When talking about accounting, the first thing that comes to mind is a stressed-out person buried under piles of paper. This stereotype is probably based on the fact that historically accounting practices have been run in a similar fashion for the last couple of decades.

Fast forward to today, and we see drastic changes to that stereotype as Pricewaterhouse Coopers (PwC) has purchased a site in the Sandbox metaverse, becoming the first globally recognized professional services company to enter the metaverse.

Indeed, modern-day accounting firms embrace technological advancements to boost performance and make the lives of their clients and employees easier. By 2030, the global accounting software market is expected to reach $38.08 billion, growing at a robust CAGR of 8.14%. Meanwhile, let’s see what the accounting trends are for the year to come.

1. Cloud-based accounting solutions

Cloud-based computing has been around for a while now but the pandemic and the resulting shift towards remote workforce has accelerated cloud adoption across industries, and accounting is not an exception.

With 67% of accountants preferring cloud-based accounting solutions, it’s no wonder that the market for cloud accounting software is expected to reach $4.25 billion by 2023. Unlike on-prem solutions that require expensive IT infrastructure and ongoing maintenance, cloud-based accounting software requires less upfront costs and can be updated automatically. In addition, instant access to data from anywhere makes these solutions a smart choice for companies with a hybrid workforce, enabling seamless collaboration for employees, no matter the location.

2. Focus on enterprise-wide integrations

As improving business efficiency is top of mind for CEOs amid the challenging economic landscape, another trend is the increased focus on systems integration to enable seamless flow of data and streamline workflows.

For example, integrating accounting software with CRMs, ERPs, and other in-house systems allows to drastically reduce manual efforts and save time while enabling accuracy and visibility. With integrated connections, employees can enter important information like contacts, bills, and invoices just once and keep it synchronized across all enterprise systems — no more exporting, double data entry, or input errors.

Source: ScienceSoft

3. Increased accounting automation

According to Forbes, accounting automation is becoming increasingly popular among businesses that look to reduce the growing workload of accounting processes. Undoubtedly, many client-facing accounting tasks can be automated, including journal entries, data entry and processing, account reconciliation, invoicing, tax management, and more.

And accountants are more than ready to embrace the technology — according to research by Sage, 86% of accountants said automating admin tasks would free them up to better focus on providing value-added services for clients. More than half of respondents expect their roles to become more strategic and concerned with providing more financial and business advice to their customers.

4. Data-driven analytics and forecasting

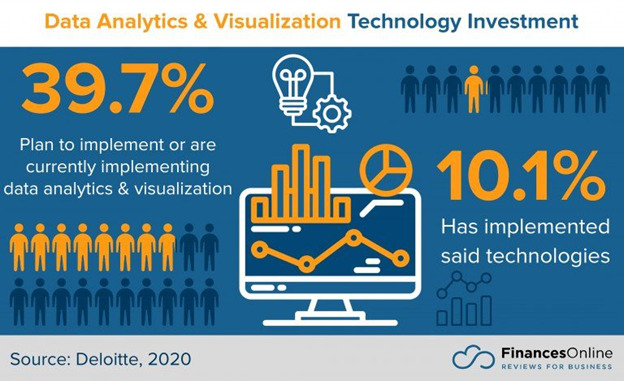

Among other trends in the accounting industry, experts predict to see an increased demand for advanced analytics and data visualization capabilities that would help with data-driven decision-making.

Accounting firms are sitting on a goldmine of data that can be tapped for insights and opportunities to move from being reactive and transactional to being proactive and analytical. Namely, advanced data analytics enables accountants to gain a deeper perspective on the company’s financial operations, measure business performance, assess potential areas of risk and elaborate mitigation strategies.

Thus, it comes as no surprise that almost 40% of finance professionals are implementing or plan to implement business intelligence technologies.

Source: FinanceOnline

5. The growing role of artificial intelligence

Speaking of automation and data-driven analysis, one can’t help but mention the growing importance of artificial intelligence (AI) and machine learning (ML) in shaping the accounting industry. With the ability to crunch vast amounts of data and identify patterns, AI-powered accounting software can supercharge bookkeeping operations, enhance productivity, and provide-on-the-spot visibility.

Ernst & Young, for one, uses AI to capture relevant information from lease contracts like lease start day, the amount to be paid, termination or renewal options. There are many other ways that AI helps financial experts accomplish their tasks, including:

- Detecting and flagging fraudulent activity;

- Compiling financial reports;

- Performing audits against all transactions in a ledger to find outliers;

- Classifying tax-sensitive transactions and identifying potential tax fraud cases;

- Performing cash flow analysis to identify trends or opportunities.

These benefits are not lost on accountants. A recent survey revealed that 20% of accountants are currently investing and adopting AI, while another 20% are planning to do so in the next year.

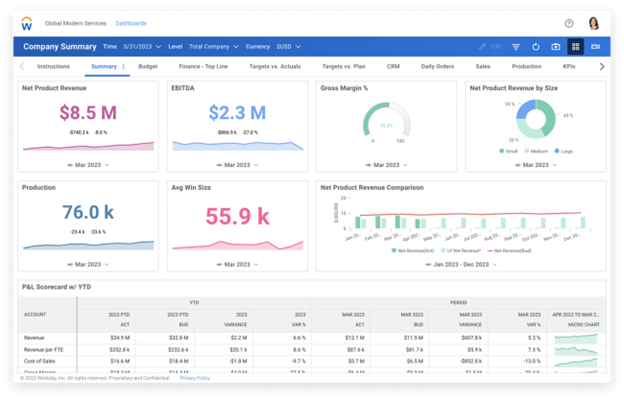

6. Real-time reporting and data visualizations

As accounting professionals start making better use of advanced data analytics, the demand for solutions with flexible, real-time reporting features and powerful data visualization capabilities will grow.

With the ability to pull up-to-the-minute information from multiple sources, accountants can easily create custom reports and cut the time wasted on hand-off, spreadsheets, and manual data entry. And graphical representation in the form of interactive charts, dynamic graphs, comparison bars, and more enables experts to drill down to source transactions and provide clients with a better understanding of cause and effect.

Source: Workday

7. Electronic signature

To streamline workflows and improve productivity, accountants rely on many digital tools, and one such tool is electronic signature software. Not only can electronic signatures significantly accelerate the document sharing process and thus cut the admin tasks, but these tools also reduce costs by eliminating the need to scan and print documents.

And although e-signature solutions had a less-than-perfect record of acceptance due to legitimacy issues, the pandemic has catalyzed the transition to electronic document execution. The global digital signature market is expected to grow at a CAGR of 30% reaching $7.10 billion by 2025.

8. Data security under scrutiny

Accounting cybersecurity continues to be a primary concern as hackers target sensitive financial and personal data. Just last year, the Internal Revenue Service reported a 91% spike in identity theft and tax refund fraud. Another report released by Federal Trade Commission data revealed that consumers lost over $5.8 billion to fraud in 2021. Data breaches are costly for companies, too. Gustafson & Co., an Oregon-based accounting firm, was forced to pay $50,000 after personal data of 1,900 individuals was exposed.

In the year to come, industry experts predict increased investments in accounting cybersecurity. This can include anything from training staff to security best practices to implementing security measures like identity and access management to multifactor authentication to end-to-end data encryption.

9. Regulatory updates and new accounting standards

In addition to social-economic disruption, the pandemic has caused changes in accounting and reporting standards. For instance, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed to provide financial help to struggling individuals and entities, which could have significant tax accounting implications, including changes in how deferred tax assets and liabilities are measured, whether deferred tax assets are realizable, or changes in an entity’s tax positions.

The transition to remote work also has tax implications that must be taken into account by accountants. If an employee’s home office is located outside of an employer’s place of business, tax compliance becomes more challenging, and best accounting software needs to be flexible enough to incorporate new procedures.

10. Blockchain is next in line

Blockchain has long been on the radar of accountants, CPAs, and auditors as the technology that could potentially revolutionize the accounting industry. Simply put, blockchain is a peer-to-peer distributed digital ledger that enables secure and transparent transfer of assets ownership. When implemented correctly, blockchain offers unique value like near real-time settlement of transactions, utmost clarity over ownership and obligations, and streamlined reconciliation.

Although the industry may still be years away from unlocking the full potential of blockchain, technology adoption is growing. For instance, the Big Four — Deloitte, KPMG, EY, and PwC — are working with 20 Taiwanese banks to launch a new blockchain-based system to help auditors verify transactions and facilitate the external confirmation of balances.

The future of accounting is bright

In 2023 and beyond, many fresh opportunities are awaiting the accounting industry. From AI-powered analysis to automated accounting to blockchain-based solutions, we can expect all kinds of technological advancements in this sector.

And to stay competitive and meet the needs of their clients, accounting firms must stay up-to-date with technological trends, optimize their current software and remain open to innovations.