Nowadays, the banking industry is facing an acute problem of fraud. The problem is global, and no country is fully protected. In 2024, losses from financial fraud related to payment cards and other methods reached $12.5 billion, marking a 25% increase from the previous year. This surge highlights the growing challenges in combating fraud as financial institutions and consumers face increasingly sophisticated scams.

Advanced fraud management in banking, including AI-driven banking software development services, enhance security by analyzing customer behavior and transaction patterns. These technologies help banks identify suspicious activities in real-time, minimizing losses and maintaining customer trust. By integrating robust fraud detection systems, banks can effectively combat financial fraud, ensuring safer transactions and protecting their clients’ assets.

The Most Common Types of Banking Fraud in the UK

Check, Plastic, Card and Bank Account: 336,707 reports

Check, plastic, card, and bank account fraud made up the largest proportion of total reports in 2021 in the UK – a whopping 336,707 cases, equating to 38.45% of all reports.

Online Shopping and Auctions Fraud: 103,254 reports

The second most common fraud was online shopping and auction fraud, accounting for 11.79% of all fraud cases in the UK in 2021.

Application Fraud (excluding mortgages): 91,593 reports

Application fraud saw over 91,000 reports in 2021 in the UK, and this is excluding mortgage fraud.

Banking Fraud Prevention and Detection with Data Analysis Software

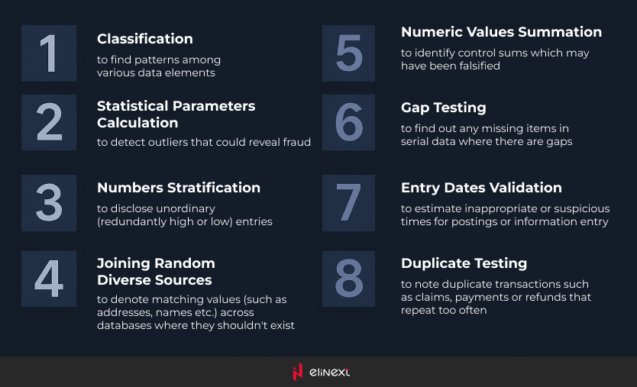

One of these options is the use of data analysis software which, in most cases, guarantees an impeccable fraud detection and prevention in banking industry. There is a spectrum of analysis measures that can be applied for fraud management in banking. It ranges from contextual situations for a singular fraud investigation to a repeatable analysis of financial processes susceptible to criminal activity in the first place.

If the risk of fraud is really high, financial and banking institutions can employ a constant or continual approach to the fraud management system in banking. To disclose fraudulent activity, a lot of banks use special transaction monitoring systems. Financial software development services play a crucial role in enhancing security measures by providing advanced fraud management in finance industry. But that is only the tip of an iceberg.

There is a list of analytical techniques used to detect fraud. The most effective among them are:

Despite all these measures, customers that use their own confirmed devices to complete online transactions may still become the victims of fraud. The most popular schemes for cheating are:

- session stealing

- man-in-the-middle

- key-loggers

- phishing

For fraud management in finance industry, banking institutions are advised to undertake a number of security measures:

- they must do their best to stop machine-resident and web-based attacks from fraudulent transactions in progress.

- they shouldn’t forget to vindicate online banking clients from session-based transaction attacks.

Our advice here is to smoothly test the efficiency of fraud-screening models and rules and update them when testing reports point out the need. Financial software development services ensure that software models, which are continually refined, readily adapt to brand new knowledge.

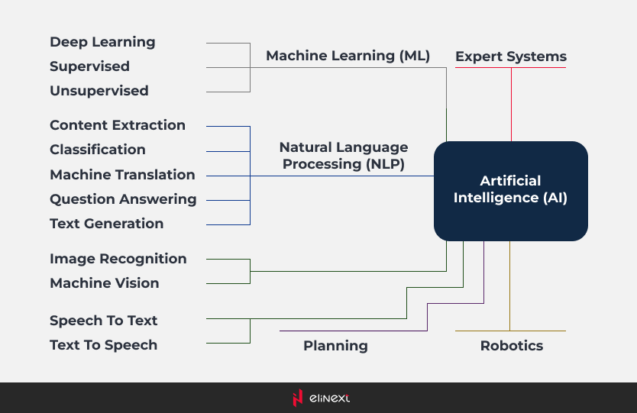

AI Technology in Banking Fraud Management

Originally introduced in the 1950s, AI has gained a new wave of popularity just recently due to a variety of reasons. One of them is, obviously, fraud detection and management in banks.

Banks are beginning to utilize AI to fight against cybercrime and address complex issues in real time for fraud management in banking. Over the last ten years, AI software development company has significantly improved the monitoring process: now it is capable of learning in a fast-paced environment and responding to fraudsters’ techniques as they appear.

Such systems are trained to recognize potential fraud through supervised training, when the variety of random samples is manually classified as genuine or fraudulent. Subsequently, the algorithm for fraud prevention in finance industry learns from these manual classifications to determine the legitimacy of future activities on its own.

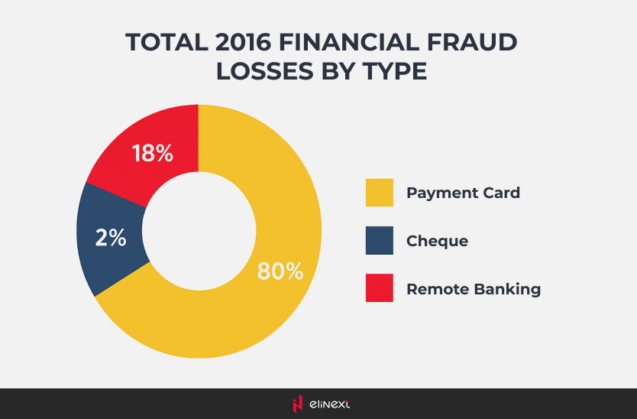

Types of Financial Fraud in the Banking Industry

The banking industry faces various types of financial fraud, including credit card fraud, identity theft, and account takeovers. Effective fraud detection and prevention in banking is vital to protecting customer assets. With advanced fraud management in banking, institutions can use AI and machine learning to analyze transaction patterns, quickly identify anomalies, and reduce losses. By implementing robust strategies, banks can strengthen their security measures and protect customers from evolving fraud threats, providing a safer banking experience.

Identity Theft

Identity theft remains a significant threat in the banking industry, where fraudsters access personal information to commit fraud. Effective fraud detection and prevention in the banking industry is crucial for safeguarding customers and maintaining trust.

Phishing and Social Engineering

Phishing and social engineering are deceptive tactics used by fraudsters to manipulate people into giving up sensitive information. Phishing often involves fraudulent emails or messages, while social engineering relies on psychological manipulation. Both pose significant risks to personal and financial security, requiring increased awareness and robust security measures.

Insider Fraud

Insider fraud occurs when employees use their access to confidential information for personal gain. Effective fraud detection and prevention in banking is essential to reduce this risk. By implementing strict monitoring and access controls, banks can protect assets and maintain trust.

Wire Fraud

Wire fraud involves the unauthorized transfer of funds through electronic communications, often using deceptive techniques. Victims may receive fraudulent requests impersonating legitimate entities. Protecting against wire fraud requires vigilance and strong security measures.

Synthetic Identity Fraud

Synthetic identity fraud occurs when criminals create fake identities using a combination of real and fictitious information. This form of fraud can evade traditional detection methods, making it critical for institutions to improve their fraud detection systems to effectively combat this growing threat.

Regulatory Compliance in Fraud Prevention and Detection

Compliance with regulations is essential for effective fraud detection and prevention in banking. Adhering to laws and guidelines helps banks take the necessary measures to detect and mitigate fraud risks, ensuring customer protection and trust.

AML (Anti-Money Laundering)

Anti-money laundering (AML) refers to a set of rules and practices designed to prevent the illegal transfer of funds. AML efforts are aimed at detecting suspicious activity, ensuring compliance, and promoting transparency in financial transactions. Effective AML strategies are vital to protecting the banking industry from financial crime and maintaining confidence in the financial system.

KYC (Know Your Customer)

Know Your Customer (KYC) is a critical process in the banking industry that involves verifying the identity of customers. It plays a significant role in fraud detection and prevention in the banking industry by helping institutions identify suspicious activity at an early stage. Effective KYC procedures enhance security, build trust, and ensure compliance with regulations, ultimately reducing the risk of financial fraud.

GDPR, PCI DSS

GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard) are the most important frameworks for data protection. GDPR focuses on protecting personal data and privacy, while PCI DSS sets security standards for payment card transactions. Both regulations are critical to enhancing security and trust in the financial sector.

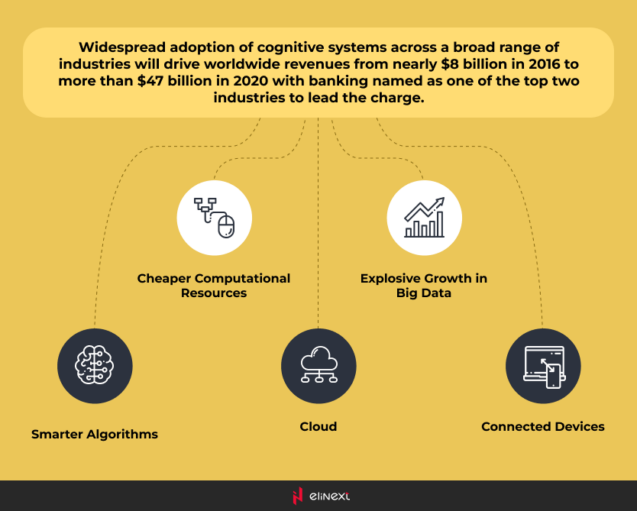

Future Trends in Fraud Detection and Prevention in Banking

The future of fraud detection and prevention in the banking industry will be determined by advances in technology. Artificial intelligence (AI) and machine learning will enable real-time analysis of transaction data, improving the ability to detect anomalies. Additionally, biometric authentication methods such as facial recognition and fingerprint scanning will ensure secure access and reduce identity fraud. As cyber threats evolve, continued innovation in security measures will be critical to protecting customers and maintaining trust in the banking sector.

Biometric and Behavioral Authentication

Biometric authentication uses unique physical features such as fingerprints, facial recognition, or iris scanning to verify identity. In contrast, behavioral authentication analyzes user behavior patterns such as typing speed and mouse movements to ensure security. Together, these methods improve access control, providing strong protection against fraud while improving user experience across a variety of applications, especially banking and online services.

Blockchain for Transaction Validation

Blockchain technology offers a decentralized and secure method of verifying transactions, ensuring transparency and immutability. Each transaction is recorded in a block, linked to previous blocks, creating a tamper-proof chain. This increases trust between parties, reduces fraud, and streamlines processes in sectors such as finance and supply chain management, revolutionizing the way transactions are verified and recorded.

Proactive vs. Reactive Fraud Detection Strategies

In the realm of fraud prevention in the finance industry, understanding the difference between proactive and reactive strategies is crucial. Proactive detection involves deploying advanced technologies and predictive analytics to identify potential fraud before it occurs. In contrast, reactive strategies focus on responding to incidents after they occur. Combining both approaches improves overall security, allowing institutions to effectively mitigate risk and protect customer assets.

Conclusion

In conclusion, effective fraud detection and prevention in the banking industry is essential for safeguarding assets and maintaining customer trust. By leveraging advanced technologies, including cloud development services, banks can enhance their fraud management systems. These services provide scalable solutions, enabling real-time data analysis and improved response strategies. As fraud tactics evolve, the integration of innovative tools and methodologies will be vital in developing robust defenses. Emphasizing collaboration between technology and regulatory compliance will further strengthen fraud management in banking, ensuring a secure financial environment for all stakeholders.

FAQ

What is fraud detection and prevention in the banking industry?

Fraud detection and management in banks refers to the processes that identify, analyze, and mitigate fraudulent activity. This includes monitoring transactions, implementing security measures, and using technology to protect customer assets.

Why is fraud management important in banking?

Fraud management is critical in the banking industry as it protects financial institutions from significant losses, reputational damage, and legal consequences. With the growth of online transactions, effective fraud management ensures customer trust and protects sensitive data, ultimately improving operational efficiency and long-term profitability.

How do banks detect fraud?

Banks detect fraud using advanced technology, particularly through machine learning. A ML software development company can create systems that analyze vast amounts of transaction data to identify suspicious patterns and anomalies. These systems are constantly learning from new data, improving their ability to detect potential fraud in real time, thereby increasing security and reducing losses.

How does AI help with fraud detection in banks?

AI significantly improves fraud detection in banks by analyzing large data sets to identify suspicious activity. It learns to distinguish between legitimate transactions and potential fraud, capturing trends that human agents might miss. Using real-time monitoring and continuous learning, AI systems improve accuracy and efficiency, allowing banks to prevent financial crime and better protect customer assets.