Client

Our client is an African company that operates in the fintech domain. They act on the financial market of Nigeria and develop solutions for local investment managers and companies.

Project Description

Our customers were looking for a software development partner to get a custom collaborative tool that minimizes the decision-making process for managers. The web app had to be developed from scratch. The software had to be focused on the tools and asset classes of principal concern to local asset managers.

The main functionality of the platform had to improve asset management by making insights on the cost of a certain action, or absence of that action.

Challenges

This was a challenging project for the lesser-known market for our company as most of our customers come from the American market and Western Europe. Also, the platform had to be built from scratch, there was no previous version of it to begin from. If we had to list the challenges, it’d look the following way:

- Building an AI-based fintech solution from scratch, with no existing version of it to template from

- The software had to be integrated with the Nigerian financial market

- All the prices had to be shown in the national currency by default to eliminate exchange rate issues and restrictions.

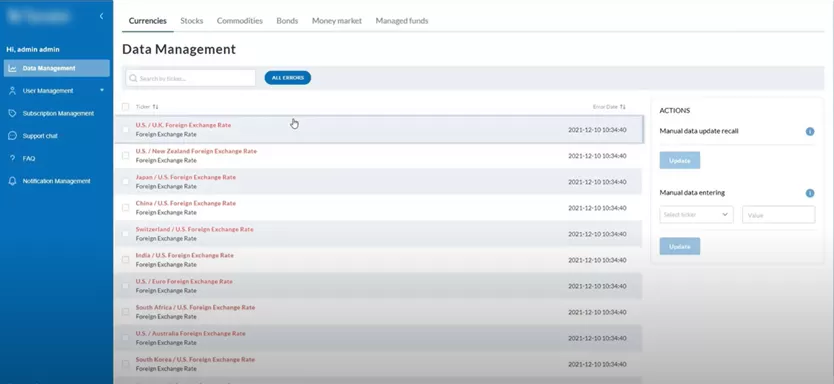

- A lot of external data had to be integrated, and we kept receiving false inputs from the third parties

- UI had to be user-friendly and allow end-users to see the insights displayed on the dashboard vividly

- Tight schedule for 18 months to keep up with alongside adjustments and changes from the client

Process

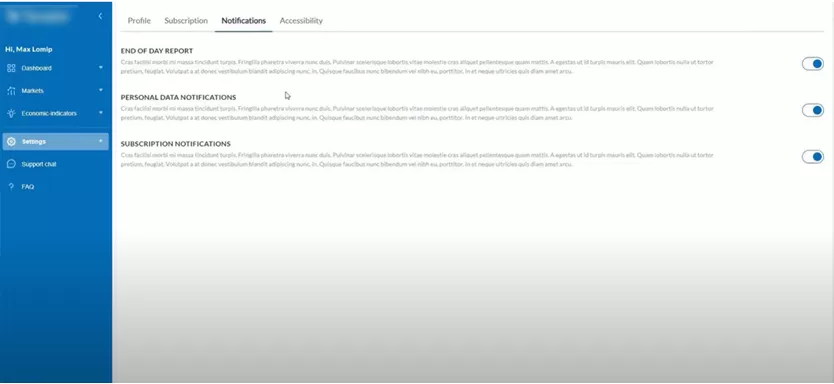

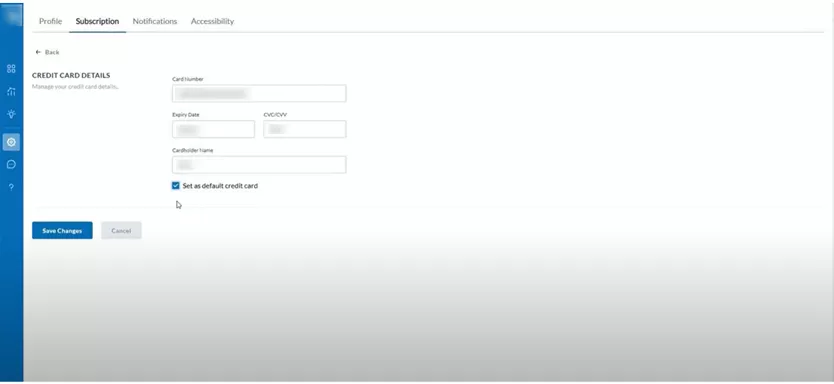

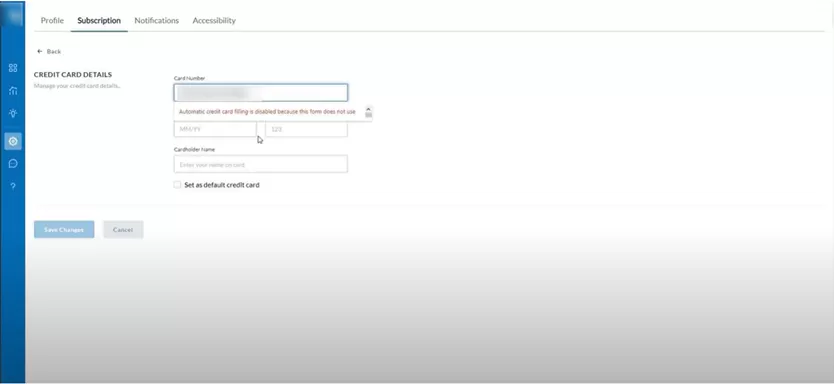

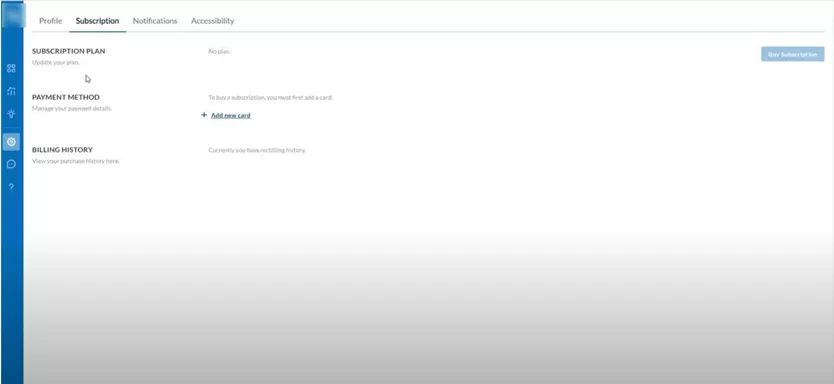

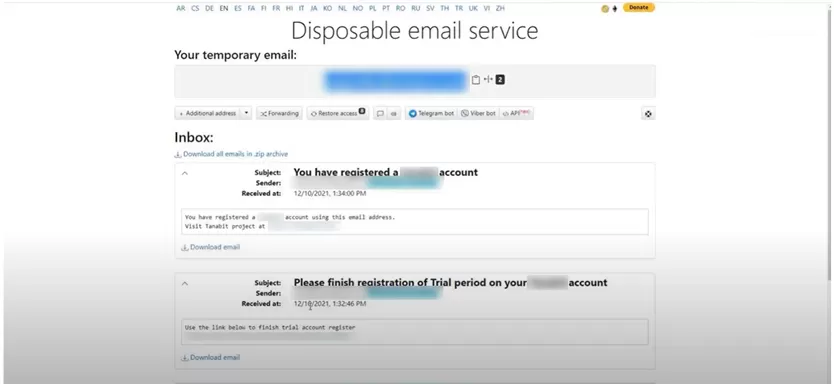

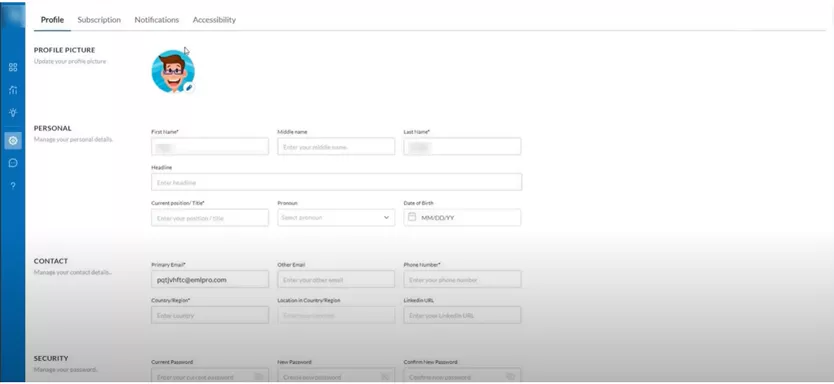

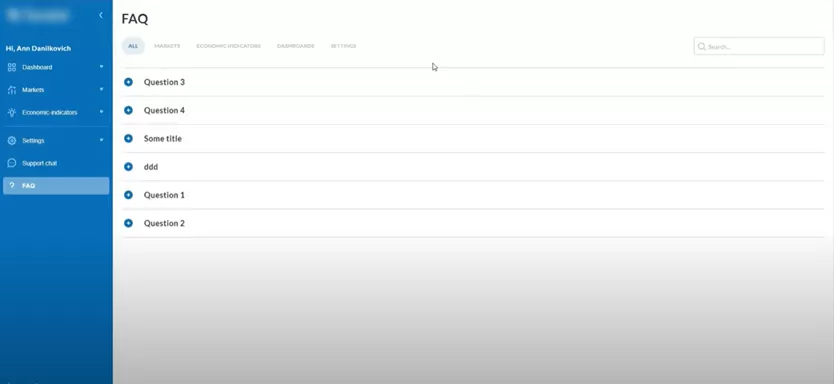

The solution includes six modules: authentication, profile settings, support chat, analytics dashboards, market module, and economic indicators modules. The authentication module allows users to log in with their e-mail and passport, has a reset password option, and allows “keep the user logged in”. The profile settings allow for managing personal data, integrating LinkedIn data, and managing email notifications and subscriptions among other things.

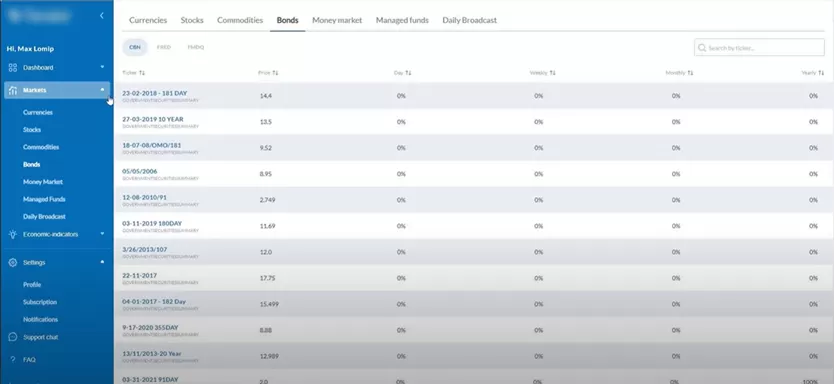

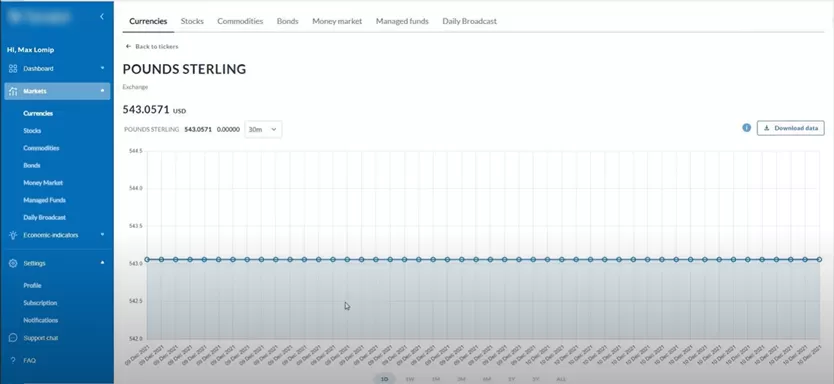

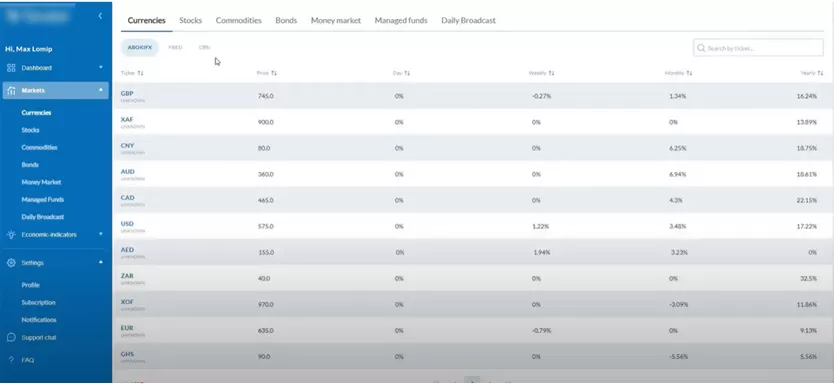

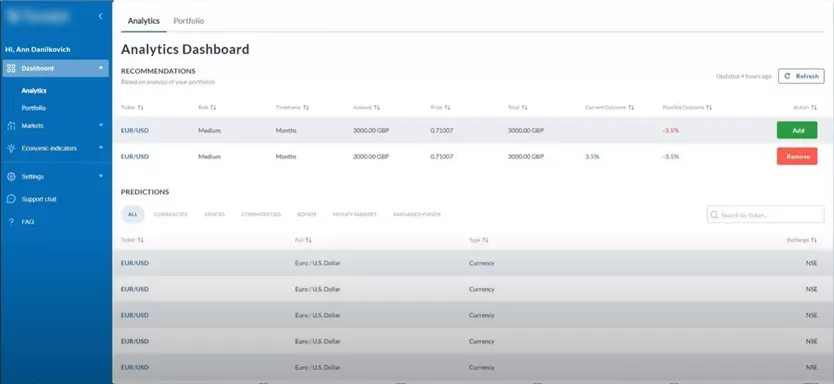

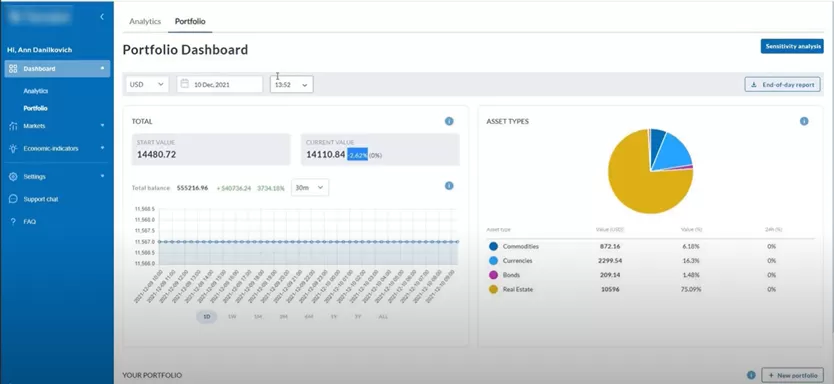

With the help of the support chat module, one can send requests to the support specialists, and attach files, and the history of the chat can be saved. With the help of the dashboard module, users can manage their portfolios, and see predictions of ML models on the dashboards. The market module helps to see the current situation of the market, including currencies, stocks, exchange rates, commodities, bonds, and other information integrated into the software.

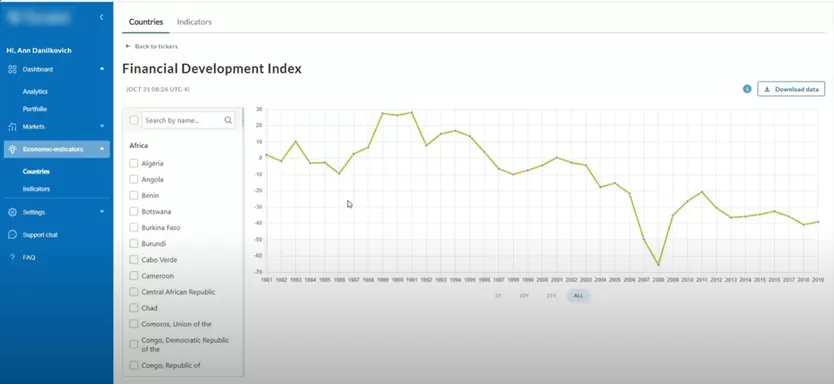

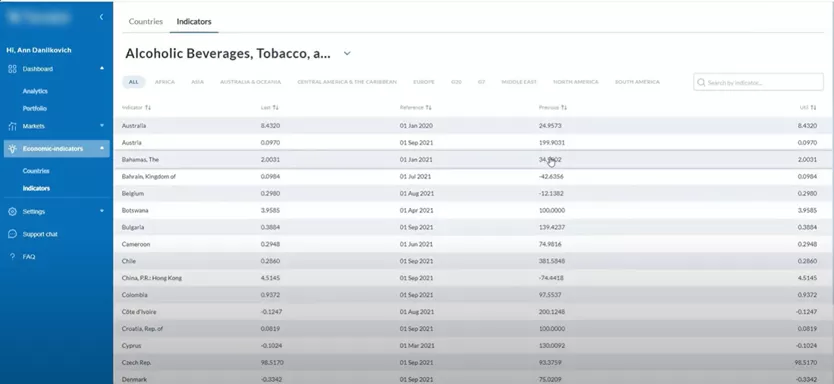

With the help of the economic indicators module, one can see the list of these indicators, view details on them in the cart, and filter them, i.e. by country of interest. There were six stages of development:

Stage 1: Analytics Engine

Elinext had to come up with an AI-based analytics engine to build the core of software so that end-goal of the project would be met

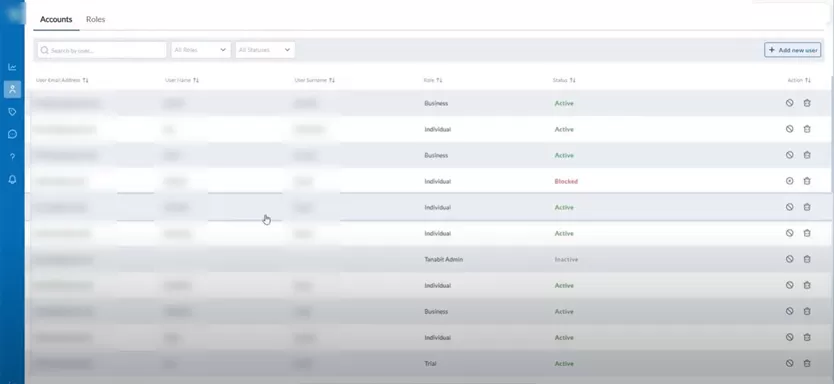

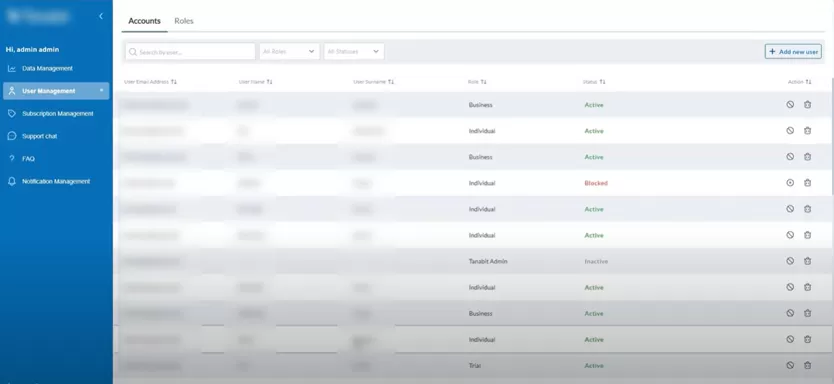

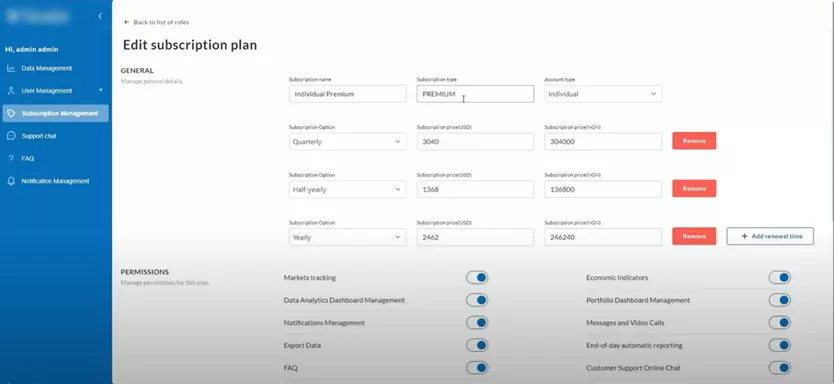

Stage 2: Admin Panel

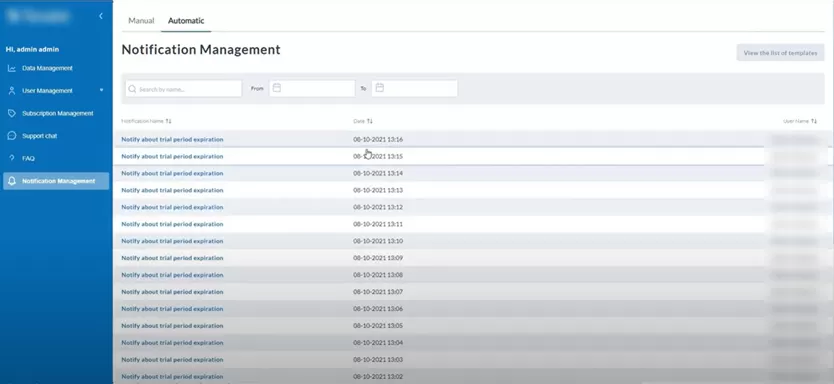

It is different from the user panel and allows adding, removing, and postponing different types of users into the system, among other things.

Stage 3: Integration with 3rd party services

The Elinext team needed external data from third parties to arrive on time and be precise for testing and integrating our AI algorithms on time, which was not always the case, but in the end, it didn’t affect the schedule of delivery. Data is integrated flawlessly into the solution at the moment.

Stage 4: SMS notifications

This stage is self-explanatory. Users now have an opportunity to receive a notification while using the platform and being away from the web platform.

Stage 5: Analytic dashboard

Dashboards had to look user-friendly and allow investment managers to act upon the information presented in them.

Stage 6: Economic Indicators

One sees economic indicators, vied details on them in the cart, and filters them. It was the last module for our realization.

Solution

Elinext helped the client to develop and implement a data analytics platform that gives end-users (businesses and individuals) the opportunity to transform datasets from the Nigerian financial system to useful information, pleasantly presented in nice-looking dashboards. This solution helps financial market participants in Nigeria identify and manage the risks in the financial market.

The main purpose of the system is to be able to track fund flows across sectors (real sector, external, fiscal, and monetary), and their impact on markets (equity, fixed income, commodity, currency).

The solution assists analysts, investors, and market researchers in improving their workflows. It helps with automating data gathering and analysis in a nice actionable format, and cost-efficient in comparison with the competitor’s offerings.

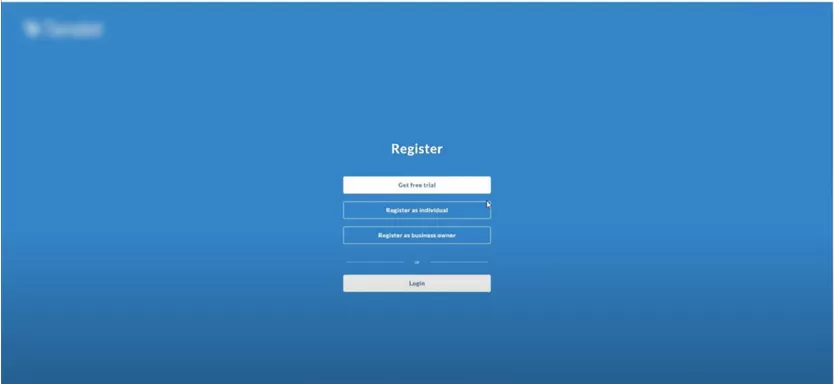

There are three types of users for each of whom the platform looks a little different:

- business users

- individual users

- software owner admins.

Each type of user has its own interface.

Solution development on our side was completed in time. The platform is GDPR-compliant.

Results

The dedicated team that worked on the project delivered a completely updated system that takes into account many analytical factors and uses machine learning to grove away valuable insights on their attractively looking dashboards. All the work was made according to all the requirements provided by the customer. The project expanded from the initial MVP version as changes were made on the fly, which widened our work scope throughout the development.

At the moment customer attracts new investments into their project, registers new users (both companies, and individuals) who are using their tool, and pay for the subscription. That wouldn’t be possible without them having an MVP version of the solution. Currently, our work on the project is completed, but there is a possibility our customer will come back to us for expansion features, and, possibly, mobile applications created for the platform.