Ever since the first telegraph-powered electronic fund-transfer system was put in place back in the ‘20s, technology and finance have embarked on a joint endeavour. From the first credit cards to the first ATM, the birth of NASDAQ, the first smartphone, the introduction of Google Wallet, or neobanking, it has become obvious that innovation and digital transformation were the secret ingredients that encouraged the financial industry to enter a new evolutionary phase, a phase in which traditional financial institutions and the emerging FinTech players join forces to efficiently access new markets and products. But what exactly turns some classical financial centres into fertile soil for the FinTech industry while others deter financial innovation? Is the lack of a well-established financial industry a limiting factor for FinTechs? In today’s article, we will take a peek at some of the most important European FinTech hubs and the underlying conditions that foster innovation.

FinTech Industry: the overall global context

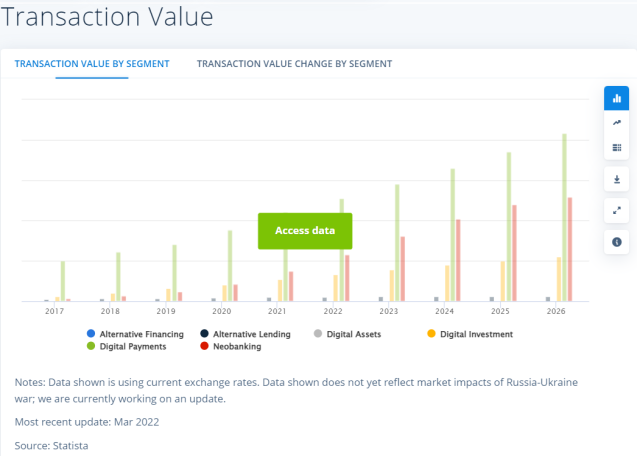

According to Statista, in 2022, Digital Payments will become the market’s largest segment with an impressive total transaction value of no less than US$8,502.00bn. By 2026, the number of Digital Payments users is expected to reach 5,197.44m. By 2023, the revenue growth of the Neobanking segment is expected to reach 40.3%.

Even though the stats do not take into account the impact of the Russia-Ukraine war, it is clear that the FinTech global market is steadily growing. According to Allied Market Research, by 2030, the global FinTech market is expected to grow at a CAGR of 20.3%, reaching an estimated value of $698.48 billion.

The European FinTech Market

We have previously taken a glance at the global FinTech market context. But does the European one share similarities? According to Statista, in 2022, Neobanking will be the largest European market segment, reaching a total transaction value of $1,913.00bn. By 2023, this segment’s revenue growth is expected to reach 42.9%. As far as the Digital Payments segment is concerned, by 2026, the number of users is forecasted to reach 583.27m.

But what is it exactly that makes Europe such an amazing hotbed for Fintech investment?

Regulations that support FinTech growth

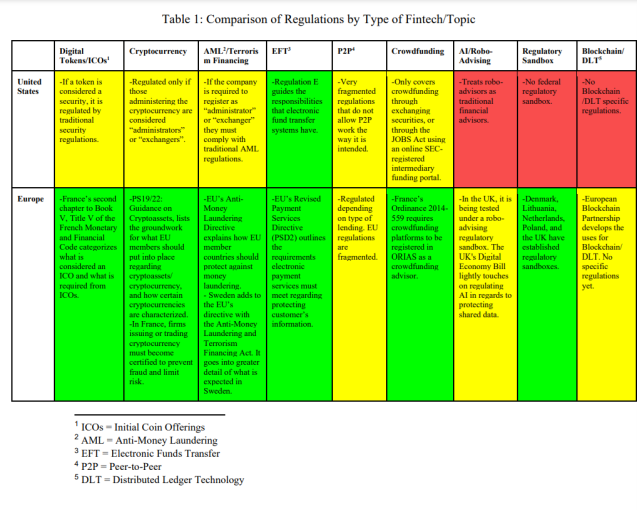

The regulatory frameworks can either deter or support FinTech growth. For example, in the UE, the PSD2 regulation aims at improving financial services and products by fostering the collaboration between banks and FinTechs. Customers can share financial data by means of secured third-party APIs. When it comes to adapting regulations to the evolving FinTech industry, the U.S. seems to be slacking. Let’s take a look at this comparison:

Source: Victoria Williams, ‘Fintech Regulations in the United States Compared to Regulations in Europe and Asia’

We could conclude that the approach toward financial innovation in the U.S. is more restrictive than its European counterpart.

Access to talent and capital

The strength and growth of FinTech hubs highly depend on the ability to develop and retain the talent pool. Deloitte provides two relevant examples: UK’s Tech Nation Visa (i.e. a program designed to attract global talent for the digital technology sector) and Hong Kong’s FinTech Career Accelerator (i.e. a program thought out to sustain the placement of outstanding students in the financial services sector). Similarly, access to capital – regardless of where it comes from – is another key element for growth.

Demand

At the end of the day, FinTech is a lucrative sector. And its growth depends on demand, be it B2C or B2B. Even though strong FinTech hubs usually rely on a well-developed local financial services industry (e.g. London, New York, etc.), that is not always the case. A good example would be Tokyo. Despite having a well-developed financial services industry, the FinTech industry is not developing as fast as expected.

Main European FinTech hubs

As of 2020, Statista ranks London as the leading FinTech hub, followed by Berlin, Paris, Barcelona, and Manchester. The index score is based on vital criteria such as demographics, business environment, and talent and innovation.

But let’s take a look at some of the best European locations that foster FinTech innovation and growth.

London

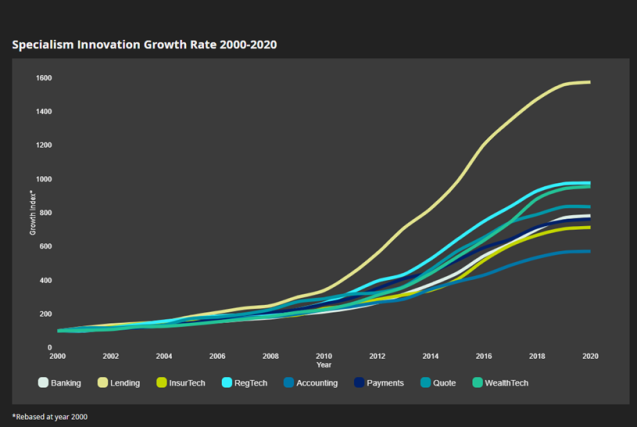

According to Deloitte, London has all the necessary ingredients to ensure digital success: demographic diversity, governmental and regulatory backup, talent, and capital. Over the past 20 years, the UK has registered an impressive growth rate, especially in Lending, RegTech, and WealthTech:

London is home to two-thirds of all UK FinTechs and is recognized globally as one of the top three FinTech hubs. Among the best start-ups and scale-ups headquartered in London, we can highlight Revolut, YoYo, Monzo, Curve, Starling Bank, TransferWise, WeGift.io, etc.

Berlin

Back in 2017, Deloitte ranked Berlin as the second biggest tech hub in Germany, mainly due to its highly-specialized ICT sector and the high number of STEM students. Even though the financial infrastructure may be perceived as slacking, the FinTech start-up scene is thriving mainly due to the fact that Berlin boasts both local and abroad tech talent. At a quick look, Berlin currently shows no less than 4,438 start-ups & scale-ups. According to the FinTech Magazine, the financial technology firms headquartered in Berlin concentrate on investment, asset management, and banking-as-a-service (BaaS). Berlin boasts various FinTech accelerators: Axel Springer Plug And Play Accelerator, Techstars Berlin, or Germantech Berlin.N26, Finleap, Raisin, Ratepay, Solarisbank, or Trade Republic are only some of the FinTech companies that made Berlin their home.

Paris

Paris has been slowly – but steadily – carving out its own niche within the FinTech ecosystem. According to Business Insider, France has become the third-biggest FinTech hub in Europe, becoming a top destination for Fintech investors and becoming the home of numerous unicorns such as Alan, Lydia, Ledger, Swile, PayFit, or Dataiku. There are several factors that make Paris attractive for FinTech investors: a favourable regulatory environment that fosters the collaboration between private and public sectors, capital availability, demographic diversity, and an impressive talent pool forged in top-tier universities such as Polytechnique, ESSEC business school, or Paris Dauphine. Additionally, there are multiple programs thought out to foster FinTech growth: BNP Paribas – PlugAndPlay, The Finance Innovation Cluster, or Platform 58. And that’s not all. Paris also hosts two major annual FinTech events: the Climate Finance Day and the Paris Fintech Forum. Among the most important FinTech companies currently headquartered in Paris, we can highlight Ledger, Shift Technology, October, Alan, Spendesk, Qonto, or SlimPay.

Barcelona

In 2020, Barcelona was proudly announcing a pioneering initiative: Barcelona Fintech Hub. Designed to foster the cooperation between start-ups in the fintech, proptech and insurtech sectors, banks, big companies, investors, and venture capital funds, this initiative turned Barcelona into a booming FinTech hub. Additionally, Barcelona boasts other attractive traits: a well-established financial services infrastructure, high-yielding business environments, demographics, talent pool, and affordable prices. Among the FinTechs headquartered in Barcelona, we can highlight bnc10, Verse, Kantox, ID Finance, Strands, Unnax, etc.

Wrap up

Technology and financial services are – more than ever – two interrelated areas. Undoubtedly, the global financial market has entered a major transformation phase in which cutting-edge technologies are reshaping the financial ecosystem. Technological advancements, compounded with other crucial factors such as regulatory permissiveness, expert talent pool, or capital, have significantly driven the growth of the FinTech industry not only in Europe but across the globe. Even though FinTech is far from being a new concept, the sector is now experimenting an unprecedented growth, taking by storm the financial services industry.