With 1,056 fintech startups, Germany’s financial technology sector is booming. In fact, the German fintech market is the second largest in Europe and the fourth largest in the world. The market is expected to register an annual growth at a CAGR of 9%.

A number of reasons have contributed to the high adoption rate of fintech services in Germany, including:

- Internet penetration rate is around 94%;

- Over 78% of Germans have smartphones, and almost a third of population have four or more connected devices;

- Germany is No.15 in Networked Readiness Index that assesses a country’s ability to fully leverage information and communication technology for competitiveness;

- 71% of Germans are digital payment users;

- High GDP per capita of $50,760 in 2021.

Among German fintech startups, challenger banks play a prominent role. Challenger banks, also called neobanks, are startup digital banks armed with the latest technology in order to compete with traditional financial institutions. Lately, Germany has seen considerable growth in the challenger bank space. So, let’s see what are the top 5 neobanks in Germany are.

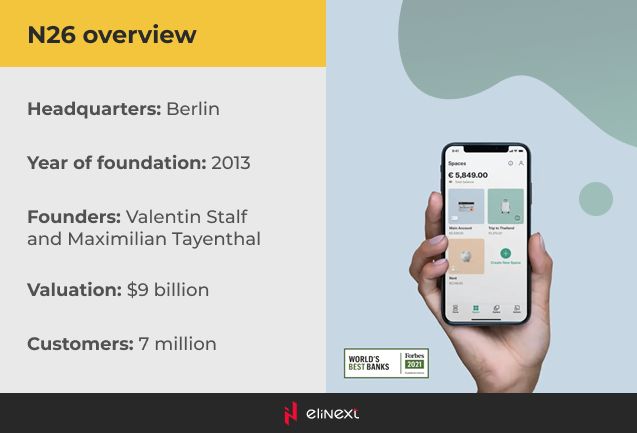

1. N26

One of the first neobanks founded in Germany, N26 is now one of the largest European fintech companies. N26 positions itself as Europe’s first completely mobile bank. This fully licensed challenger bank offers simple and flexible banking experiences that fit perfectly the mobile lifestyle of a modern customer. N26’s mobile app allows users to open bank accounts within seconds, withdraw and deposit money, track expenses, make transfers, and more. In addition to a physical card, customers can get a virtual card tied directly to their N26 app’s mobile wallet and make payments via Google Pay and Apple Pay.

To support the rapid growth and global expansion, N26 runs on a cloud platform powered by Amazon Web Services (AWS). The architecture is based on over 100 microservices that are written in different languages and frameworks (mostly Kotlin or Java and Spring Boot). But what makes the challenger banks so revolutionary and efficient is the use of artificial intelligence. N26 leverages AI to organize a user’s expenses by category and make it easier to track spending. Also, artificial intelligence powers a digital assistant that handles 20% of customer service requests, improving customer service and saving time for human agents.

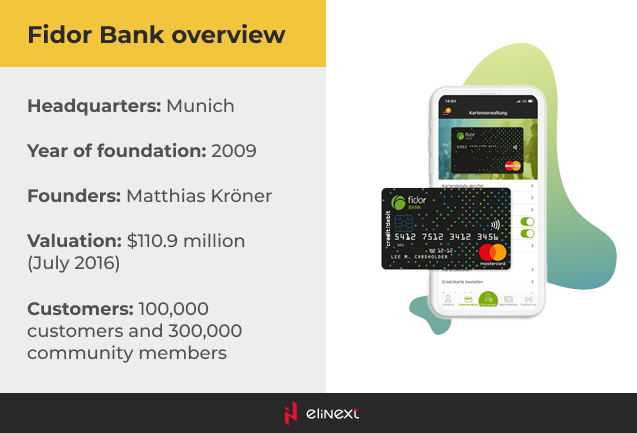

2. Fidor Bank

Fidor Bank claims to be one of the most innovative challenger banks. In fact, it has received several international awards, including “Best Neobank” at the Efma Accenture Awards, part of Accenture Banking Innovation Programme. Fidor Banks offers a range of banking and financial services — from simple account management to quick installment loans and mobile payments to even saving bonds and cryptocurrencies.

Being an award-winning innovative bank, Fidor Bank leverages a highly modern tech stack. In 2014, the neobank was one of the first banks to integrate the blockchain-powered Ripple payment protocol into its platform. Patrick Gruban, CIO of Fidor TechS, also revealed that the team was working on a prototype that replicated customer accounts in an Ethereum-based blockchain system. Fidor Bank is also no stranger to machine learning and natural language processing technology. The bank has recently partnered with Finn AI to roll out an AI-fueled banking chatbot that provides customers with instant access to financial support.

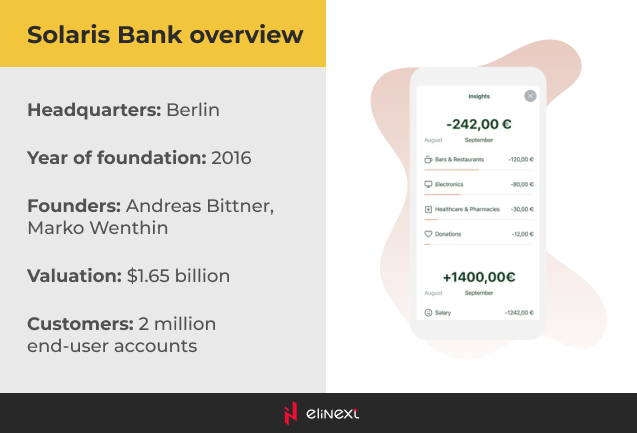

3. Solaris Bank

Solarisbank is not a typical challenger bank but rather a tech company with a banking license. One of the earliest movers in the embedded finance space, Solarisbank provides around 180 APIs to help fintech startups and neobanks build digital banking products and services. Its Banking-as-a-Service platform covers everything from digital cards and securities brokerage to consumer lending and PSD2-compliant payments to KYC services.

Solarisbank is also the first bank in Germany that has fully migrated its tech stack, digital products, and databases to AWS. This allowed the tech company to meet the scaling and automation requirements and accommodate the needs of a growing customer base.

4. Nuri

Nuri, formerly known as Bitwala, is the second-largest challenger bank in Germany. In addition to a fully-featured digital bank account and a free Visa debit card, Nuri is also cryptocurrency-friendly as it allows users to trade and invest in Bitcoin and Ether, as well as earn up to 5% interest per year on a Bitcoin account.

To build its service offering, Nuri partnered with Solarisbank that we discussed earlier and integrated the required infrastructure modules through APIs. By leveraging Solaris Digital Assets’ licensed custody solution, Nuri is able to provide custodial crypto wallets in addition to non-custodial ones to empower users to buy and sell cryptocurrencies in a safe and secure way.

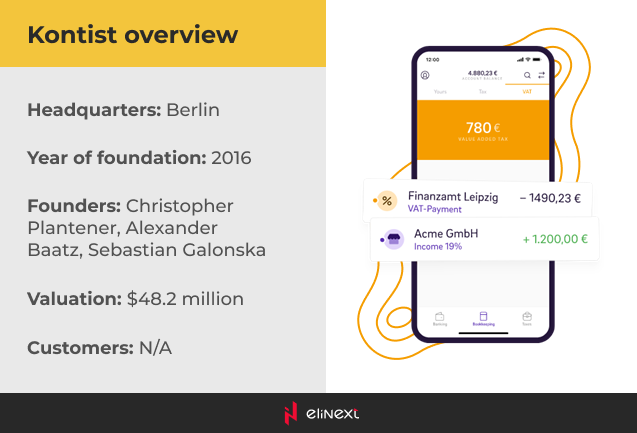

5. Kontist

As the gig economy continues to grow, Kontist undertakes to fill a market need by serving freelancers and self-employed. Given that taxes are one of the major challenges faced by gig economy workers, the challenger bank provides digital banking, tax consulting, and automated bookkeeping services, all in one place. Kontist calculates in real-time the income tax and VAT on transactions and shows how much a user actually has.

Technology-wise, Kontist leverages an AWS-based infrastructure and a modern tech stack, including JavaScript, React Native, Redux, TypeScript, as well as Google Analytics. To enable effective automation of accounting processes, the team also uses machine learning, and future plans include the use of ML-powered predictive analytics to help users make informed tax decisions and save money.

The bottom line

The consumer appetite for digital banking services continues to grow. Tech-savvy customers are now demanding easy, on-the-go access to financial services, mobile-friendly products, and tailored offerings.

With the developed digital infrastructure, highly qualified workforce, and generous VC investments, Germany has a fertile ground for fintech innovation. With over 1,000 fintech startups and 12 fintech unicorns, the German fintech scene is definitely worth keeping an eye on.

If you are looking for a mature partner with fintech development experience, Elinext can help. For over 20 years, we have been pushing the envelope of digital transformation in the financial services domain and helping our clients gain their competitive edge.