed by neobank in 2017.

But what is the difference between these two banking models? Let’s find it out.

Defining Challenger and Neobanks

Challenger banks — midsize or specialist established firms — appeared to compete with larger institutions by specializing in underserved areas. The new branch in banking was created in the way to be technology-driven, offering online-only operations and avoiding complexities specific to the traditional banking model.

Neobanks were introduced two years later after challengers as completely digital mobile outfits. In contrast to the traditional banking model, neobanks do not have branch networks and reach customers on mobile applications. Also, neobanks avoid banking legacy systems by using such techs as machine learning and AI.

Comparing Different Banking Models

So what is the difference between digital banking and a traditional model? First of all, both neobanks and challengers do not follow a cumbersome organizational structure prevailing in traditional banking, as well as eliminate the use of legacy systems, focusing on completely digital services. However, in contrast to traditional financial institutions, digitized competitors do not offer a full suite of services. But this little disadvantage works for them in the best way, allowing them to minimize the impact of regulatory requirements. In addition to these benefits, both challengers and neobanks offer a relatively high rate of return to their clients.

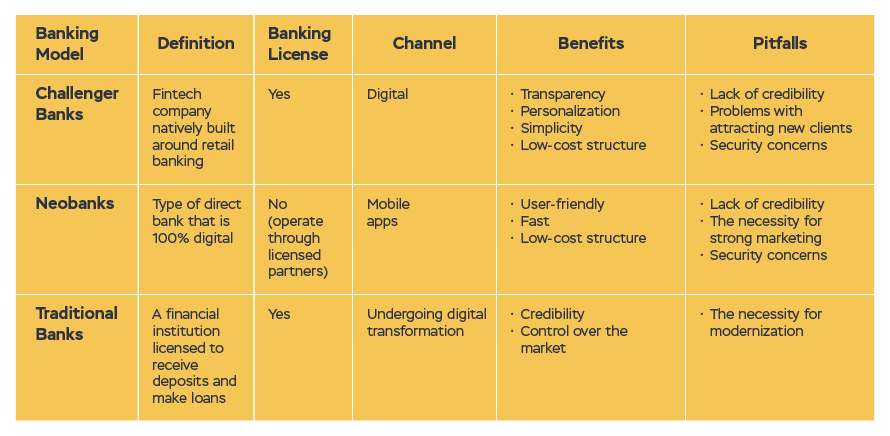

The illustration below briefly compares challenger banks, neobanks, and traditional banks in terms of related pros and cons, used channels, and the necessity to have a banking license.

The Future of Banking

Even though both neobanks and challenger banks are on the rise, traditional financial institutions aren’t asleep as well. Responding to modern requirements, more and more legacy firms are launching digital banks of their own. In this way, one of the most working models for today is represented by established players taking the best of two worlds by making their full-service models go digital.

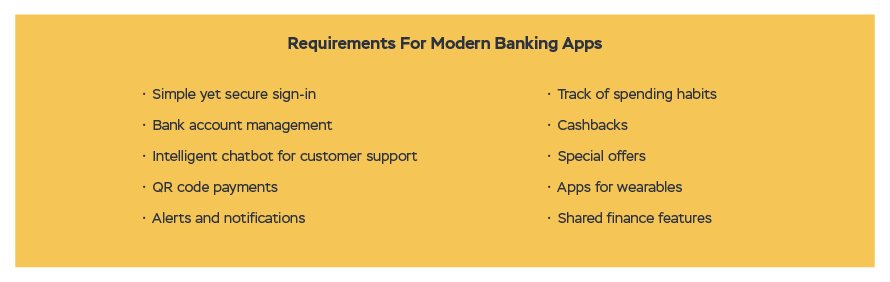

While the future of each type of banking discussed is uncertain, it is obvious that today’s success largely depends on user-friendly mobile applications that make banking services accessible from anywhere, anytime. Nevertheless, not all banking mobile applications are equal. To correspond to the growing needs of customers, they should fit the present-day requirements highlighted in the illustration below.

Conclusion

The modern tendency for digitalization is the key driver for reconsideration of the ways banks provide their services. The rule for today is the following: the quicker is the adoption of innovative technologies that ensure higher accessibility of services, the better is the outcome.

Having over two decades of experience in developing solutions for banking & finance, Elinext offers its expertise for the industry players willing to take their businesses to the next level. If you have any ideas regarding a banking solution that will go in line with your business goal, or you are looking for it, contact us. We are here to assist you in reaching new heights with the help of technology.