The global interest in utilizing cloud technologies among the financial institutions experiences the growth in recent years.

As we live in a world that is heavily impacted by revolutionizing Big Data analytics, major domains are looking for improvement of their capacity for these immense streams of data that comes from all sources.

The banking sector is no exclusion from this. One of the solutions that come to the rescue is cloud computing.

Big volumes of incoming data are just one of the major challenges modern banks face. Among the others are managing risk, providing high-level security while giving an unparalleled level of user experience while keeping up with the standards of regulating authorities and lots of other staff.

We are here to figure out how exactly this transition is going.

In this blog post, we are going to explore the boosting and slowing factors that exist in bank transition to the cloud technologies, explore the current state of affairs (with official information about banks using this or that technology) and predict the future for the cloud in the financial sectors.

What we can say, to begin with, today it is a superior option for boosting the data handling capacity. It is able to provide the flexible, agile and scalable environment for data storage, processing, and analytics. But let’s take baby steps (like banks do with adopting the cloud technology), and to begin with, define the cloud in banking before exploring its applications.

What is Cloud Computing and How is it Applicable to Banking?

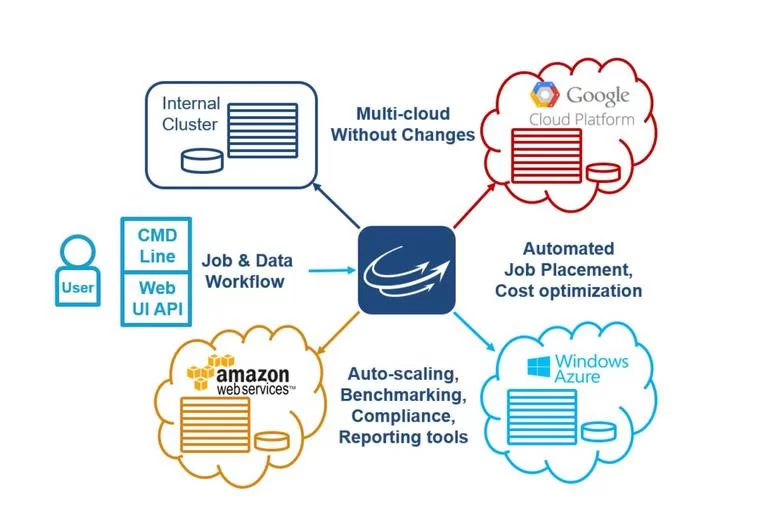

If you are reading this, you probably have a general understanding of the matter. By cloud computing, we mean a new hybrid technology that combines servers, software, networking, databases, different documents, and other stuff across the Internet. This enables virtually limitless specialized uses for businesses such as data storage for insurance companies, content management for publishers, CRM for banks and other large institutions, and countless other applications.

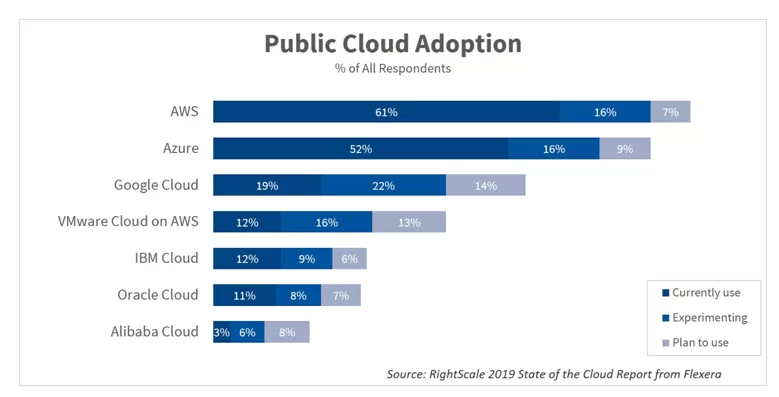

The companies that offer such services are cloud providers, and here you’ll see world’s tech giants: Amazon, Microsoft, Google – ahead of the race with their brands called AWS (Amazon Web Services), Azure and Cloud respectively.

Cloud services are delivered on demand with pay-as-you-go pricing.

Source: zdnet.com

As you can see from the picture above, Flexera report shows that among the other big players on the market are IBM, Oracle, and Chinese retail giant Alibaba.

We’ll tell you which major bank prefers whose service a little later, and now we’d like to give you a glimpse at what it is all about.

Source: flexera.com

Cloud computing creates a multi-channel relationship with the customer at many levels, helping banks with maintaining and improving customer service.

Cloud is used for storing, backup and recovering data of the enterprise-sized companies. Banks are known for the slow adoption of technologies due to doubts in reliability and issues regulation of their services, however, the volumes of data storage are initiating the unavoidable transition to cloud in the nearest future.

ActiveViam conducted interviews with the banks and their consultants and over half of the respondent were already using public cloud service or knew that this service is utilized in their banks.

64% of respondents have intention on migrating some of the systems to public systems in the next year or two.

That same report by the company has the following info from the respondents:

- They believe that cloud projects will rise by 6-10% in the next two years

- Some projects have the warranty for the budget increase of up to 70% within that time span.

Let’s explore how cloud adoption might help banking institutions manage their activities more efficiently?

The Main Reasons for Turning to Cloud

We are about to explore the main reasons banks across three continents (North America, Europe, Australia) make attempts of putting some of their services and applications to banks, what drives them to do it and what obstacles.

Let’s begin with the words of J.P. Morgan global CIO Dana Deasy interview to CIO Journal. Here is his position on why his bank is going to embrace cloud technology in this or that matter.

Some companies move to the cloud due to trying to find the great cost-effectiveness, Deasy had low expectations toward the significant cost savings, at least in the nearest future.

The more important reason is in making developer’s work more efficient and in employing machine learning, microservices that ease up an application running across all the platforms.

Their strategy of embracing cloud technologies was an interesting one as they launched a large private cloud, but we’ll tell more of it below.

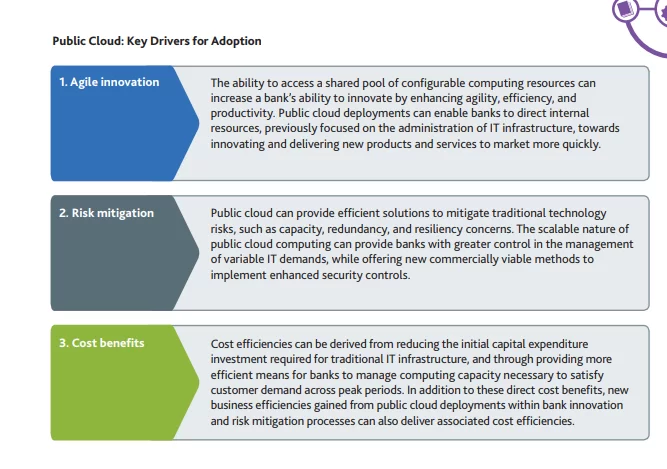

Returning to the reasons, the British Bankers’ Association (BBA) sees the following three key motivators for the adoption of public cloud-based services by the banks:

- Agile Innovation

- Risk Mitigation

- Cost Benefits

Source: bba.org.uk

Agile innovation. Banks aim for innovation with the help of improvement in agility, efficiency, and productivity. Public cloud deployment allows bank having their own direct access to the internal product and their delivery to the market in a more speedy fashion.

Risk mitigation. Addition to the risk factors is the one thing modern banks can’t afford. As the cloud helps to lower the risks concerning capacity, resiliency, and redundancy together with improving scalability in their security sectors equipment, there is an additional point to using it.

Cost benefits. While this is not the deciding factor for many banks as of yet, it matters a lot in the long run. The potential of savings is significant, the profit comes from saving on investments that are needed for traditional IT infrastructure, improved risk mitigation, improved ability to combat financial crime with increased transparency, etc.

Challenges on the Way

According to Business Insider, “many in banking still wary of moving data and key applications into the cloud due to cybersecurity, operational and regulatory fears.”

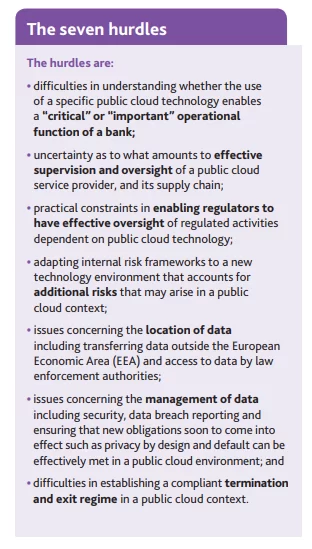

The aforementioned BBA see the following hurdles on the way to cloud adoption:

Source: bba.org.uk

At the same time, some steps towards the improvement of these hurdles are constantly made. hear this story.

Michael Harte, at the time of the events when his banks turned to cloud, the CIO at Commonwealth Bank of Australia (CBA) (back at the start of the decade – 2010s). He presented to the Board the idea of moving most of the bank’s back office to Infrastructure-as-a-Service (IaaS). The board was persuaded the regulator wouldn’t allow it and asked him to return with a different plan.

Six months later, Michael presented the same plan to the Board.

The CEO was irritated as it was obvious the regulator wouldn’t allow it.

At that point, he brought in the head of the Reserve Bank of Australia to the Board meeting, who endorsed the IaaS plan and said it was fine.

Consequently, CBA moved to IaaS and saved 35% of their operational costs, as well as becoming far more agile.

Also, much of the evidence suggests that the cloud can be just as secure as private data centers, while many are predicting that in terms of computing power, the next few years will see the cloud surpass the aggregate power used in all private data centers combined.

What Cloud Software Providers Do Banks Prefer at The Moment?

J.P. Morgan Chase & Co., after more than a year of testing offerings from large cloud providers, has its first two applications to run in the public cloud back in 2017.

The bank started the move with a couple of applications in wholesale trading, and the third app in risk modeling sometime later, “aiming to use the bursting capability of cloud computing to handle high-volume, complex computations at sometimes irregular intervals”, according to the word of bank’s ex-CIO Dana Deasy.

“Public cloud is serious. It’s time to move.” – he added.

Amazon.com Inc.’s Amazon Web Services (AWS) was chosen by the bank at the time.

The current Chief Information Officer at JPMorgan Chase, Lori Beer continued the course chosen by her predecessor.

She claimed that the bank has learned a lot during its transition to using services from outside cloud computing providers such as Amazon Web Services. In succession of these endeavors, “JPMorgan will soon give the green light to storing “highly confidential” data with cloud providers”. That serves as a sign of the bank’s confidence in its revamped cloud strategy.

—

TD Bank Group (TD) and Microsoft back in April 2019 announced a strategic relationship in which TD will use Microsoft Azure as the cloud foundation to provide its technology and design teams with tools designed for secure, agile and flexible access to data and AI resources.

This further enables the Bank to adapt and quickly respond to changing customer needs.

“At TD we are shaping the future of banking in the digital age by creating personalized, connected and legendary experiences across all of our channels. Our strategic relationship with Microsoft will help accelerate and fuel new and innovative banking experiences for our customers, clients, and colleagues”, – said Bharat Masrani, Group President and Chief Executive Officer, TD.

Microsoft Azure is positioned to help accelerate new capabilities when it comes to the design and delivery of future customer banking experiences.

—

Royal Bank of Canada

Royal Bank of Canada (RBC) has adopted the IBM Cloud to increase business agility, shorten time-to-market, and facilitate the adoption of emerging technology.

“Perhaps three main imperatives for us to adopt something like IBM Cloud solution: The top one is increasing the business agility, and the next one is much shorter time to market; and the last one is the ability to take advantage of IBM Cloud in terms of adopting new technology, to speed us up tremendously in terms of adopting new technology as well. ”

Those are the words of Francis Li, senior director of solution engineering and wealth management at Royal Bank of Canada.

—

We can see that there is no special trend to follow and no one-fits-all solutions for all the banks as big banks choose across different providers.

Elinext software developers possess both expertise and experience in developing cloud solutions using services by all the leading providers across multiple domains, including the financial sector. If you are looking for one, please contact us to get you a free quote.

What’s Next For Cloud Technology in Banking?

More and more banks are going to transfer part of their operations to the cloud. It is hard to guess which cloud provider will prevail, but we can see big banks choosing among the leaders of the industry quite sporadically.

Some banks trust Amazon, the others choose Microsoft’s Azure, the third ones turn to IBM Cloud, while many stay reluctant to using any cloud technologies in their operations seeing no point in fighting regulators and overcoming other hurdles mentioned earlier.

We’ll keep a close look at the situation, and here is the prediction of Microsoft representatives as for April 2018:

“The key to successful cloud adoption in financial services will be a tight partnership between regulators, financial institutions and cloud providers to ensure that the right frameworks, programs, and processes are in place as financial services providers increase their usage of cloud services”.

If everything adds up, banks will be able to save more and operate in a more agile and secure environment.