Technological developments are not new to finance. From the creation of credit cards to online and mobile banking, the financial industry has always been at the forefront of innovation. But the pace and intensity of current digital transformation are arguably the highest and have the potential to become revolutionary. This process of financial innovation based on technology is called fintech. Fintech is a catch-all term that refers to the use of different techs like blockchain and distributed ledger technology, big data and analytics, artificial intelligence, and machine learning, to streamline, automate, and enhance financial services.

With over 96% of households having access to broadband services, Europe emerges as one of the key players in the fintech race. The home to several global fintech companies and world-famous financial software solutions, Europe is among the leaders in the global financial development index and innovation index.

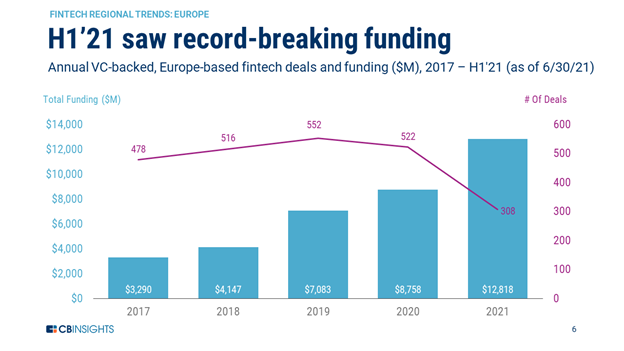

However, the European fintech landscape didn’t always look so promising. In 2014, the total value of fintech investments was $1.48 billion, in 2017 — already $3.28 billion. Fast forward to 2021, and European fintech funding reached an all-time high of almost $13 billion, as shown in the graphic below. What’s more, there are over 30+ fintech unicorns in Europe today — a sign of a maturing fintech ecosystem.

Source: CBINSIGHTS

Modern European fintech landscape

The United Kingdom

Second, only to San Francisco, London has flourished as a leading global hub for fintech startups and unicorns with over 4,000 fintech companies currently residing there. In 2021, British fintech companies managed to raise $5.7 billion.

The UK’s most valuable and perhaps well-known fintech company is Revolut that is now worth $7 billion. This is an app-based digital bank that offers a wide range of retail banking services from opening an account to making global transfers to splitting and settling bills.

Germany

With around 800 fintech startups, Germany has a thriving fintech scene and is ranked second for VC funding into financial technology companies. The German fintech sector is characterized by investments in innovative technologies like blockchain and artificial intelligence.

The star of Germany’s fintech landscape is N26, a digital bank with 7 million customers globally. After attracting another $100 million in Series D, N26 has raised $570 million in total funding. The neobank allows users to open accounts from a smartphone, track their expenses, make transfers, and more.

France

Although France has been a late bloomer, it is now Europe’s third-largest fintech hub that has raised $2.17 billion raised in funding this year, more than double than it attracted last year. In terms of transactional value, the biggest segment is taken by digital payments, including credit cards and mobile payments.

In fact, the mobile payment app Lydia closed $131 million Series B, making it the largest fintech round in the history of France. With 30% of all under-30s registered with the super-app, Lidya is processing around €250 million transactions per month.

Austria

Austria too is making positive strides in the financial technology direction and is often seen as a hub for cryptocurrencies. The Austrian government and public authorities started early to analyze crypto use cases and applied efforts towards the creation of optimal conditions for the new technological framework. Thus, in 2017 Vienna became home to the first retail store of bitcoins known as the House of Nakamoto.

Austria got its first unicorn when Bitpanda secured $170 million in a Series B round and reached $1.2 billion at valuation. The Vienna-based neo-broker makes it easier for ordinary people to invest in bitcoin and digital assets as well as precious metals and stock.

Switzerland

Ranked No.1 in 2021 Global Innovation Index, Switzerland is quickly evolving into a dynamic fintech hub. While 10% of all European fintech startups are located in Switzerland, 46% of them are in Zurich. Most Swiss fintech companies provide solutions for investment management and the insurance industry.

Digital-first insurance startup Getsafe has raised a total of $53 million since its foundation. The solution is aimed at millennials and offers flexible home insurance, personal possessions cover, and accidental damage cover.

Key challenges to fintech innovation

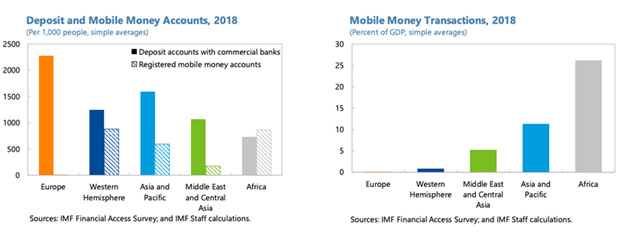

Although Europe is becoming a force on the fintech scene, there are areas where it still lags behind other regions. According to research by the International Monetary Fund (IMF), Europe is among the least developed parts of the world in terms of mobile money adoption.

Source: IMF eLIBRARY

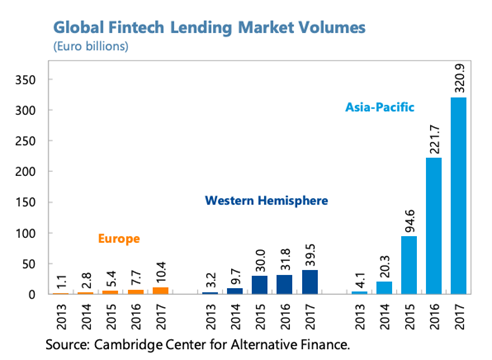

Other areas where Europe significantly falls behind North America and Asia-Pacific are fintech lending and alternative financing. With €10.4 billion, Europe accounted for just 3% of the global fintech lending volume in 2017.

Source: IMF eLIBRARY

Among the factors that contribute to less-developed fintech activities and lower penetration of fintech services in Europe, experts cite bank-dominated financial systems, privacy concerns, as well as strict regulations and standards.

High pre-existing banking presence

In Asia, Latin America, and Africa, a large share of the population is underserved or even entirely excluded from the financial system. This makes it a fertile ground for financial software companies that offer mobile money solutions and payment apps to proliferate.

Unlike these least developed parts of the world, Europe has an extensive network of formal financial institutions and a higher level of financial inclusion. Currently, there are 6,008 banks operating in the EU, with almost 1,500 banks in Germany alone. The bank-dominated financial system makes it more difficult for fintech services providers to gain a foothold on the market.

Security and privacy concerns

When it comes to financial services, security has always been top-of-mind for both providers and customers. While banks are an attractive target for cybercriminals, fintech companies that leverage digital platforms and technology to digitize and store personal and financial data, are even a better bet. In fact, fintech is the most frequently attacked industry after healthcare.

The pandemic and global shift towards remote workforce have pushed security concerns to the front burner as the “new norm” has created fertile ground for cybercriminals exploiting weaknesses in personal firewalls and antiviruses. Just last February, a UK-based fintech startup LOQBOX that provides credit score services suffered a cyber-attack, resulting in a loss of personal details and payment history of its customers.

Heterogeneity of regulations

The financial industry is among the most heavily regulated sectors in the world, and rightfully so. These regulations are in place to safeguard financial systems and institutions, prevent financial fraud, protect consumers’ investments, and more.

Issues arise, however, when these standards and guidelines, namely PSD II, GDPR, Interchange Fee Regulation (IFR), and the AML 5th Directive, have overlapping requirements. For example, GDPR dictates banks to protect user data, whereas under PSD II financial institutions must provide customer and transaction data to third parties.

Also, significant regulatory heterogeneity across EU jurisdictions remains a major challenge. From discrimination against foreign IBANs to different Know Your Customer (KYC) requirements to duplicative anti-money laundering requirements — regtech variations hamper financial innovation and affect consumers.

The bottom line

The numbers and examples we shared with you in the article clearly show one thing — Europe is on the fast track to becoming a vibrant hub for fintech innovation. The DACH region, France, and the UK are particularly impressive on that scene, attracting billions of venture funding into their fintech startups.

There are, however, certain areas where Europe falls behind due to dominance of traditional banks and formal financial institutions, increased security concerns and trust issues, and lack of a single pan-Euro regtech playbook.

With a mix of fintech software development expertise and business-savvy management, Elinext enables financial services providers and companies to drive their digital transformation initiatives by delivering secure, data-driven fintech solutions. Have a look at our case studies to see how we helped our client push the envelope in fintech innovation.

Other visitors also read:

Exploring the Impact of IR35 on Software Development

Changes in ASC 606 and Their Effect on Subscription-Based Businesses