Client

Our customer is a recognized leader in financial transaction management solutions that enable firms to improve operational control, reduce costs, build new revenue streams, mitigate risk, and comply accurately with regulations.

They provide a range of solutions for the transaction lifecycle with embedded artificial intelligence and machine learning technologies, which can also be deployed in the cloud or as managed services. Transaction Lifecycle Management (TLM) solutions designed by our customer deliver greater efficiency to their clients’ operations, while Elinext provides comprehensive financial software development and quality assurance services to ensure those solutions work smoothly and error-free.

Project Description

Our customer engaged us due to our expertise in financial transaction management, well-recommended banking app development services, and our proven track record of delivering innovative, scalable solutions. They selected us as a QA services vendor from multiple options based on our advanced technological capabilities and insightful industry knowledge.

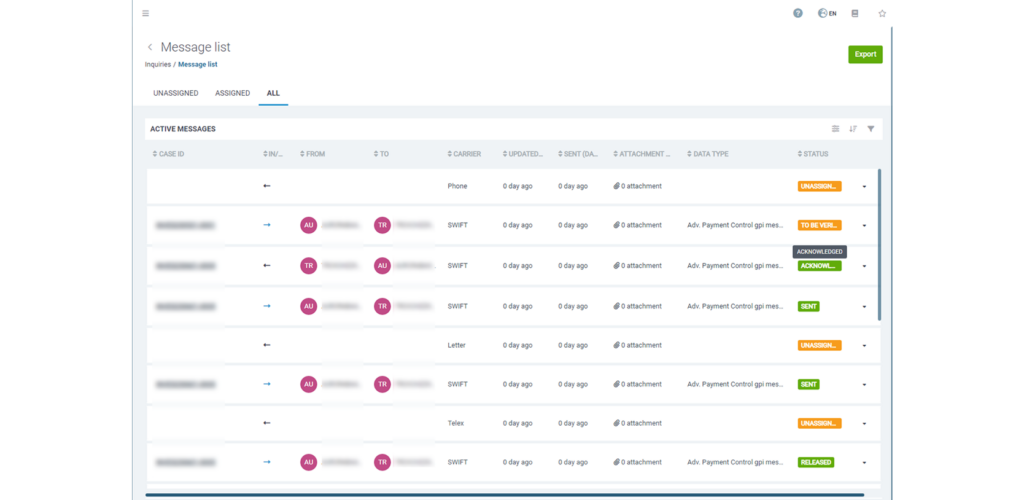

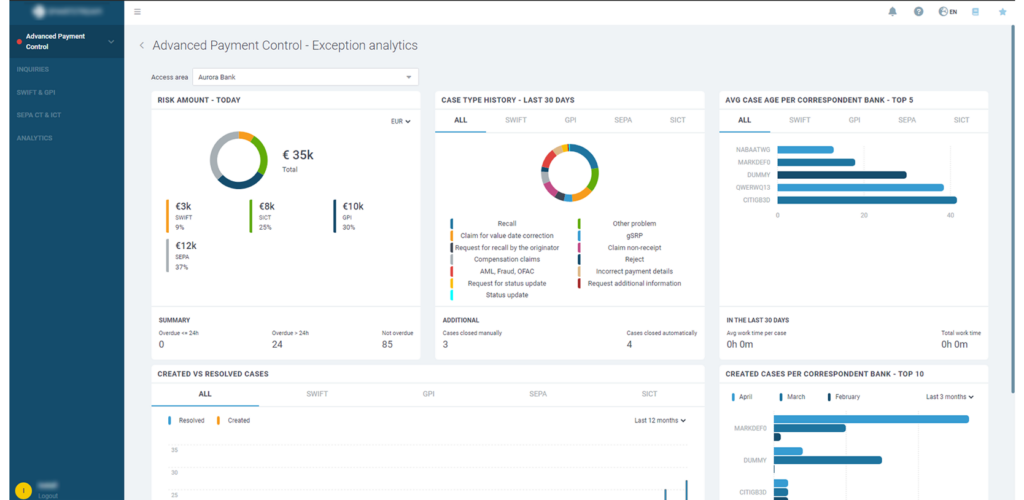

Elinext’s QA team was selected to do banking application testing for our expertise in testing and quality assurance for sophisticated solutions like the one our customers had. Our comprehensive understanding of digital payments, advanced payment control, and compliance with ISO 20022 and SWIFT standards were factors in our selection.

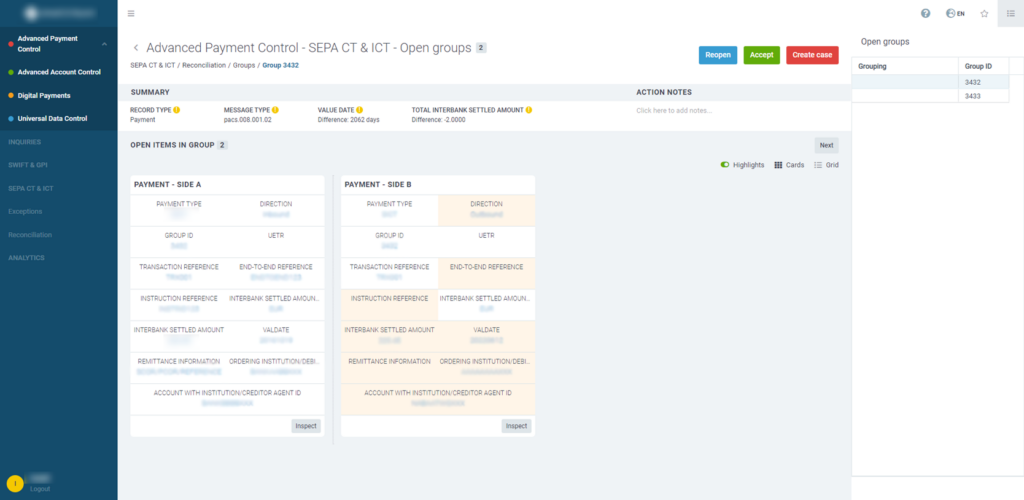

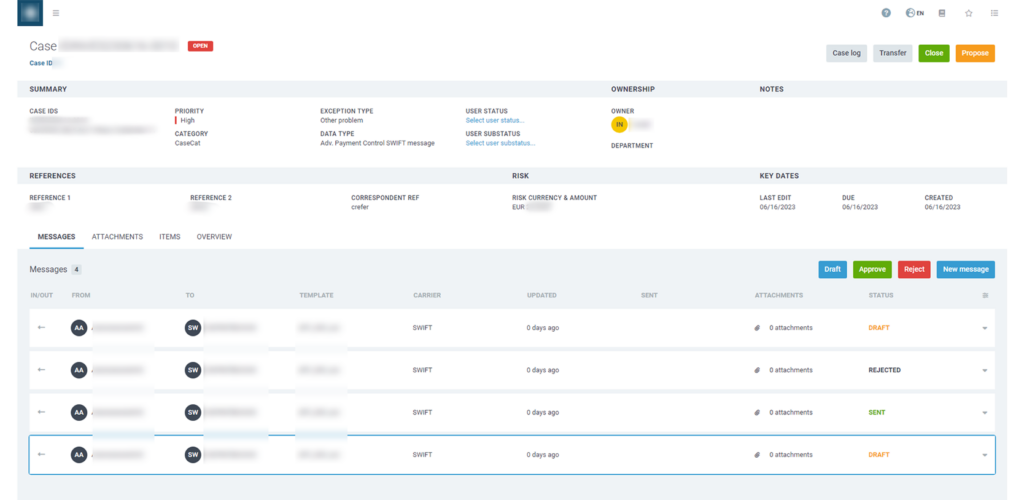

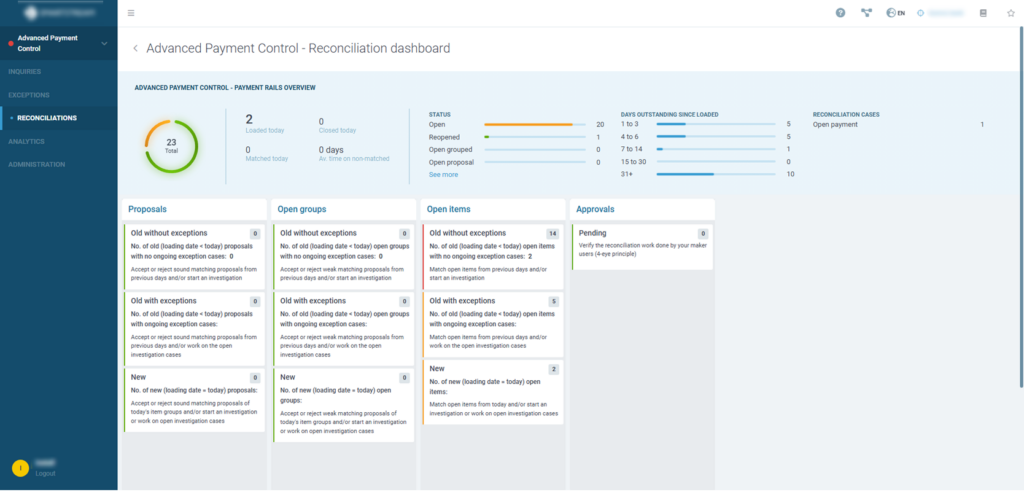

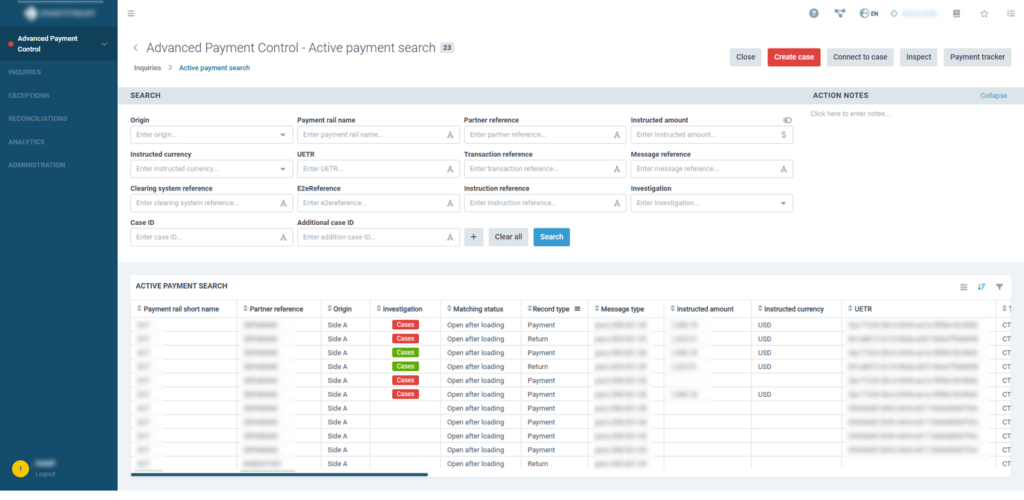

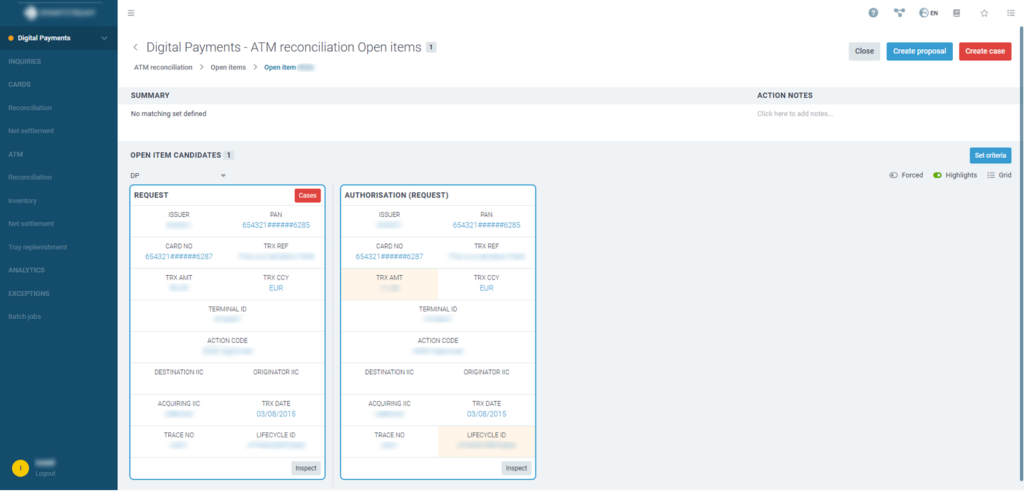

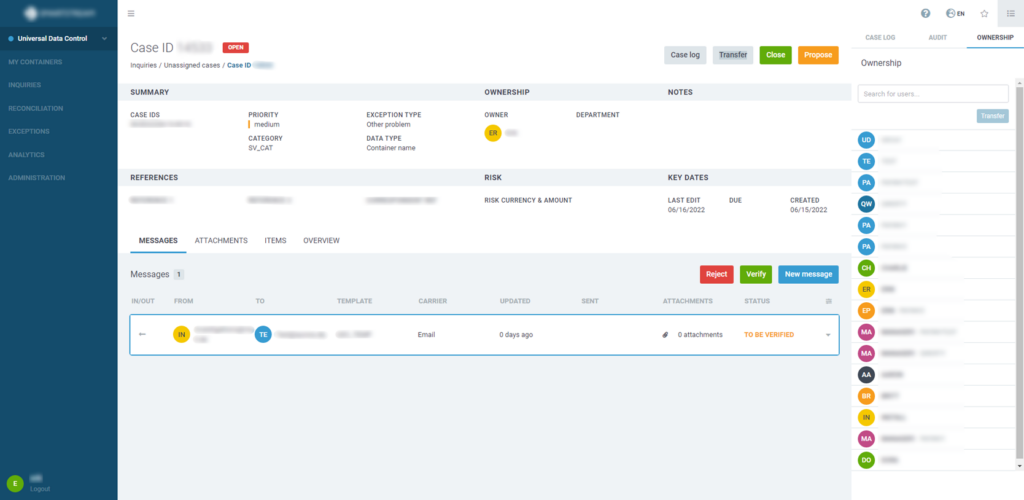

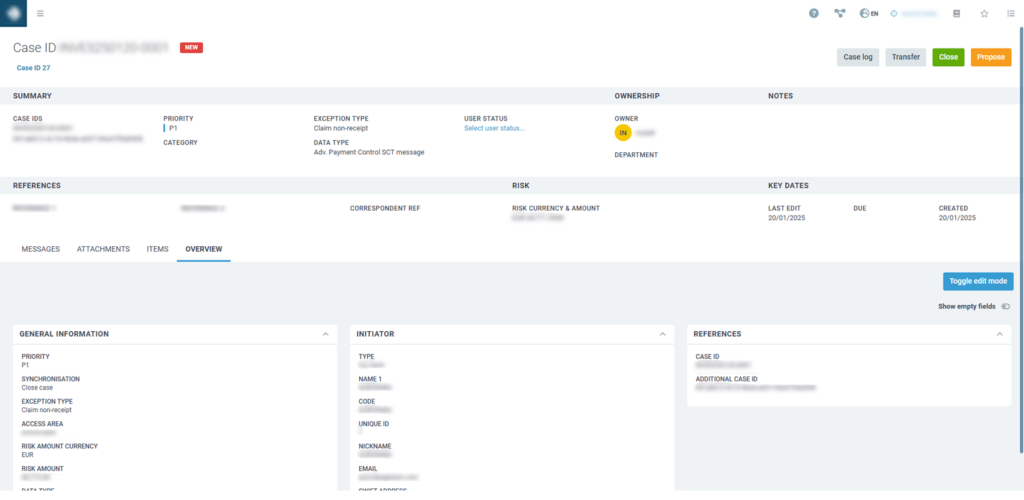

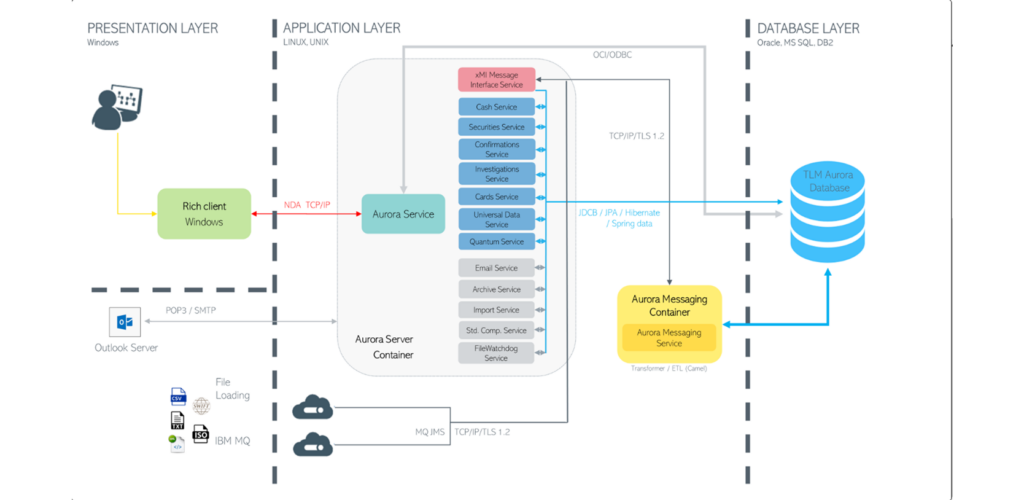

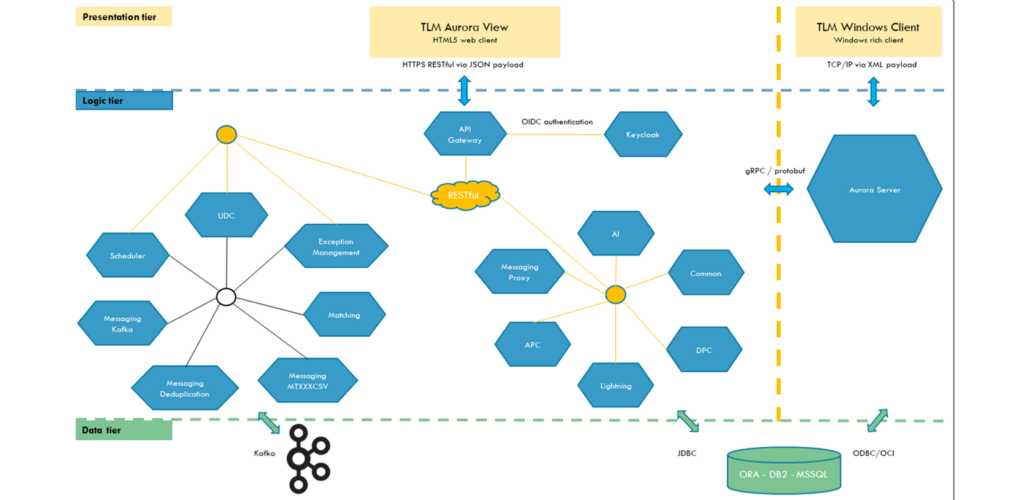

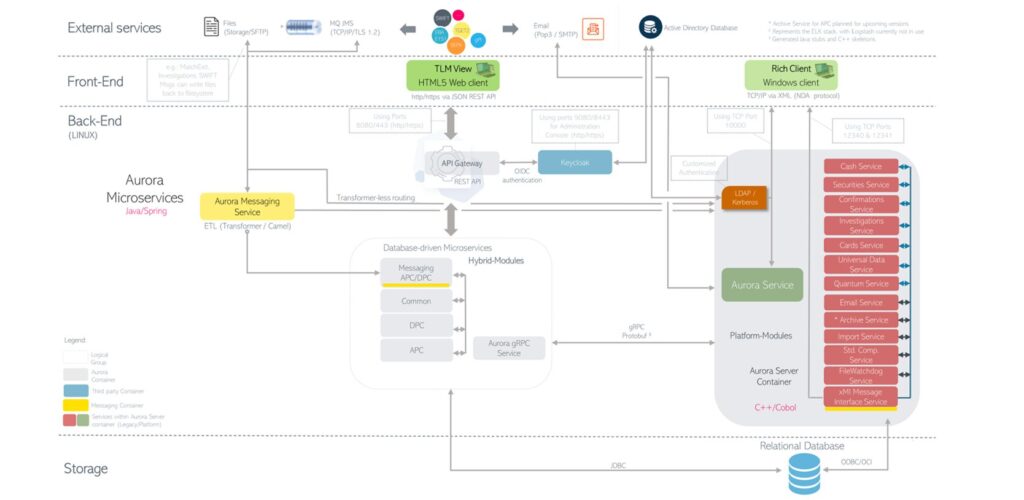

The project we provided banking application testing for was an innovative and comprehensive transaction management solution that automated multi-product reconciliations, ensuring control and transparency of cash, securities, treasury confirmations, and digital payments operations.

We’ve been delivering top-notch web app development and testing for seven years now with new releases arriving every six months (on average).

Challenges

Our customers faced challenges in managing and reconciling high volumes of financial transactions across multiple products. The manual, paper-based processes were inefficient, prone to errors, and increased operational risks. They needed a solution to automate these processes, enhance control, and provide greater visibility into transactions

SmartStream aimed to:

- Increase operational efficiency by automating transaction reconciliations (a significant reduction in manual reconciliation efforts would allow a targeted 50% increase in straight-through processing (STP) rates)

- Reduce operational costs and risks associated with manual processes (by automating transaction management processes, our customer expected to lower operational costs by up to 30%)

- Have enhanced accuracy and control (by improving transaction accuracy and control, aiming to reduce reconciliation errors by 40%)

- Achieve full compliance (by keeping up to ISO 20022 and SWIFT standards

- Improve their time-to-market (anticipating a 25% reduction in time-to-market for new features and updates in their TLM software)

The pain points were pre-existing and exacerbated by the growing complexity and volume of financial transactions. These issues were specific to their business but also reflected broader industry challenges in transaction management. They needed high-quality banking app testing.

Our customer had attempted to address these challenges using internal resources and possibly other vendors, but the solutions were not comprehensive or scalable enough to meet their evolving needs.

As for our QA team, Elinext was uniquely positioned to address the challenges faced by our customer and conduct banking application testing due to several key factors: QA team was uniquely positioned to address the challenges faced by SmartStream with the Aurora application due to several key factors:

- Expertise in Testing and Quality Assurance: The Elinext team had extensive experience in banking application testing and ensuring the quality of complex financial solutions. Our team was skilled in identifying and mitigating potential issues, ensuring that the application operates reliably and efficiently.

- Deep Understanding of Digital Payments and Advanced Payment Control: Our engineer’s knowledge of digital payments and advanced payment control processes allowed us to effectively test and validate the functionalities of the TLM application. This expertise was crucial in ensuring that the application met the high standards required by financial institutions.

- Compliance with Industry Standards: Our employees had a thorough understanding of ISO 20022 and SWIFT standards, which were essential for financial transaction management. Our ability to ensure compliance with these standards was a significant factor in our selection.

- Knowledge of Workflow Processes and Business Logic: The Elinext team had a comprehensive understanding of the workflow processes within the TLM application, as well as the product and business logic. This knowledge enabled our QA engineers to conduct thorough and effective banking app testing, ensuring that the application met all business requirements and provided a seamless user experience.

- Proven Track Record: Our proven track record in the financial services industry, combined with our technical expertise in banking application testing and ability to deliver high-quality, scalable solutions, made us the ideal partner for this project.

These factors, combined with our meticulous approach to quality assurance, ensured that we were uniquely qualified to address the challenges faced by our customer and their web application.

Process

Throughout our cooperation with our customer, we tracked our progress and gathered feedback. We use Jira to manage tasks and deadlines, ensuring everyone is aware of their responsibilities. Regular updates and feedback loops helped us stay aligned with the client's vision and make necessary adjustments along the way.

Our customer chooses their timelines. Given the complexity and scale of the TLM application in question, each release cycle can range from 6 months to a year.

This extended timeline ensures thorough planning, design, development, testing, and deployment, allowing us to deliver a high-quality, reliable solution. In addition, customer-specific hotfix tasks are released in the interim, which the testing team also switches to.

This is the rough picture of how the banking app testing releases usually looked on the timeline:

-

Planning Phase (2-4 weeks)

During this phase, we define the scope, objectives, and requirements for the testing process.

Activities:

- Requirement Analysis

- Test Strategy Development.

- Resource Allocation

Deliverables: Test plan, test strategy document, resource allocation plan.

-

Design Phase (3-5 weeks)

During the design phase, we come up with test cases and scenarios based on the requirements for banking application testing.

Activities:

- Test Case Design

- Test Data Preparation

- Environment Setup

Deliverables: Test cases, test data, environment setup documentation.

-

Development Phase (4-6 weeks)

During this phase, we develop test cases

Activities:

- Test Script Development

- Test Environment Configuration

Deliverables: Tests, environment, configuration documentation.

-

Implementation Phase (6-10 weeks)

During this period of testing, we execute the test cases and validate the system.

Activities:

- Test Execution

- Defect Reporting and Tracking

- Regression Testing

Deliverables: Test execution reports, defect logs, and regression test results.

-

Validation and Verification Phase (3-6 weeks)

During the final phase of banking app testing here, we validate the test results and ensure the system meets the required standards.

Activities:

- Review and Analysis

- Performance and Security Testing

Deliverables: reports, performance, and security test results, validation report.

Solution

The solution for the TLM application involved a comprehensive approach to testing and quality assurance to ensure the system's reliability, performance, and compliance with industry standards. Elinext QA team conducted extensive automated software testing services (as well as manual software testing services) throughout the project lifecycle. We use a variety of testing types to cover all aspects of the TLM application:

- Functional Testing: to verify that all features and functionalities of the application worked as expected.

- Regression Testing: to ensure that new updates or changes did not introduce any new issues.

- Performance Testing: to assess the application's performance under different loads and ensure it can handle high volumes of transactions.

- Usability Testing: to ensure the user interface was intuitive and met user needs.

- Compliance Testing: to verify adherence to ISO 20022 and SWIFT standards

Additionally, we conduct the following types of banking app testing:

Sanity Testing: This was performed after receiving a new build to ensure that the critical functionalities of the application were working as expected. It helped our QA engineers quickly validate that the changes or fixes did not break existing functionality.

Deployment Testing: The Elinext team tested the deployment process to ensure that the application could be successfully deployed in different environments.

Smoke Testing: This initial testing was done to check the basic functionality of the application. If the application passed the smoke test, it was considered stable enough for more in-depth testing.

Component Testing: Our engineers tested individual components of the application in isolation to ensure that each part functioned correctly before integrating them into the larger system.

Integration Testing: This involved testing the interactions between different components and systems to ensure they worked together seamlessly. It was crucial for verifying data flow and communication between modules.

System Testing: The Elinext team conducted end-to-end testing of the entire application to ensure that it met all specified requirements and functioned correctly in a complete system environment.

The testing area is currently covered by about 6000 test cases. The QA team maintains and adds new ones as new features are added.

In a typical financial institution, TLM might process millions of transactions daily, ensuring accurate reconciliation and reducing operational risks. The system's capabilities help in managing and analyzing these large datasets efficiently, providing valuable insights and improving decision-making processes.

Results

All of our services throughout this project are delivered on time and within the allocated budget. Ever since teaming up with us 7 years ago, our client has seen improved test coverage and accuracy which results in faster deployment and speeded testing cycles.

Teaming up with us has led to several benefits that our client sees over time, including reduced maintenance costs thanks to the thorough testing that minimizes the number of post-release issues, leading to lower maintenance costs and fewer emergency fixes; and enhanced compliance and risk management as we ensure that the app meets all regulatory requirements for the company to avoid penalties and fines.

Having an experienced QA team on the project helps with risk mitigation as identifying and addressing potential issues early protects the client from potential financial and reputational damage.

Also, the testing process fostered better communication and collaboration between development, testing, and business teams, leading to a more cohesive working environment.

Within the last six months, we achieved a 95% defect detection efficiency, reduced post-release defects by 60%, and shortened the cycle time from feature request to delivery by 25%.

Currently, the project is in the maintenance phase, with ongoing support and updates to ensure optimal performance.

As for what the future holds for us on this project, several exciting features and enhancements are in the plans, including the implementation of advanced analytics and reporting tools, integration of advanced security protocols and encryption methods, and integration with popular third-party services and platforms.

Benefits for the Client/Business

Within the last six months of cooperation, the Elinext team has achieved a 95% defect detection efficiency, reduced post-release defects by 60%, and shortened the cycle time from feature request to delivery by 25%.